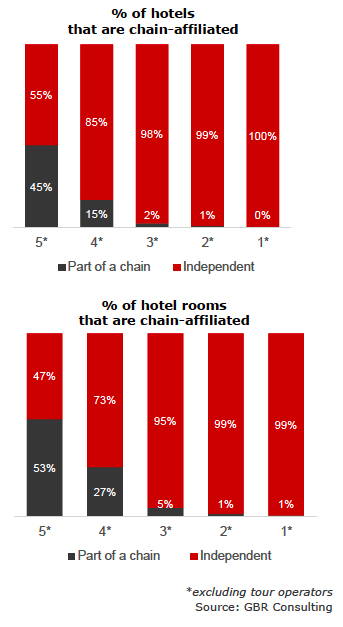

According to data from the latest quarter published by the consulting firm GBR Consulting, the presence of hotel chains in the Greek market is gradually strengthening, reflecting the industry’s shift toward professional management and unified corporate branding. As of October 2025, approximately 8% of hotels and 22% of rooms in the country operate under an international, national, or local brand.

The highest level of penetration is observed among five-star hotels, where 45% of properties and 53% of rooms belong to organized chains. In the four-star category, the corresponding figures are 15% and 27%, while one- to three-star establishments operate predominantly as independent units.

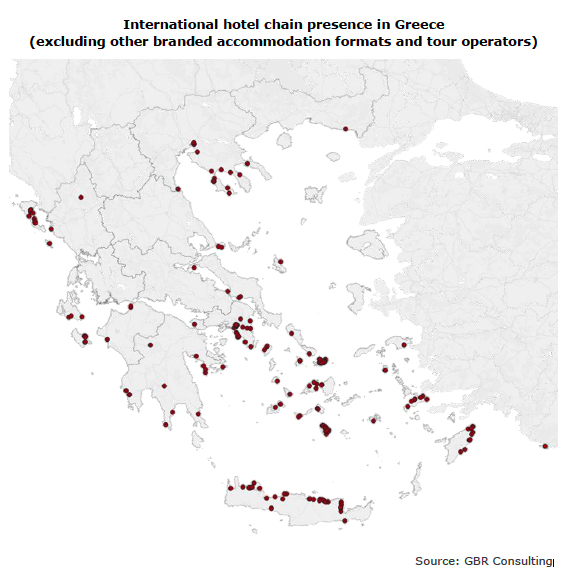

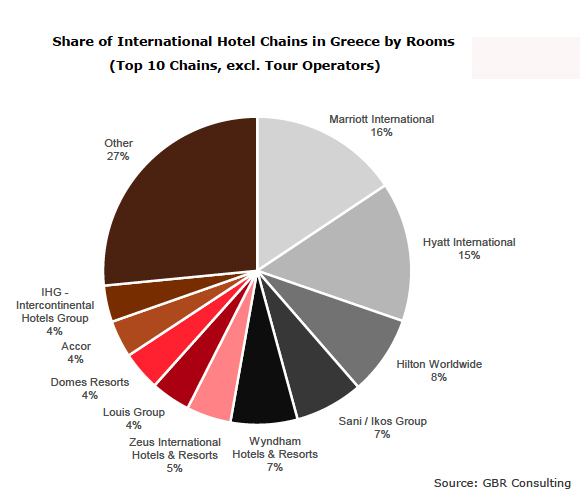

At present, 41 international chains operate in the country with 399 properties and 37,298 rooms, along with 59 national chains comprising 351 properties and 48,969 rooms, and 64 local chains with 296 properties and 29,948 rooms. Within the five-star category, 19% of hotels are affiliated with international brands, while in the four-star segment, the share does not exceed 2%.

At the same time, the brand landscape is evolving rapidly through international agreements. Hyatt completed the acquisition of Mr & Mrs Smith in 2023, while Hilton incorporated selected Small Luxury Hotels (SLH) into its network as of January 2024. In 2025, Zeus International introduced new commercial brands, Zeus and Zeus Essence, consolidating its corporate identity.

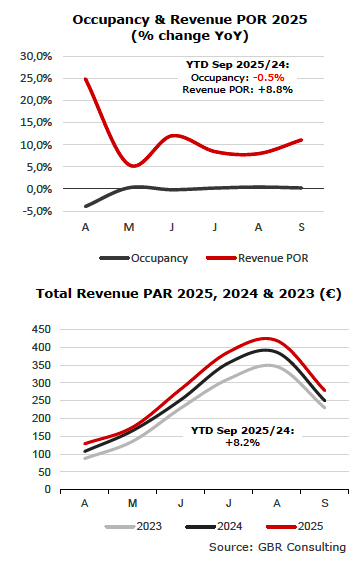

Hotel and Revenue Performance

The overall performance of the sector in 2025 has been positive. The GBR revenue index, which covers revenues totaling €1.7 billion up to September, recorded an increase of 7.7% compared to 2024.

In urban hotels, the first quarter showed high occupancy rates with stable ADR, while the trend reversed in the second quarter. During the third quarter, occupancy declined by 1.3%, offset by a 3.8% rise in room rates, leading to a 6.7% increase in RevPAR for the nine-month period.

In resort hotels, the picture was even stronger: despite a 1.6% drop in occupancy in the second quarter, revenue per occupied room rose by 10%. In the third quarter, occupancy levels stabilized, and Revenue POR increased by 8.9%, resulting in an overall RevPAR growth of 8.2% through September.