Construction investments are increasing at an accelerated rate from 2020 onwards, while last year they had the highest contribution (8,6 units) to the increase in total investments (11,7%). The sector's prospects for the coming years are significantly strengthened, by the investments expected to be made in the context of the implementation of programs such as "Next Generation EU" and the absorption of the resources of the Recovery and Resilience Fund (2021-2026), the Corporate Agreement of Regional Development (NSRF) 2021-2027 and are related to the energy upgrade of the country's building potential, urban renewal strategies, etc.

The Construction Production Index in Greece increased by 23% in 2022 compared to an increase of 6% in 2021. From 2017 to 2020, this index followed a downward trajectory, while the consecutive increases of the last two years covered 77% of the losses. The growth rate of the production index in construction in Greece was the highest among the countries of the European Union (EU-27) in 2022. Greece, in fact, is one of the 6 countries of the EU-27 in which the largest cumulative rising index between 2019 and 2022. The others are Romania, Italy, Croatia, Malta, and Slovenia.

The Construction Business Expectations Index, which shows considerable volatility, rose to 18,6 points in March this year, its highest level since October 2003 (19 points). Although the moving average of the last six months remains negative, as the index was in negative territory from November 2021 until January of this year, it is following a strong upward trend in the early months of 2023. Among the individual categories that make up the construction industry's business expectations index, forecasts for the volume of work, although negative, improved markedly from one month to the next, while the positive forecasts for employment continued to strengthen.

Construction is expected to pass €14 billion in 2023. That would be growth of 4,8% and showing the acceleration of a key industry in the country that was held down for years, first by an eight-year economic and austerity crisis and then during the Covid-19 pandemic.

For all those woes, medium to long term growth story in Greece remains intact and the construction industry in Greece is expected to grow steadily over the next four quarters. The growth momentum is expected to continue, recording an annual growth rate of 4 percent through 2027 when the industry is in line to reach €16,4 billion.

European prospects

In 2022, GDP increased by 3,5% in both the eurozone and the EU as a whole, after a growth of 5,3% and 5,4% respectively in the previous year. Russia's war of aggression against Ukraine has significantly impacted global supply chains and reinforced global inflationary pressures. The EU’s geographical proximity to the war and its dependence on Russian energy resources leaves it particularly exposed to the effects of the conflict. As such, early forecasts for 2023 were pessimistic. Nevertheless, in 2023, the EU’s GDP is expected to expand by 0,8%, a stronger growth than initially expected, and inflation will be lower than in forecasts made towards the end of last year.

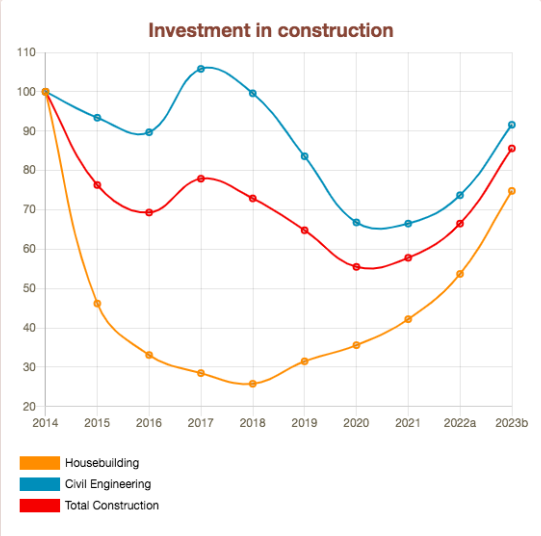

Rising prices and supply shortages for energy and certain construction materials have negatively impact several contractors in Europe, with many at risk of not being able to fulfil contractual obligations or refraining from participating in public tenders. The sustained high energy and raw material costs have a negative impact on production levels, potentially slowing down construction works. Nevertheless, the total investment in construction increased by 2,0% in 2022, not too far off than what FIEC had initially projected (+2,2%). For the second year in a row, Italy (+12,1%) registered the largest increase in investment while Bulgaria registered the sharpest decline (-23,1%).

The outlook for 2023 is more pessimistic with investment in construction in Europe expected to fall by 2,5%, with all segments expected to contract expect for civil engineering. Sweden is expected to be the country hit the hardest, with investment in construction expected to fall by 13,7%, while Portugal should be the best perfomer with an expected growth of 3,4%.

In terms of employment, the sector employed 11,1 million workers in 2022, a decrease of 4,0% compared to 2021.

Prices of construction materials

The Covid-19 pandemic caused significant disruptions to global supply chains, with several contractors experiencing delays in the delivery of products. The ongoing war in Ukraine has further strained the supply of certain raw materials, especially steel, in Europe and price increases for construction materials are being observed across all EU Member States.

Looking at certain construction materials individually, prices for steel and bituminous products peaked in most EU countries around mid-2022 and dropped towards the end of the year. Meanwhile the prices of cement have been gradually increasing over the past year. Indeed, a sharp hike in energy prices has been observed across the EU since 2021 and energy-intensive industries including concrete and cement tend to pass on the impact of higher prices to contractors.