According to data from Cushman & Wakefield through the second quarter of 2025, nearly 75% of leasing activity was concentrated in central business district (CBD) locations, as companies continue to prioritize modern, high-quality office premises. This elevated demand, analysts note, has constrained availability, with the vacancy rate declining to 7.1% in the second quarter. Concurrently, prime market rents increased by 3.7% year-on-year and by 13.2% over the past three years.

The complex landscape of the European office sector is further shaped by the limited pipeline of new developments. Prime high-street yields fell to 5.2%, while property values rose by 5% year-on-year—marking the fourth consecutive quarter of positive growth. By the end of the third quarter of 2025, only 10.1 million sq. m. of office space remained under development, the lowest level in a decade, underscoring the likelihood that supply shortages will persist.

All major European office markets are expected to record rental growth during the 2025–2027 period, with an average rate of 4.7%. The London market is set to lead this trend, with rents in the City forecast to rise by 9.9% and the West End by 10.3%, while central Paris is projected to see an increase of 6.1%.

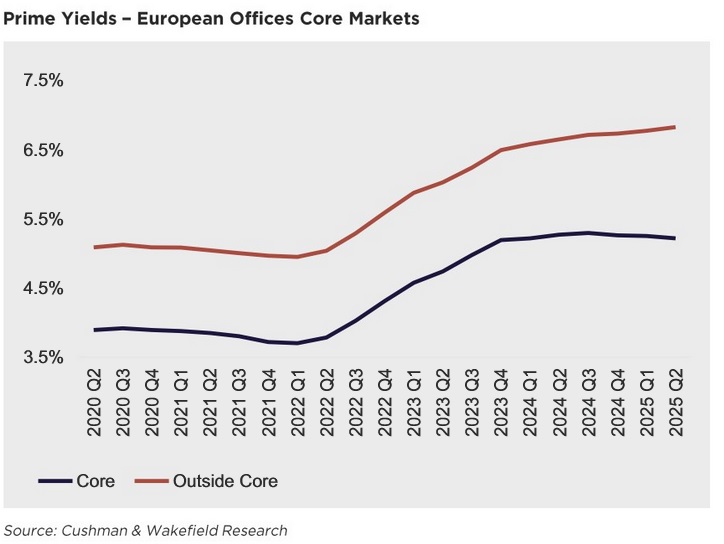

From an investment perspective, the combined effect of rising rents and an improving economic outlook in Europe is expected to result in selective further yield compression. Prime yields in central locations are projected to decline by 25 basis points by 2027, reaching 5.0%.

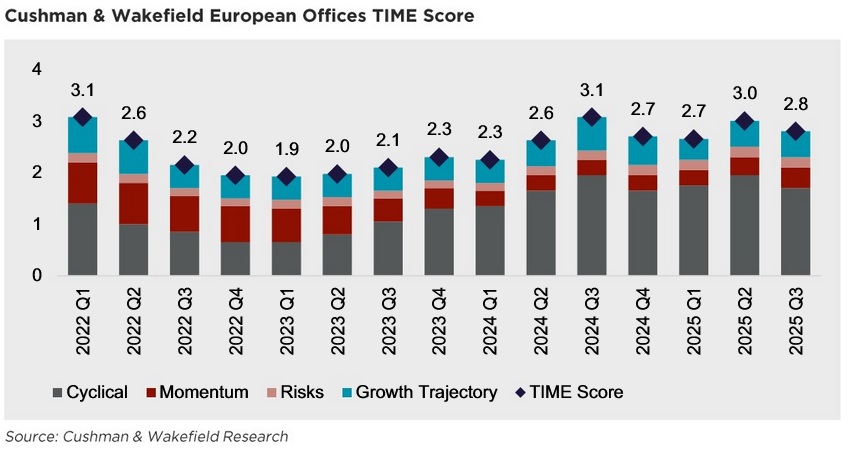

The European Fair Value Index for the office sector improved to 87 in the third quarter of 2025, indicating that more markets remain undervalued rather than fully priced. Despite a slight decline in the TIME Score from 3.0 to 2.8 during the same quarter, the index remains at one of its highest levels in the past two years, reflecting a broadly positive investment environment.

Significant improvements are being recorded in market liquidity and the average transaction size, both of which have climbed to their highest levels since late 2023. Moreover, upgraded forecasts for business investment and GDP growth in 2025 further support the index’s overall positive developmental trajectory.

The TIME Score is a tool that summarizes changes across key indicators of the investment market. A value close to 0 indicates underperformance across most indicators, while a value near 5 reflects favourable conditions. According to C&W analysts, market-related components of the model showed positive momentum, with liquidity and average transaction size reaching their highest levels since the end of 2023.