A new study has found that climate-related risks are increasingly being factored into the pricing of commercial real estate across the euro area. Researchers discovered that investors are applying growing discounts to buildings exposed to physical climate threats—such as floods or heatwaves—with these price penalties rising by 24 percentage points between 2007 and 2022. Despite this shift, market activity in high-risk buildings has remained stable, suggesting that the adjustment has been gradual and orderly.

The study also examined transition risks—such as tighter environmental regulations or shifting demand for greener buildings. It found signs that older properties are becoming harder to sell, raising concerns that they may be turning into so-called “stranded assets.”

While the findings suggest that markets are beginning to price in climate risks, the researchers caution that it’s unclear whether these risks are fully accounted for. They emphasize the need for better data, particularly on building energy efficiency, to support more accurate risk assessments and pricing in the future.

Newer Office Buildings Command Price Premium in Euro Area

Before diving into regression analysis, researchers examined pricing trends across euro area office buildings and found a consistent premium for newer properties. Transaction data revealed that offices under five years old have commanded significantly higher prices compared to older buildings throughout the entire study period.

Interestingly, the gap between buildings under five years old and those aged five to ten years has widened in recent years, suggesting that investors are placing increasing value on newer—and possibly more energy-efficient—properties. This trend supports the idea that building age is becoming a stronger signal for both quality and climate-related performance in the commercial real estate market.

Shift Toward Newer Office Buildings in Eurozone CRE Market

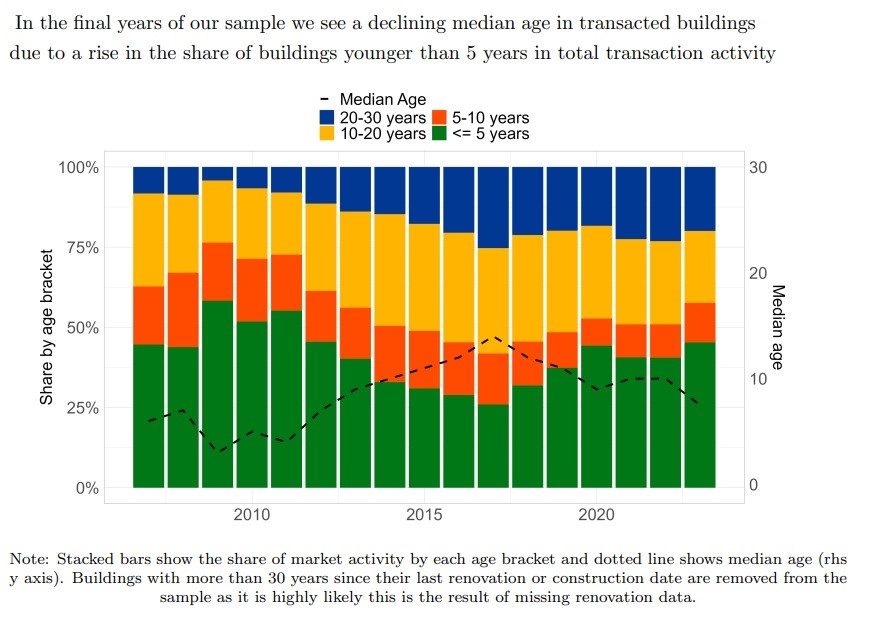

New data show a gradual shift in euro area commercial real estate transactions toward newer office buildings, with a steady decline in the median age of transacted properties beginning around 2017. This trend aligns with growing pricing premiums for newer buildings, as documented earlier in the study.

The rising share of newer buildings in total transactions may reflect increased investor preference for modern, energy-efficient assets. However, researchers caution that construction cycles also play a key role. For example, the early part of the sample—before the global financial crisis (GFC)—saw a higher proportion of young buildings being sold, likely due to a construction boom in the preceding years. After the GFC, this share declined sharply, mirroring a significant drop in new construction activity across the region.

These dynamics suggest that both investor sentiment and broader economic conditions influence the age profile of commercial property transactions over time.

Climate Risks to Commercial Real Estate Could Threaten Financial Stability

The growing impact of climate change on commercial real estate (CRE) prices could have serious implications for financial stability and the broader economy, a new analysis suggests. As the value of office buildings and other CRE assets declines due to climate-related risks, the resilience of firms, investment funds, and insurers holding these properties may come under pressure—posing potential threats to the financial system.

Falling CRE prices could also increase credit risk across the financial sector. Many of these assets are used as collateral for loans, meaning a drop in their value could expose lenders to greater potential losses and limit borrowers’ access to credit. Such dynamics could intensify the macroeconomic fallout of climate-related events.

However, the pace and nature of the market’s adjustment to climate risks will be critical in determining the severity of these effects. Research on climate and financial stability consistently shows that a gradual, well-managed transition—where policymakers and markets adapt in step with new data and clearer risk assessments—can significantly reduce costs and disruption. In contrast, a sudden and disorderly adjustment—triggered by an abrupt event or regulatory shock—could result in sharper financial turmoil. This includes a loss of market liquidity and the emergence of “stranded assets” that investors may be unable to sell at any price.

Stress tests conducted by the European Central Bank and the European Systemic Risk Board have repeatedly found that banks would suffer significantly higher capital losses in scenarios involving rapid, unplanned transitions (ECB/ESRB, 2020, 2021a, 2022), underscoring the urgent need for proactive risk pricing and more transparent data.

Read the full study here.