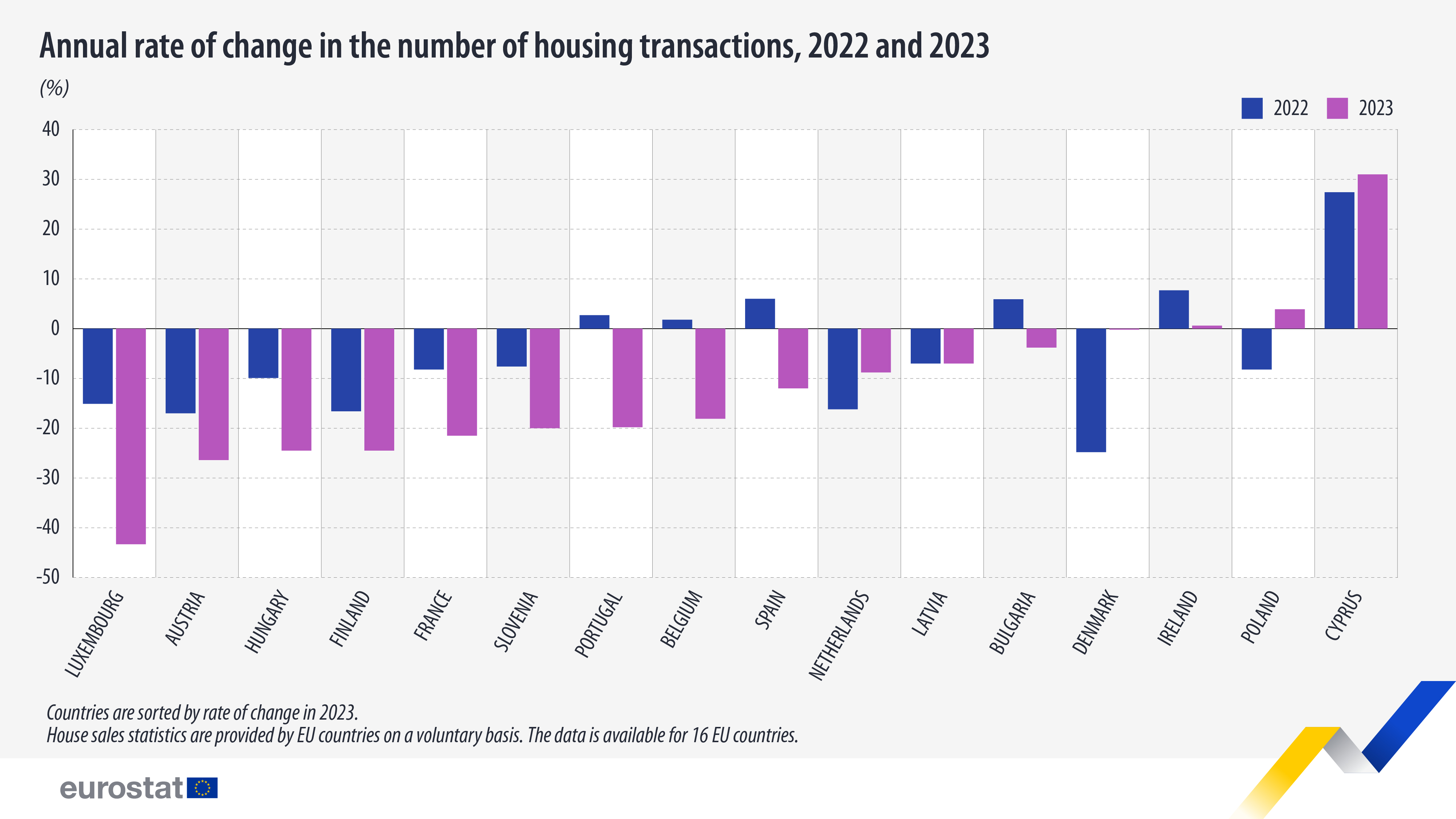

The largest decreases in the number of transactions in 2023 were recorded in Luxembourg (-43.3%), Austria (-26.4%), Hungary and Finland (each -24.5%). In contrast, increases were registered in Cyprus (+31.0%), Poland (+3.9%) and Ireland (+0.6%).

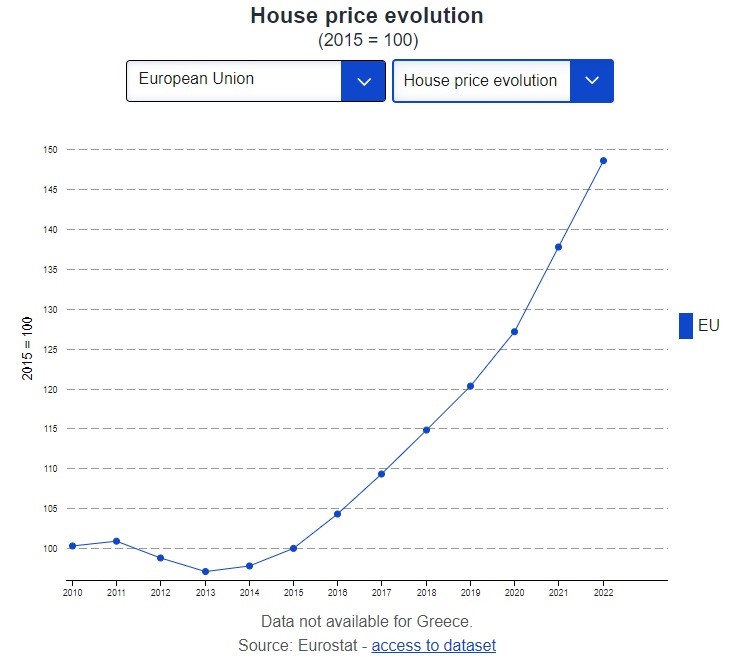

House prices up by 47% in the EU between 2010 and 2022

Looking at the trend of house prices between 2010 and 2022, there has been a steady upwards trend since 2013 with particularly large increases between 2015 and 2022. In total, there was an increase of 47% between 2010 and 2022.

There were increases in 24 Member States and decreases in 2 over this period (data for Greece not available) . The largest increases were observed in Estonia (+192%), Hungary (+172%) and Luxembourg (+135%), while decreases were registered in Italy (-9%) and Cyprus (-5%).

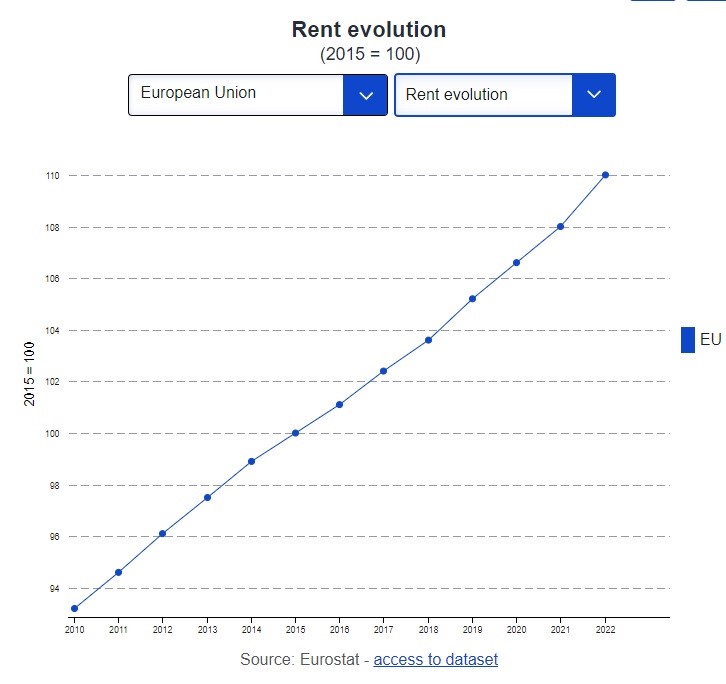

Rents up by 18%

There has been a steady increase of rents in the EU between 2010 and 2022 – in total 18% during the whole period. There was an increase in all Member States except Greece (-25%). The largest increases were registered in Estonia (+210%), Lithuania (+144%) and Ireland (+84%). In Cyprus the increase was only +0.2%.

Housing affordability in the EU

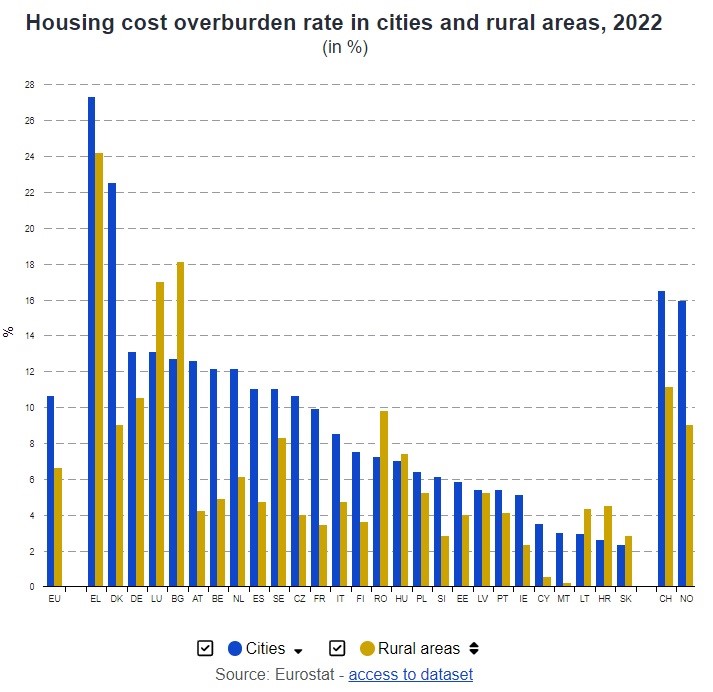

Housing cost overburden highest in cities

With house prices and rents rising, the cost of housing can be a burden. This can be measured by the housing cost overburden rate, which shows the share of the population living in a household where total housing costs represent more than 40% of disposable income.

In the EU in 2022, 10.6% of the population in cities lived in such a household, while the corresponding rate for rural areas was 6.6%. The highest housing cost overburden rates in cities were observed in Greece (27.3%) and Denmark (22.5%), and the lowest in Slovakia (2.3%) and Croatia (2.6%).

In rural areas they were highest in Greece (24.2%) and Bulgaria (18.1%), and lowest in Malta (0.2%) and Cyprus (0.5%).

The housing cost overburden was higher in cities than in rural areas in 20 Member States and lower in 7. The extremes in this difference were Denmark (13.5 percentage points, with 22.5% in cities and 9.0% in rural areas) and Bulgaria (-5.4 percentage points, with 12.7% and 18.1%).

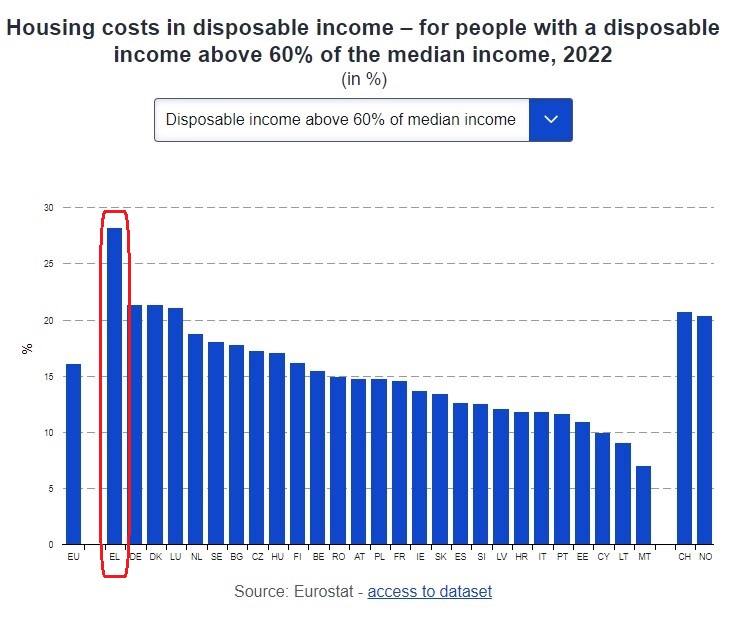

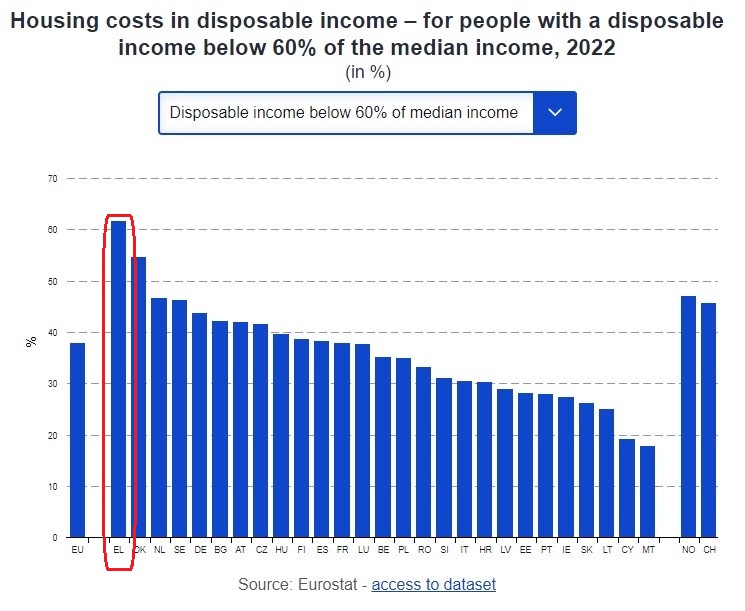

Greece recorded the highest share of housing cost in total disposable income

Another way of seeing whether housing is affordable is by the share of housing cost in total disposable income. On average in the EU in 2022, 19.6% of disposable income was dedicated to housing costs. This differed among the Member States, with the highest shares in Greece (34.2%), Denmark (25.4%) and Germany (24.5%).

Looking at those having a disposable income of below 60% of the national median income, people who could be considered as at risk of poverty, the share of housing in disposable income was 37.9% on average in the EU. On the other hand, for those having a disposable income of above 60% of the median income, the share amounted to 16.0%.