The year 2024 was dubbed the "Year of Elections," with half of the global population taking part in the electoral process. The outcomes of these elections, especially in the United States, had a far-reaching global impact.

Despite geopolitical challenges and ongoing conflicts in Ukraine and Israel, the demand for travel remained robust. According to Eurostat, Europe saw an increase of 50 million overnight stays in 2024 compared to 2023, setting a new record.

While hotel demand experienced modest growth in occupancy, the rise in average room rates has started to stabilize.

Inflation in Europe eased, enabling the European Central Bank (ECB) to lower interest rates in a bid to stimulate economic growth. Similarly, the Bank of England reduced interest rates, although the economic outlook for the United Kingdom remained mixed.

According to the ECB's wage index, wages increased by 5% by the end of 2024. While cost pressures continued to be a concern for hoteliers, the stabilization of inflation helped to stabilize profit margins.

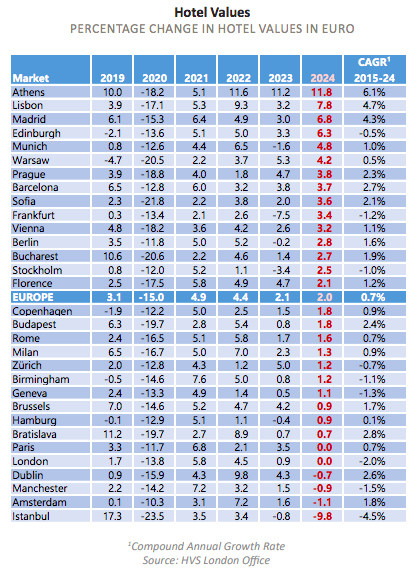

Despite a more complex geopolitical and economic landscape, hotel values in Europe rose by 2%, with RevPAR remaining positive and net profits largely stable. This was further supported by a decline in borrowing costs.

Most European markets reported a positive increase in RevPAR, with the recovery in occupancy helping to offset price stabilization. Cities such as Lisbon, Madrid, and Edinburgh saw significant growth, benefiting from a surge in leisure travel.

The Investment Landscape in Europe

Transaction volume surged by 67% year-on-year, reaching €17.8 billion in 2024, although this still represented 81% of the levels seen in 2019.

The number of individual transactions increased by 17%, with their value rising by 42%.

Major transactions included the sale of the Mandarin Oriental Paris (€205 million), Six Senses London (€211 million), and Hilton Paris Opera (€240 million).

The UK and Spain emerged as the hottest markets, together accounting for 36% of the total transaction volume. The UK saw an impressive 268% increase in transactions compared to 2023.

European investors remained the most active, contributing to 70% of the transaction volume.

London reclaimed its position as the most liquid market, with transactions surpassing €3 billion—doubling the previous year’s total.