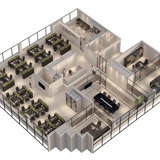

The Retail Park is located at 54 Piraeus Street, in Neo Faliro and covers an area of 14,895 sq.m., with lettable areas of 14,555.46 sq.m. and 400 underground parking spaces. The 14 stores that will be housed will be occupied by Triple-A tenants such as AB Vassilopoulos, LCWaikiki, Moustakas Mc Donald’s and others. The Retail Park with green characteristics is under construction and its completion is expected within the next three months, while its full operation is projected for June 2022.

Through this new investment, TRADE ESTATES REIC aims at the expansion of the retail activity that is developing at the intersection of Kifissou and Piraeus streets. In combination with the existing commercial complex where the Company already operates in the area of Renti, along with the two existing Big Box stores of leading retail groups, a top commercial destination is created characterized with easy access from both directions on Piraeus Street.

The Company is planning in the short term the exploitation of the synergies between these two retail parks. This investment is part of the Company's strategy to specialize and focus on the development of Retail Parks and new generation Logistics Centers, as these two categories are an integral part of the Omnichannel approach that is evolving in world trade.

Convenience Retail Parks is the strongest trend of retail worldwide as consumers are becoming more time constrained and also in the post Covid era are constantly looking for easy, safe and direct access to shopping and services.

The Chairman and CEO of the Company Mr. Vassilis Fourlis stated: “Consistent with our strategy to have a leading market position in the sector of retail parks, we announce another acquisition by TRADE ESTATES REIC.Our intention is to make targeted investments after continuous research and analysis of market developments, which reveal critical opportunities for value creation through the development of top commercial destinations for modern consumer families.

This transaction is part of our Company's dynamic strategic plan for the creation of a portfolio of unique commercial assets through acquisitions and development throughout the country and in the greater geographical region”. The total cash consideration for the purchase of the shares of the Company "BERSENCO REAL ESTATE DEVELOPMENT AND PROPERTY MANAGEMENT SA" by TEN BRINKE Group amounts to € 18.3 million and is part of a broader partnership between the two counterparties.