Globally, inflation has continued to rise in 2022 while central banks continue to aggressively combat it with interest rate hikes, adding to uncertainty and weighing on sentiment. The market slowdown is particularly felt in the office sector. Investors are cautious. Real estate users are now beginning to take a more careful approach by postponing decision-making and sometimes reducing their space requirements. Teleworking and its maintenance are important factors shaping the office spaces demand.

According to the latest Eurostat data, employees in Greece working remotely reached 14.8% in 2021, from 10.4% in 2020 and just 5.2% in 2019. That is, they have almost tripled compared to before the pandemic. The corresponding average percentage in Europe exceeds 26% in 2021, from 22.4% in 2020 to 15.1% in 2019, with Greece consistently having lower rates than its European counterparts. The hybrid work model between the office and home contributes to a new normality.

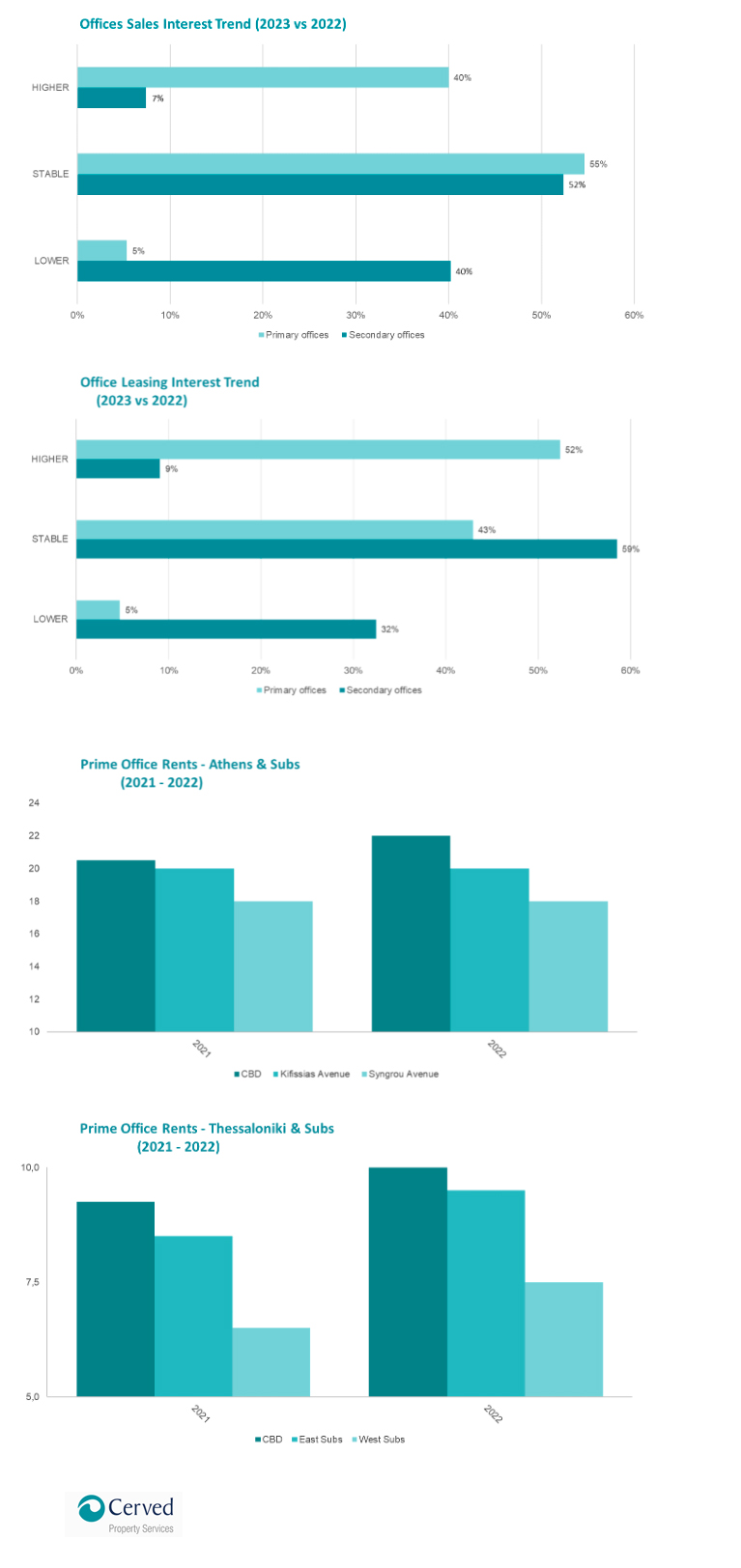

Nevertheless, the lack of quality office space still characterizes the Greek market, and demand exceeds supply—the previous years' under-investment resulted in a massive shortage of modern and highly energy-efficient office buildings. Athens is becoming a prominent office market because there is a more significant profit margin while offering higher returns for investors than other European office markets. As a result, new projects are coming for Grade A certified office spaces that will partially meet the current demand. The Athens office market is still developing, trying to find the pace and premium products. The dominant investors remain, the Greek REITs and the multinational companies seeking to relocate to ESG-certified office spaces. Demand for Grade A office space shows resilience, and many potential investors are focusing on this asset class, as evidenced by recent transactions and the findings of CPS's survey, illustrated in the following chart.

Athens and Thessaloniki saw a significant increase in high-quality office rental prices due to the limited supply and high demand from large Greek and multinational companies. Such office spaces are currently rented for around 20 euros per square meter in Athens, while in some cases, they exceed 25 euros per square meter, especially in green buildings with ESG certifications in prime locations.

Nevertheless, most potential tenants of small and medium-sized enterprises were wary of making decisions due to the insecurity caused by the unfavourable international economic climate and the consolidation of telework and its implications for the future housing needs of companies. These companies are the potential tenants of B and C-class office space. As a result, there is a lack of interest and weak demand for lower-standard offices, and eventually, the distance between A-class office buildings and the rest continues to grow. Their vacancy rate continues to increase, their rents are under pressure, and they seem to be going through a period of devaluation. These different speeds underlined in CPS survey findings are likely to continue unless the economy recovers, resulting in small and medium-sized enterprises' growth and absorption of the non-premium office space stock.

Greek retail has entered a phase of transformation in recent years.

The dominant trend of this period is, on the one hand, the further expansion of large enterprises and, on the other hand, the gradual reduction of smaller ones due to the ten-year economic crisis, accelerated by the changes in purchasing habits brought about by the pandemic and inflation. Meanwhile, the impact of inflation in Greece compared to other countries is more noticeable since the ten-year Greek crisis has severely hit Greek households. 2022 started quite well and then accelerated. And while in the first quarter, there was post-pandemic optimism, and consumers began spending money; along came the war in Ukraine, the energy crisis and price hikes. These adverse factors justify the climate of discouragement that prevailed in the year's second half. The effect of inflation on the consumption of products in Greek supermarkets is also evident.

In January-September 2022, the turnover of fast-moving consumer goods increased by 4.5% due to price increases and not the rise in demand, as in the same period, sales volume fell by 1.4% compared to last year. The role of tourism was decisive for the retail trade. During the summer months June-August quarter, the total market turnover in Greece increased by +11.0%, a trend much higher than the one recorded in the market in the first five months of the year (-0.2%). Important to highlight is the fact that the driver of market growth in the first five months of 2022 was purely inflationary, while the summer months saw an increase in demand. The island regions seem to have performed better than the rest of the country due to tourist traffic, which has been very high this year compared to the last two years.

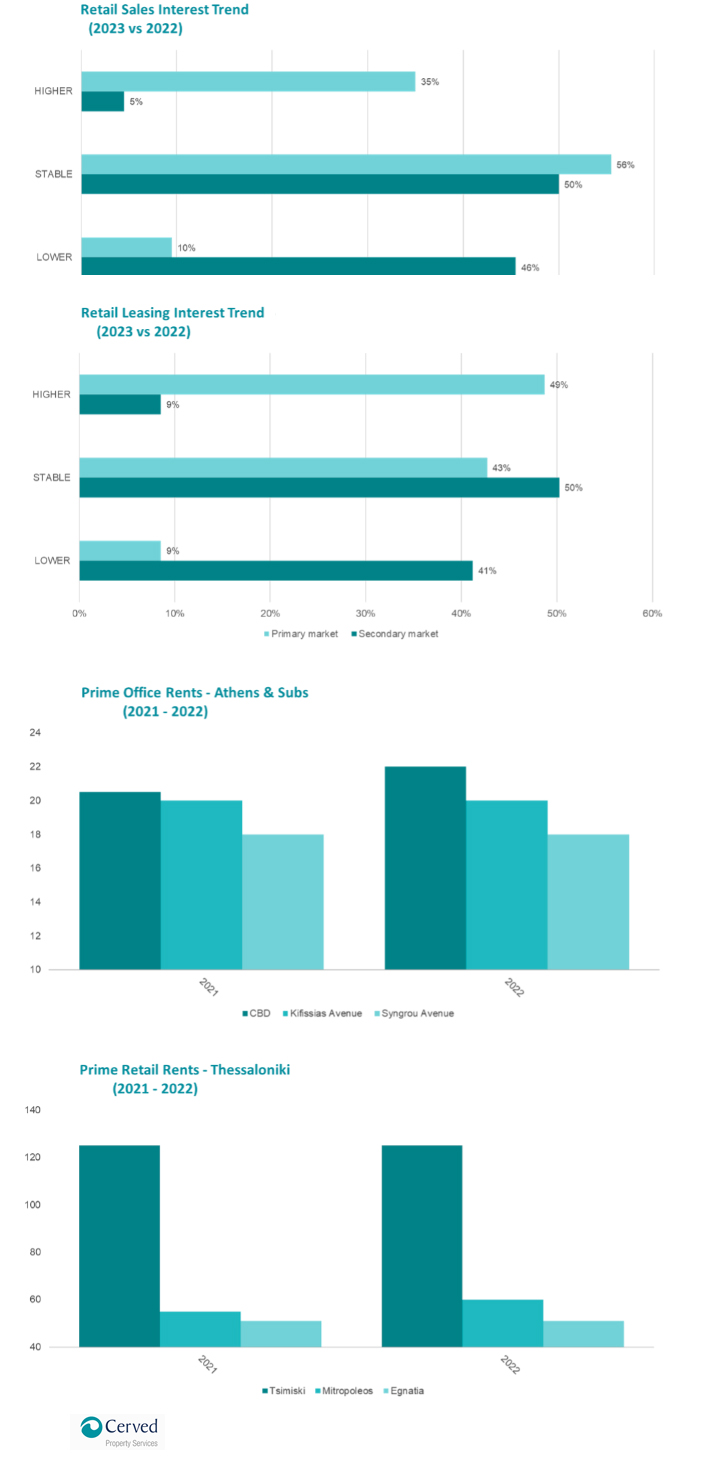

The shift to e-commerce has been one of the most significant changes in our lives triggered by the pandemic. Starting from successive lockdowns, consumers reduced visits to physical stores. At the same time, substantial portions of the population, who did not have much relevant experience, became familiar with and turned to online shopping on a more permanent basis. This shift from physical stores to e-commerce has impacted the Retail Market, driving the sales and leasing interest in prime locations much more heavily, as depicted in the CPS' survey findings. High-street retail stores are preferred to attract clientele and boost brand awareness.

The rental demand in prime locations such as Ermou and Voukourestiou streets, Glyfada, and the centre of Piraeus, but also established shopping centres, is still vital for two reasons. The lack of properties, especially in high street retail areas, pushes chains to make new leases to secure the best location for their physical stores. The second reason is that rents remain relatively reasonable, especially compared to the period before the financial crisis, when they exceeded all historical precedents, making Ermou Street one of the ten most expensive shopping streets in the world.

Thus, several new leases were registered during the year in prime locations and touristic islands, especially for sporting and luxury goods stores.

In the prime areas of Athens and Ermou Street, rental prices throughout the year showed stabilizing trends, not exceeding 270 euros/sq.m. in Glyfada, 130 euros/sq.m. in Kifissia, 110 euros/sq.m. In Kolonaki, the rental prices reach 95 euros/sq.m. In the centre of Piraeus, 80 euros/sq.m.

The asking rents remained stable too. Vacancy rates have fallen while they have remained stable in secondary locations. Yields of high street retail remained stable in 2022, with the lowest rates on Ermou Street (5.5%).

Research Team:

Dr. Dimitris Papastamos, Division Head

Maria Filippakopoulou, Sr. Real Estate Analyst

Ilias Liapikos, Real Estate Data Scientist

Stavros Kotsis, Real Estate Analyst