In December, the number of available properties increased by 17.3% on an annual basis, which is the second-highest increase on an annual basis. However, the growth in occupancy was limited to just 0.5% year-on-year, despite the strong year-on-year growth in the number of available properties.

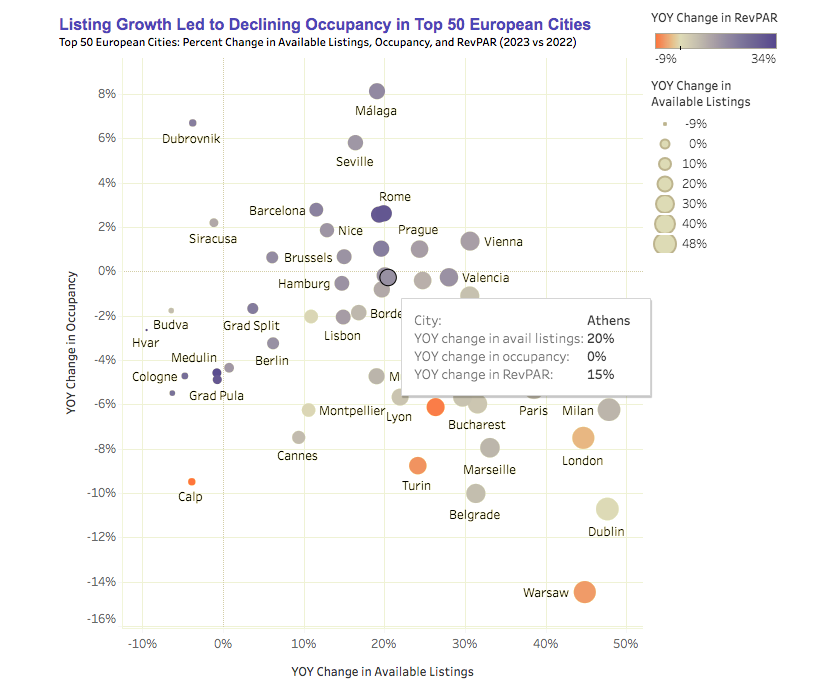

The average Revenue per available rental night (RevPAR) in 2023 was €90, which shows a 9.8% year-on-year increase and an incredible 36.8% increase from 2019. The countries that experienced the biggest growth in the number of available properties last year, such as Norway (+47.4% y/y), Sweden (+36.9% y/y), and Finland (+27.7% y/y), also saw some of the biggest year-over-year declines in occupancy.

In all three countries, occupancy fell by more than 5% on a year-over-year basis.

On the other hand, countries such as Greece and the Netherlands saw a much more modest increase in the number of available properties, resulting in only small occupancy drops of less than 1% last year.

Over the past year, hosts have gained significant pricing power due to the strong demand growth and sustained occupancy. In 2023, the average nightly prices across Europe were €164, representing an 11.9% year-on-year increase.

To be more specific:

- Available listings have increased by 17.3% year-on-year and 12% since 2019.

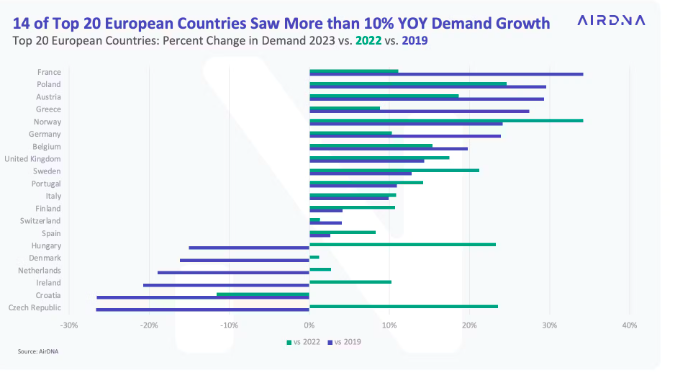

- Demand has grown by 14.5% year-on-year and 17.5% compared to 2019.

- Average daily rates (ADR) have increased by 11.6% year-on-year and 46.8% compared to 2019.

- Revenue has grown by 27.8% year-over-year and 72.4% compared to 2019.

- Occupancy has increased by 0.5% year-on-year and by 6.1% compared to 2019.

- Revenue per available rental (RevPAR) has increased by 12.1% year-over-year and 55.8% from 2019.

In 2023, a significant number of Americans travelled to Europe. According to Airbnb's data, American travellers accounted for 11% of all Airbnb stays in Europe, which is an increase of 12% from 2019, when they made up 9.8% of Airbnb stays in Europe.

Asian travellers have been the second-largest group of travellers in Europe traditionally. However, last year, only 3.3% of Airbnb stays in Europe were by travellers from Asia, which is a significant drop from 2019 when they accounted for 4.8% of stays.

The current booking trend indicates that short-term rental demand for Europe is expected to grow in 2024. Bookings for the next six months are up by 19.3% from last year. The demand rate for March is currently up 35% YoY because Easter is in March this year instead of April. However, demand for April is down by 3% YoY.

May to July show strong prospects, with demand increasing by 29%, 22.4% and 20.8% in May, June and July, respectively.