At the EPRA Conference 2025, titled “The Power Shift”, leading global economist Dr Gerard Lyons presented a concise yet far-reaching analysis of the evolving macroeconomic landscape. His remarks focused on global growth, labour market transformation, the green transition, trade fragmentation, and monetary policy uncertainty.

Dr Lyons noted that despite persistent headwinds, the global economy continues to grow. However, a projected GDP growth rate of 3.1%—once considered adequate—is now increasingly viewed as a sign of global economic underperformance, particularly compared to the high-growth benchmarks of the pre-pandemic era.

Technological disruption, he argued, is driving deep structural change in labour markets. Automation, AI, and digitalisation are displacing traditional jobs at a faster pace than the labour force can reskill, resulting in persistent mismatches and rising structural unemployment.

On climate policy, Dr Lyons cautioned against an overly aggressive shift away from conventional energy sources. He stressed that the green transition must be compatible with growth, advocating for a phased integration of renewables to avoid economic and energy instability.

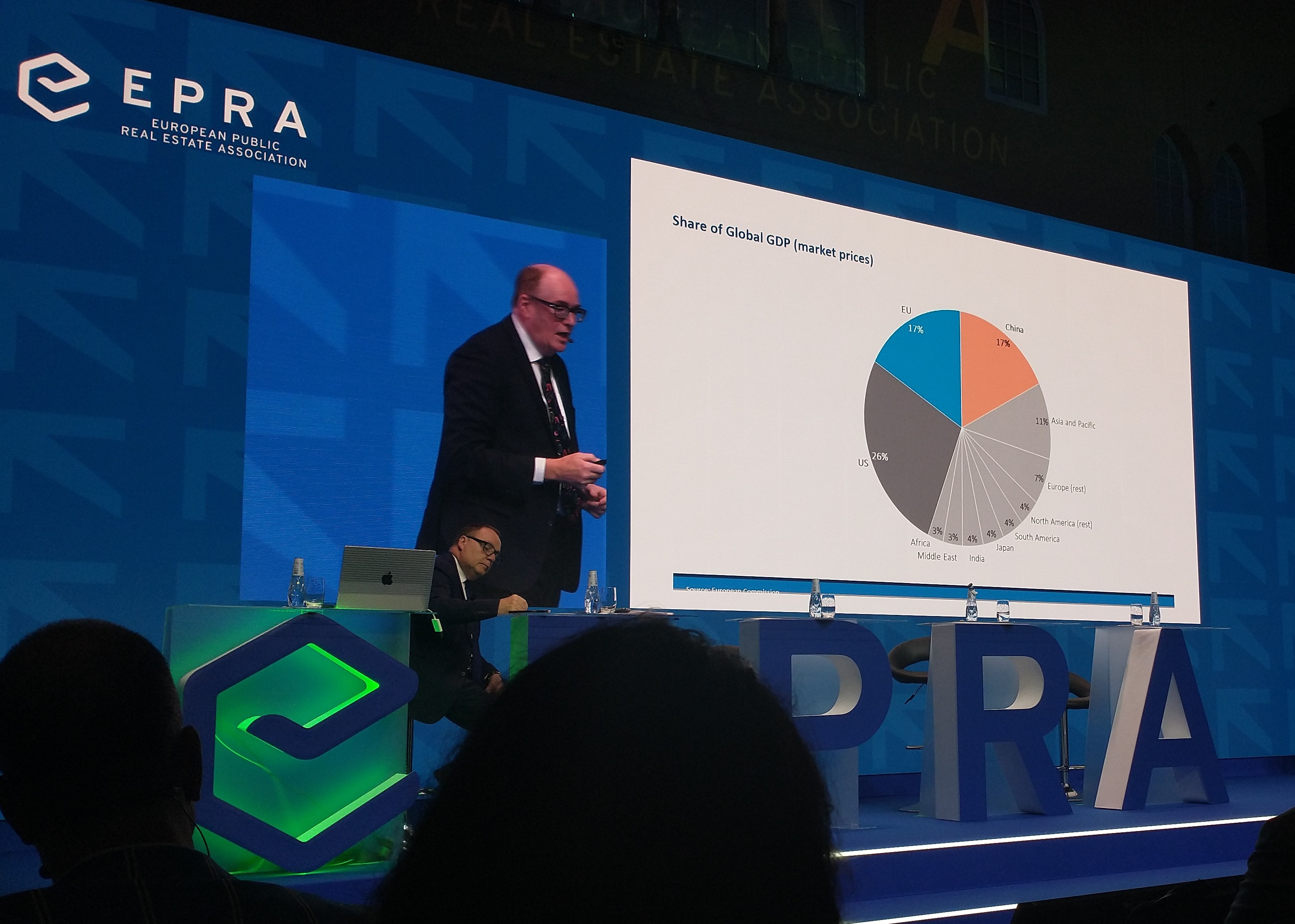

Turning to global trade, Dr Lyons highlighted the decline of multilateralism and the rise of geoeconomic fragmentation. He pointed to Asia and the U.S. as increasingly dominant regional blocs, while free trade gives way to protectionism, reshoring, and industrial policy.

Tariffs, he noted, have become a structural component of fiscal policy, now comprising roughly 5% of U.S. federal revenues. While politically durable, such measures impose a growth penalty by distorting market dynamics and weakening global supply chains.

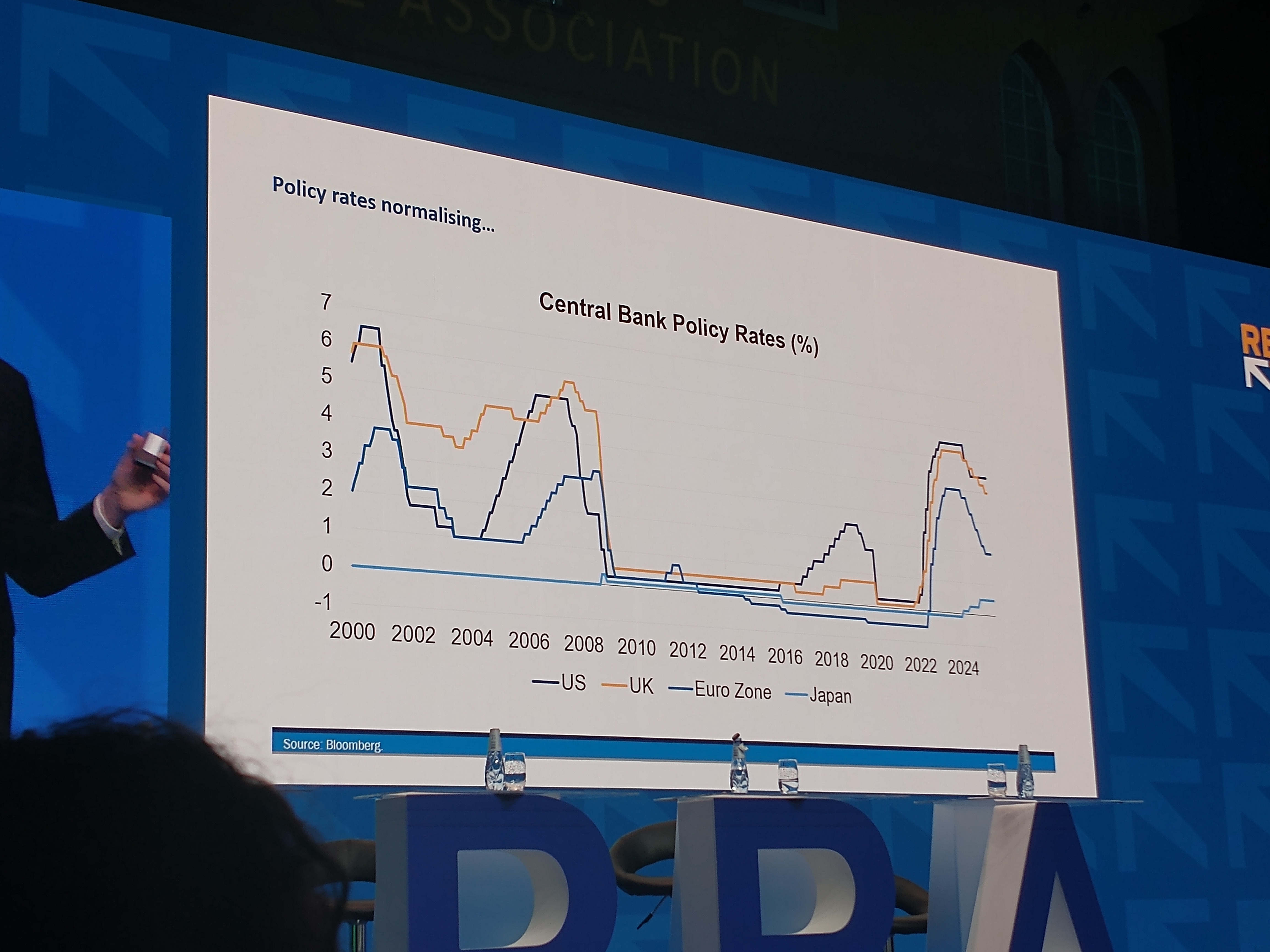

Finally, Dr Lyons addressed the challenge central banks face in determining the neutral interest rate (R*), amid shifting inflation expectations and structural uncertainty. With limited visibility, policymakers risk overcorrecting in either direction.

Dr Lyons concluded with a call for adaptive, coordinated policymaking to manage this complex transition. Sustainable progress, he argued, will depend on balancing economic resilience, environmental responsibility, and international cooperation.