The firm’s recent analysis, published in the PREA Quarterly, notes that while the outlook is improving, lingering risks—such as geopolitical tensions, policy uncertainty under the new Trump administration, and potential global supply chain disruptions—continue to weigh on investor sentiment.

The report emphasizes the evolving dynamics within diversified real estate funds. Many such funds, although marketed as diversified, are heavily concentrated in outperforming sectors like industrial and multifamily. This trend raises questions about whether investors may be better served by sector-specific strategies targeting those segments directly.

Over the past decade, real estate sector performance has increasingly diverged. Sectors supported by long-term structural trends—such as industrial and residential, benefiting from e-commerce, housing affordability issues, and demographic shifts—have consistently outperformed office and retail, which rely more heavily on cyclical demand.

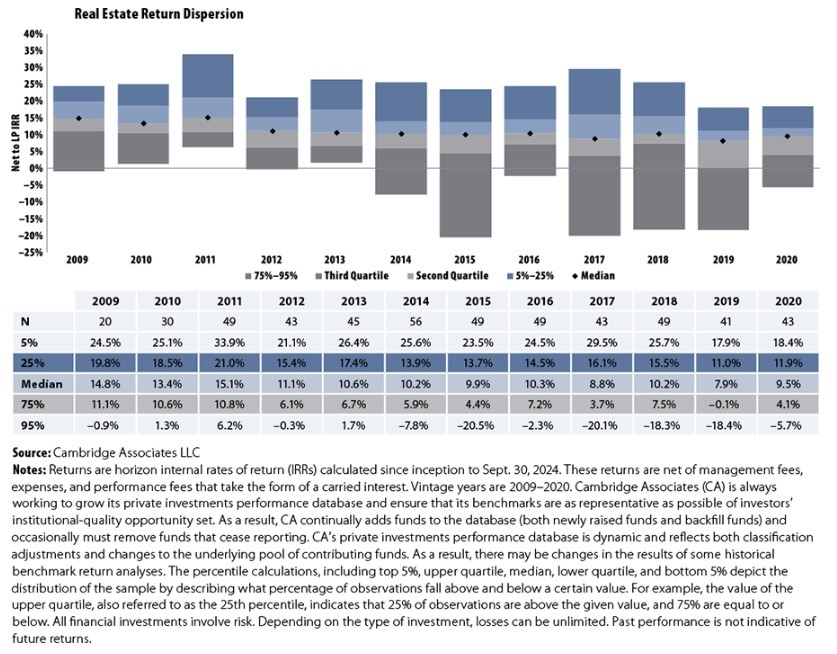

Analyzing over 500 North American private real estate funds with vintage years from 2009 to 2020 reveals notable trends in performance across different market cycles. During the immediate post-global financial crisis period (2009–2014), fund managers capitalized on distressed assets and attractive valuations, resulting in strong median net internal rates of return (IRRs) ranging from 10.2% to 15.1%, with relatively low return dispersion.

In contrast, funds with vintage years from 2015 to 2020 experienced more normalized returns, driven by increased capital inflows and rising valuations amid a low interest rate environment. These vintages displayed declining median IRRs and greater variability in fund performance. Despite this, top-quartile managers maintained strong performance, comparable to those in earlier periods.

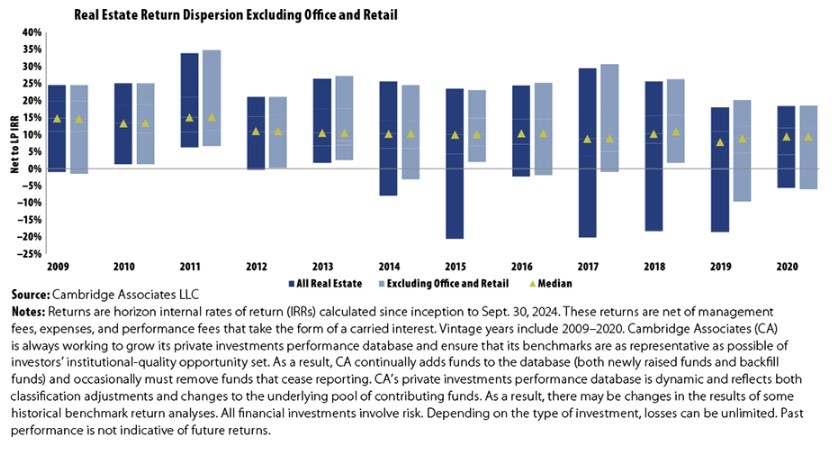

The divergence in sector-level performance over the past decade contributed significantly to the increased dispersion in fund returns. Structural advantages favored sectors such as residential and industrial—benefiting from e-commerce growth, housing affordability issues, and demographic shifts—while office and retail sectors, more reliant on cyclical demand, underperformed.

The COVID-19 pandemic further exacerbated this divergence, accelerating the decline of office and retail due to shifts in consumer behavior and the widespread adoption of remote and hybrid work models.

Funds with significant exposure to office and retail assets have experienced particularly poor performance, especially among vintages from 2015–2020. These funds were in their value-add phase during the pandemic and faced delays in stabilization, reduced return potential, and downward valuation pressure. Even when funds focused exclusively on underperforming sectors were excluded from analysis, the performance of these vintages remained challenged due to broader liquidity issues.

Notably, when office- and retail-heavy funds were excluded from the analysis, bottom-quartile returns improved significantly, although median returns were largely unchanged. The report concludes that while sector-specialist managers can deliver compelling risk-adjusted returns, they may be more exposed to secular disruptions. Conversely, fund managers with more flexible, multi-sector mandates may be better equipped to adapt to rapidly evolving market conditions.