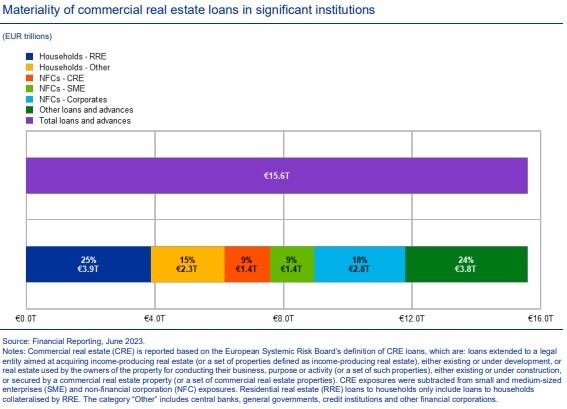

Commercial real estate (CRE) is a material asset class which accounted for €1.4 trillion of SIs’ loan books in the second quarter of 2023. €52 billion (3.67%) of CRE loans were classified as non-performing loans (NPLs) in that quarter.

This corresponds to 15% of total overall NPLs, of which the majority stems from legacy NPLs from the 2008 financial crisis. Banks’ material exposures to CRE loans are particularly concentrated in German, French and Dutch banks (around 52% of total commercial real estate).

Following years of rising property prices, CRE markets are currently in a downturn, as signs of deterioration are becoming apparent across several euro area countries. Commercial real estate is facing tighter financing conditions and an uncertain economic outlook, as well as weaker demand following the pandemic.

The main factor negatively weighing on CRE markets was the increase in interest rates and the

higher cost of debt financing. Together with higher construction costs and changing demand

dynamics (i.e. remote working and more energy efficient retail space and offices), this was associated

with a repricing in CRE property valuations (particularly office and retail), which is still ongoing.

The ECB continues to conduct a range of on-site and off-site supervisory activities13 to ensure active

supervisory focus on commercial real estate risk. This active focus will continue into 2024, with

supervisors keeping a close eye on banking and market developments in this material portfolio.

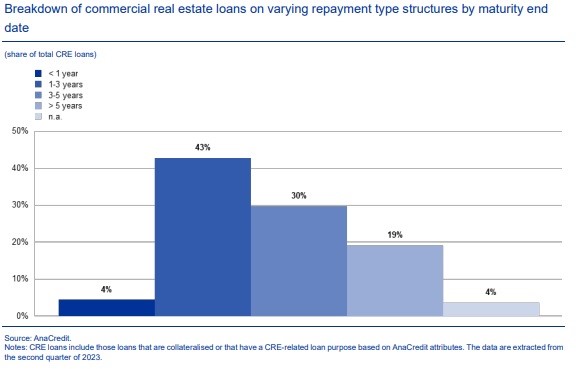

Βullet/balloon type structures maturing in the next two years accounted for 8% of CRE loans

Furthermore, there was also a sharp fall in investment and transaction volumes and a halt on new constructions, as well as compressed returns on CRE properties, leading to negative margins. Loans with a large balance falling due at maturity are often called “bullet” or “balloon” loans and are currently a particular focal point for the ECB owing to the current market conditions. A material share of these CRE loans are structured as bullet or balloon loans and as non-recourse loans.

These types of financing structures pose higher refinancing risk, meaning that at maturity, borrowers may need to refinance their loans at much higher financing costs than originally foreseen.

Other repayment options have also become challenging, as the deteriorating market conditions and higher financing costs also negatively affect the ability of the borrower to sell the asset and/or refinance the CRE loan at another bank. Of the exposures captured in AnaCredit as at the second quarter of 2023, bullet/balloon type structures maturing in the next two years accounted for 8% of CRE loans. It is crucial for banks to actively engage with their CRE borrowers and assess the refinancing risk of CRE loans in a meaningful manner. They need to focus on the key considerations of this assessment, such as updated and realistic collateral valuations, the cashflow generation capability to cover financing costs, and where relevant, also sponsorship cash injection options.