On behalf of the Hellenic Hotel Federation, GBR Consulting is tracking 7 million room nights and € 1.2 billion in hotel revenue (net) on an annual basis (2019).

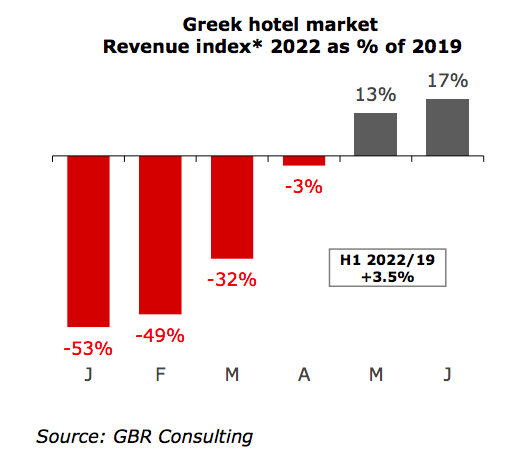

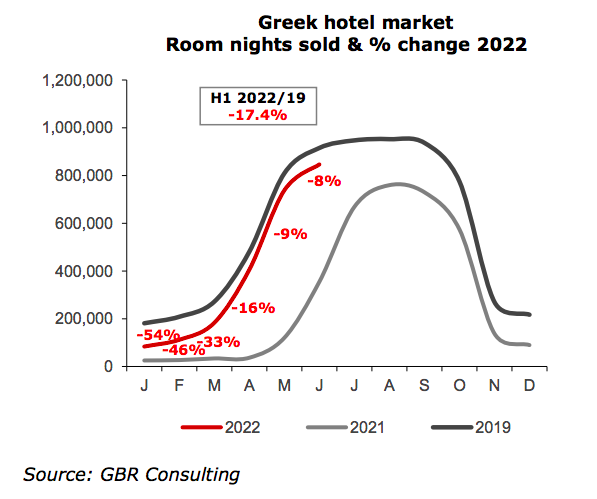

After a slow start of 2022, demand picked up but with big differences in geographic markets.

Resort hotels that in majority started the season in April and particularly May, achieved during the first 6 months of 2022 an occupancy level nearly on par with 2019, or in fact -0.7% lower. However, total revenues increased by 18.6%.

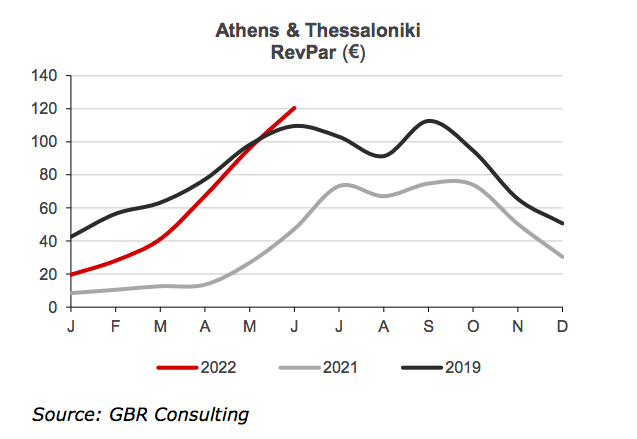

In Athens and Thessaloniki RevPAR declined 15.5% and 6.1% respectively during H1 2022 compared to H1 2019. During each month of 2022 occupancy levels were lower than 2019 in both cities, while room rates improved during Q2 compared to 2019.

A similar trend is noted for city hotels outside Athens and Thessaloniki, where occupancy levels with the exception of May were lower so far than the months of 2019. Also, total revenue was significantly lower in 2022 than 2019 during the period January – March, but recorded higher levels in May and June.

On a regional basis, the Cyclades registered +30.5%, the Dodecanese +4.5%, Crete -1.7% and the

Ionian Islands +5.5% during the review period compared with 2019.