As stated in its announcement, the listed company reported an adjusted annual return on Enterprise Value (EV) of 17.2%.

The performance of key financial figures for the fiscal year 2024, compared to the same period last year, was as follows:

-

Adjusted Earnings from Fair Value Adjustment of Investments: €16,058,000 vs. €13,958,000 (+15.0%)

-

Adjusted Operating Profit: €19,569,000 vs. €18,047,000 (+8.4%)

-

Adjusted Net Profit After Taxes: €19,273,000 vs. €17,271,000 (+11.6%)

Key Indicators:

-

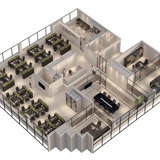

Total Building Area: 69,803 sqm

-

Gross Property Income Yield (Gross Yield): 7%

-

Adjusted Net Asset Value per Share (Adjusted NAV p.s.): €1.167

-

Adjusted Net Earnings per Share: €0.13

-

Weighted Average Lease Term (WALT): 3.5 years

-

Net Debt to Property Value Ratio: -10%