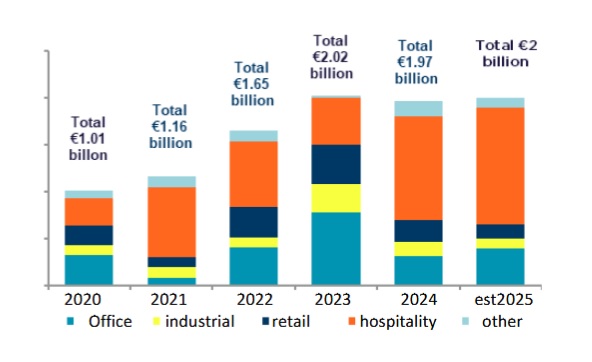

Demand for high-specification (Grade A) properties has increased significantly, with placements in the commercial real estate sector surpassing €1 billion, despite ongoing pressures observed in certain subcategories.

A highlight of the period was the acquisition of 100% of the Astir Palace Vouliagmeni resort by shipping magnate Mr. George Prokopiou, marking one of the largest private transactions in the hospitality sector in recent years. Following his purchase of a 30% stake from the Dogus Group in October 2024, Mr. Prokopiou acquired the remaining 70% from the Jermyn Street Real Estate Fund, with the total transaction value estimated at €700 million.

Despite the strong momentum in domestic activity, foreign direct investment (FDI) in real estate registered a decline. According to the Bank of Greece, net inflows for the first quarter of 2025 stood at €356.8 million, down 31.4% compared to the same period in 2024 (€520 million). This slowdown is mainly attributed to the residential sector, where investor caution has grown due to uncertainty surrounding the New Building Code (NOK), rising construction costs, labor shortages, and delays in property transfers.

The office market recorded a 12% increase in transactions during the first half of 2025, reaching €165 million, compared to the same period in the previous year.

Private investors maintained a strong presence, engaging in significant acquisitions both for investment purposes and owner-occupancy. Banks also demonstrated increased activity, with Alpha Bank strengthening its position in the real estate sector by increasing its equity stake in Prodea Investments. This move highlights the strategic importance of the sector for the banking system and reflects a clear intention to take a more active role in real estate investment structures.

In the retail sector, transaction volume reached approximately €75 million during the first half of 2025. Key deals included the acquisition of a Sklavenitis hypermarket in Rio for €11.24 million, as well as the sale of two commercial properties leased to Zara and Adidas on Ermou Street by Europe Holdings to Alpha Bank, for a total consideration of €54 million (including an office building).

In contrast, the logistics and industrial property sector experienced a decline, with total transactions amounting to just €30 million. These were primarily driven by auction-based acquisitions for owner-occupancy purposes, indicating limited investment appetite in this segment during the period.

The hospitality market, however, saw a significant surge, with transactions totaling €850 million in H1 2025—one of the highest performances in recent years. This was largely fueled by the landmark acquisition of the Astir Palace Vouliagmeni, reaffirming the strategic importance of tourism-related real estate in Greece and the growing appeal of the sector to both domestic and international investors.

Niki Sympoura, Head of Cushman & Wakefield Proprius in Greece, commented:

“The Greek real estate market is entering a phase of gradual maturity, demonstrating notable resilience despite the ongoing challenges faced by certain sectors. The increasing demand for Grade A properties, the active participation of local investors, and strategic moves in high-potential segments all reaffirm the attractiveness of the Greek market.” She added: “A key priority for the industry is the development of a modern, sustainable, and globally competitive real estate market—capable of attracting investment and providing high-quality solutions for businesses and citizens alike.”