Europe faces a deepening housing crisis, with a shortage of 9.6 million homes, or 3.5% of total housing stock. The gap between supply and demand continues to widen, driven by high migration and falling construction activity.

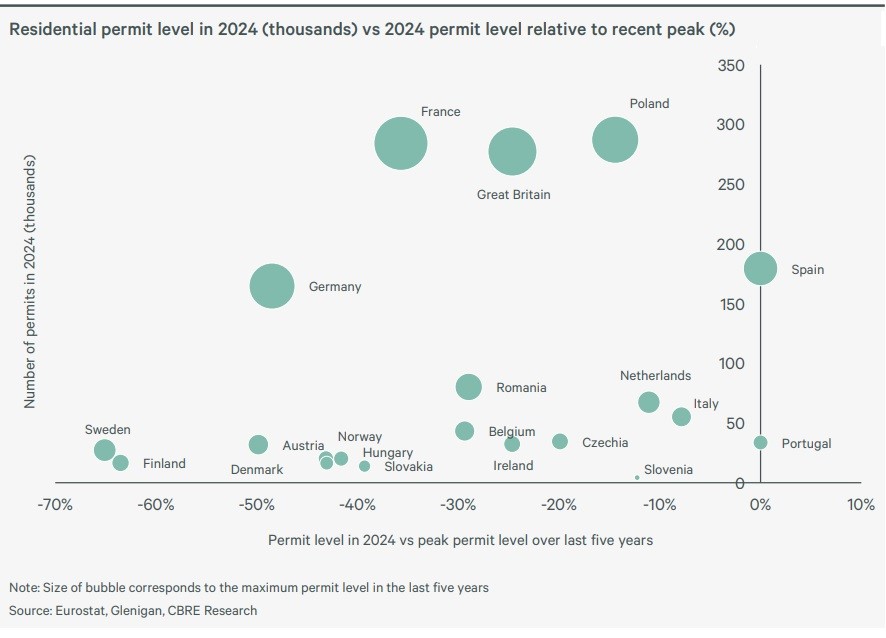

According to CBRE's "2025 European Real Estate Outlook Mid-Year Review", in 2024, only 60.5% of targeted building permits were issued. Early 2025 data shows this trend worsening. Housing delivery is expected to meet just 64% of need in 2025, despite stimulus measures and policy targets.

Governments are prioritizing housing and migration as public pressure grows. Some have introduced incentives to boost construction, but without major reforms in permitting and development policy, the shortage is set to exceed 10 million homes.

This crisis calls for coordinated action at both national and EU levels. Addressing structural barriers, enabling sustainable urban growth, and expanding housing supply are essential.

Affordability Under Pressure

Tight markets and rising rents are straining household budgets. Supply constraints have reignited debate over rent controls. Yet past experience shows such regulations can reduce supply and worsen long-term affordability.

Privatisation is compounding the problem. Institutional and private investors are buying rental properties to convert them to owner-occupied homes. This shrinks rental stock, pushes up rents, and limits options for tenants.

There is a glimmer of relief. Oxford Economics forecasts EU income growth at 4.6% in 2025, just outpacing CBRE’s projected rent increase of 4.3%. Still, the margin is slim and the crisis persists.

Policy is shifting. Instead of stricter rent controls, governments are now pursuing supply-side strategies. In Ireland, rent restrictions are being rolled back in favor of new development laws. In the UK, a £39 billion affordable housing program aims to expand social housing. Other countries are expected to follow.

Investor Behavior and Rental Contraction

Interest rate hikes (2022–2023) and tighter rent regulation have widened the gap between rental yields and vacant possession values. Investors are responding by exiting the rental sector, selling units into the owner-occupied market.

This trend is slowing, and in some regions reversing, the growth of rental supply. In urban areas, where demand is strongest, the effects are most severe.

The extent of impact varies by turnover rates, tenant protections, and market characteristics. But the direction is clear: privatisation is shrinking the rental sector.

If unchecked, these shifts will make housing less accessible and less affordable. Policymakers may need to intervene—protecting rental supply while keeping markets attractive to investors.