According to UBS’s Global Wealth Report 2025, global wealth increased by 4.6% in 2024, continuing the upward trend seen in 2023 (4.2%).

The majority of millionaires reside in North America, where their number grew by 1.2% (an increase of 684,000 individuals), with the United States alone adding more than 379,000 new millionaires.

Switzerland maintained its position as the country with the highest average wealth per capita. Significant increases in average wealth (in local currencies) were recorded in Denmark, South Korea, Sweden, Ireland, Poland, and Croatia.

Globally, the United States, China, and France had the largest number of millionaires.

Increasing Everyday MILLIONaire – EMILLIs worldwide

The term “next-door millionaire” (Everyday MILLIONaire – EMILLI) refers to individuals who live below their financial means, save consistently, invest wisely, and avoid debt. As a result, they gradually build wealth that exceeds one million euros or dollars.

Their number has quadrupled since 2000, reaching 52 million people globally by the end of 2024. Collectively, they hold approximately $107 trillion — nearly equal to the wealth held by individuals with assets over $5 million.

The report highlights significant generational differences in wealth distribution, particularly in the United States.

Millennials (born after 1981) tend to invest more in consumer goods and real estate, while Baby Boomers (1946–1964) hold over $83 trillion in net wealth — far surpassing both Generation X (1965–1980) and the Silent Generation (born before 1945).

Wealth inequality is also evident on a geographic level. In the U.S., investments are primarily focused on the financial sector, while in Australia and Singapore, there is a clear emphasis on real estate and insurance coverage.

The study forecasts a massive intergenerational wealth transfer over the next two decades, expected to exceed $83 trillion. The largest transfers are projected to occur in the United States, Brazil, and China, with the U.S. standing out as more than $29 trillion is expected to change hands there alone.

The situation in Greece

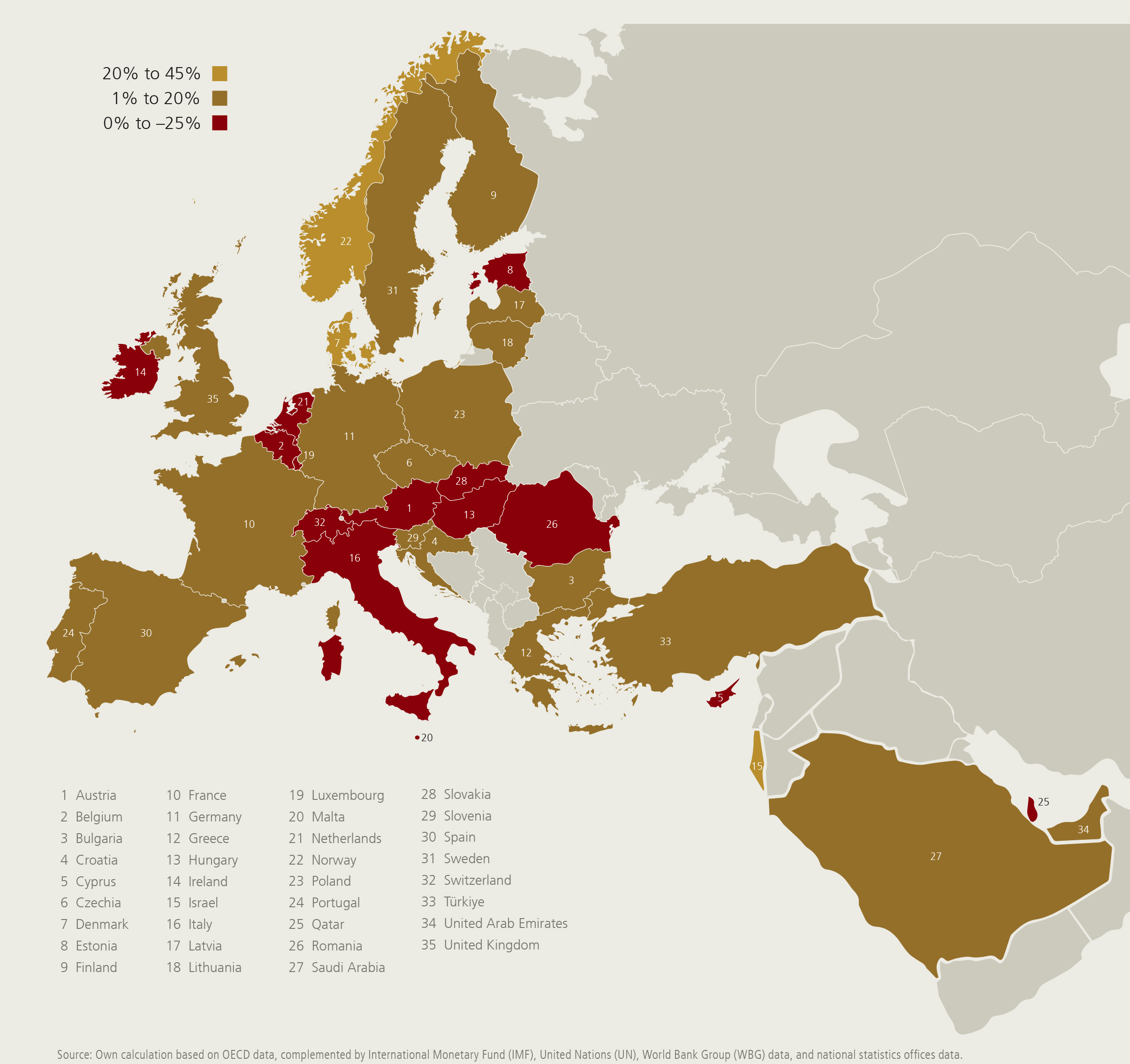

Despite global turbulence and significant market fluctuations, Greece recorded notable progress in key private wealth indicators, according to the UBS Global Wealth Report 2025.

The average net wealth per adult increased by more than 7% in 2024, in real terms (adjusted for inflation), primarily due to the revaluation of real estate assets, as the majority of household wealth in Greece is tied to property rather than financial investments.

Although total wealth increased, the number of Greek millionaires declined slightly, by 0.3% to 0.5%, in contrast to the global trend, which showed a 1.2% increase in 2024.