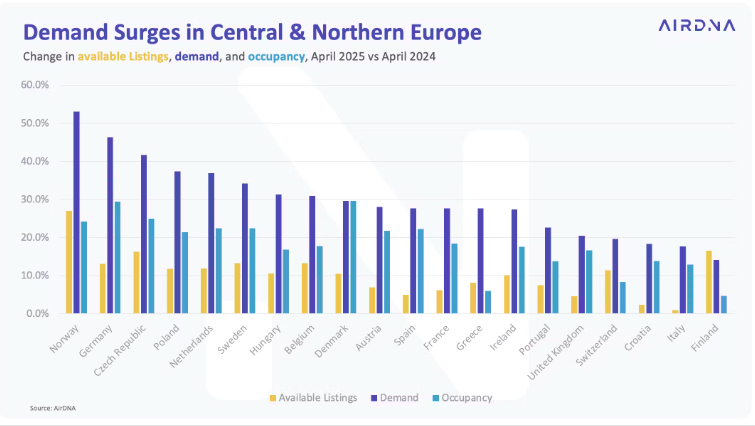

The first four months of 2025 have seen a notable surge in short-term rental demand across Europe, with a year-on-year increase of 27.4%. A key driver was the later timing of the Easter holiday in April, which encouraged a wave of short leisure getaways across the continent. To meet this heightened demand, the number of active listings across Europe rose by 7.1%, reaching 3.6 million.

Greece Hits 1 Million Beds in April – a First

In a landmark development for Greek tourism, the number of available short-term rental beds surpassed 1 million in April 2025—a threshold that in previous years had only been reached in July, typically the country’s peak travel month.

Market occupancy averaged 59%, up 18% compared to 2024, while Revenue per Available Rental (RevPAR) jumped 23%, reaching €88. The Average Daily Rate (ADR) rose 4.2%, now averaging €150 per night.

Greece Among Europe’s Top Performers

Alongside Switzerland, Greece delivered standout performance by turning moderate occupancy gains into significant revenue growth. Much of this was driven by strong pricing power—particularly in key tourist regions—where rising ADRs contributed to robust profitability in the short-term rental segment.

Although Greece is not among the countries with the highest surge in demand, it continues to show strong momentum in select markets—benefiting from the broader upward trend in European travel.

Demand for short-term rentals in Greece remains on a positive trajectory, with occupancy rates rising consistently throughout the first four months of 2025. This trend signals a healthy and growing tourism sector, positioning Greece well for a robust summer season.

Promising Season Ahead

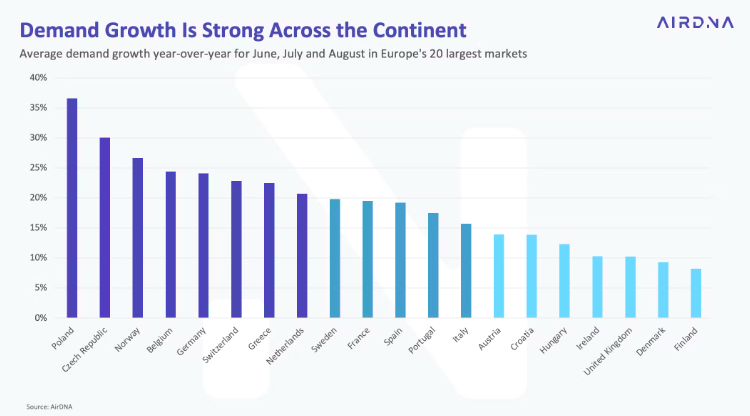

The summer season of 2025 is shaping up to be strong for Greece and other European destinations, with early bookings indicating high traveler interest. Eighteen out of Europe’s top 20 markets are seeing a year-over-year increase in demand of 10% or more, with Poland (+37%), the Czech Republic (+30%), and Norway (+27%) leading the way.

While Greece may not top the list, it continues to show steady, sustainable growth—boosting the performance of short-term rentals and laying the foundation for an even stronger summer ahead.

Foreign Tourists Drive Growth

A key trend in the Greek tourism market is the increasing dominance of international visitors. In Q1 2025, foreign tourists accounted for 86% of all visitors, with domestic travelers making up just 14%. This trend is expected to continue into Q2, with international bookings continuing to dominate the short-term rental market.

The rising influx of foreign travelers is expected to further drive demand, especially in popular destinations such as Athens, Thessaloniki, and the Aegean and Ionian Islands.

Let me know if you'd like this formatted as a press release or adapted for a specific platform.