According to the UBS Global Real Estate Bubble Index 2025, signs of a significant market correction are emerging, driven by factors such as the growing disconnect between incomes and rents, excessive borrowing, high levels of construction activity, and rapid price increases fueled by foreign investment in major cities.

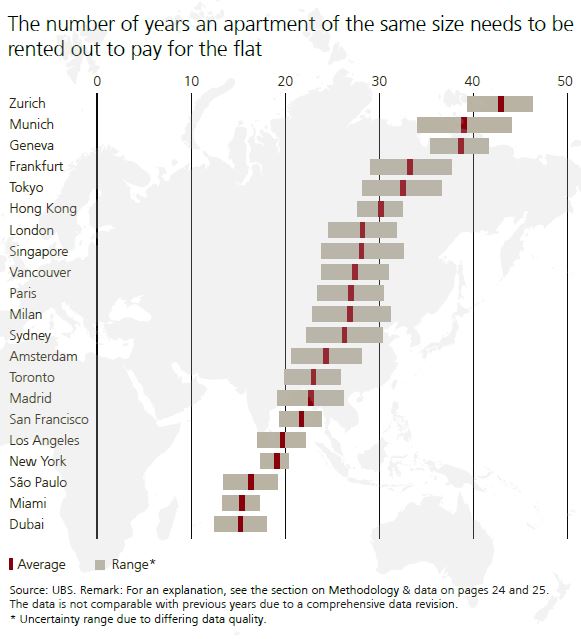

As UBS highlights, global housing prices have remained nearly stable in inflation-adjusted terms over the past four quarters, as decreased purchasing power has led to weaker demand. The study examined housing prices across 21 major cities worldwide.

The findings indicate that the risk is particularly elevated in cities such as Los Angeles, Geneva, Amsterdam, and Dubai. Notably, Dubai, along with Madrid, experienced the most substantial increase in risk compared to the previous edition of the report.

The risk of a housing bubble is considered moderate in cities such as Sydney, Vancouver, and Toronto. Madrid, Frankfurt, and Munich also fall within the moderate-risk category. According to the index, London, Paris, and Milan face a low risk of a housing bubble. Outside of Europe, Hong Kong, San Francisco, New York, and São Paulo are in the same low-risk category, with São Paulo exhibiting the lowest risk among all the cities analyzed.

Cities that were identified as having a high risk of a housing bubble in 2021—such as Frankfurt, Paris, Toronto, Hong Kong, and Vancouver—have seen average declines in real prices of nearly 20% from their peak levels, primarily due to rising interest rates in the years that followed. In contrast, real prices in cities with fewer imbalances have dropped by an average of around 5%.

However, some cities have diverged from this broader trend. Over the past five years, Dubai and Miami have emerged as clear frontrunners, with average real estate price increases of approximately 50%. They were followed by Tokyo and Zurich, which recorded gains of 35% and nearly 25%, respectively.

On a year-over-year basis, Madrid stood out as the top performer, registering the highest increase in real housing prices among all cities analyzed, with a rise of 14%.