According to EPRA' recently unveiled research paper "Alternative property sectors", some megatrends like ageing population and urbanisation are supporting the expansion of property companies specialised in healthcare and life science facilities, senior living and social housing, while creating outstanding opportunities for several stake holders to have a direct positive impact on European society.

Simultaneously, changes in households composition, migration of international students and the raise of the digital economy represent an exceptional opportunity for REITs and other listed property companies to expand their operations and property portfolios by investing in self-storage facilities, student accommodation and data centres.

Alternative housing sector

Residential properties have been part of the listed real estate industry in Europe for decades, although modestly at the beginning representing less than 3% of the FTSE EPRA Nareit Developed Europe in 2010lt became much more relevant after 2012 with the expansion of the German residential landlords and the emergence of several alternative subsectors like co-living, social housing, senior living, and purpose-built student accommodation (PBSA) in continental Europe . The growth of these alternative sub-sectors has been remarkable, now catching the attention of several policy makers, analysts and investors.

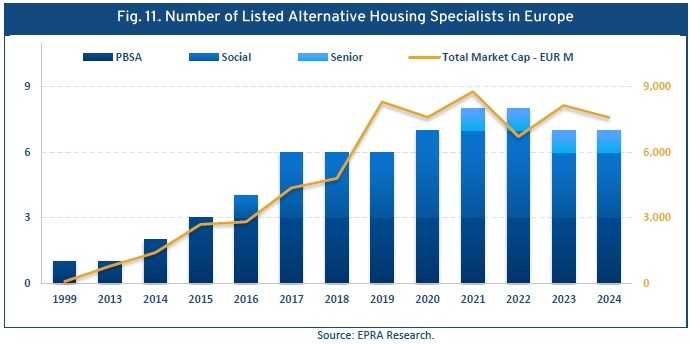

In spite of the common idea of student accommodation currently seen as an alternative sub-sector, its history is much longer. The first listed property company operating PBSA in Europe was Unite Group with its IPO in 1999. This activity was considered very niche for several years, so classified as specialty in the FTSE EPRA Nareit indexes and taking more than a decade (2011) to be reclassified into the residential sector. However, the continuous expansion of international students arriving at European universities, Empiric Student Property (UK, IPO in 2014) and Xior Student Housing (Belgium, IPO in 2015). Since then, these 3 companies have been leading this segment in Europe ahead of some private companies and investors.

On the other hand, senior living and social housing specialists are much younger. In 2016, Civitas Social Housing (UK) debuted in public markets being the first listed social housing specialist in Europe, followed by Triple Point Social Housing (UK) and Residential Secure Income (UK) in 2017, Inclusio (Belgium) in 2020 and Adriano Care (Spain) in 2021, this last mainly focused on senior housing. Actually, senior living and care homes have become two of the most successful property types used by residential companies for diversifying their property portfolios.

During, the last decade, the number of alternative housing specialists in Europe multiplied by 4 and their full market cap changed from EUR 1.4 billion in 2014 to EUR 7.3 billion in 2024, representing a total growth of 416.7% (CAGR 17.8%). Therefore, it is clear that alternative housing is becoming a more mature sub-sector, with strong fundamentals behind it and attractive potential growth and expected returns.

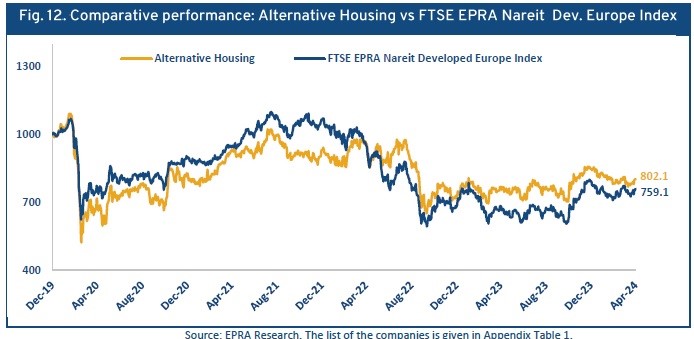

According to EPRA, the alternative housing is a sector closely related to social dynamics, demographics and other changes in different segments of the population, hence, less influenced by economic cycles than traditional real estate.

Demographic trends that will affect the sector's growth potential

Regarding a long-term potential growth, some demographic trends can be highlighted.

First, according to Savills14, in spite of all the evidence on aging population across the continent, the provision of care homes and senior living facilities has not evolved fast enough, therefore creating a significant mismatch between supply and demand. Simultaneously, looking at senior housing, most of the European markets remain highly fragmented, mainly due to regulatory and idiosyncratic differences across several territories, therefore representing a significant challenge that needs to be corrected in order to reach sustainable growth in this subsector.

Second, there is substantial evidence of undersupply of student accommodation in most of the main cities in Europe. According to JLL , the number of students in Europe is expected to grow by 10% between 2021/22 and 2030/31, reaching 23.5 million students, while the PBSA pipeline will fulfil only 11% of current unmet demand in European cities once completed.

Therefore, the total unmet demand across Europe will reach 3.2m beds, up 8% compared to 2022/23, as the PBSA pipeline fails to offset growing demand, suggesting a further need for new PBSA stock. In total, circa €450 billion of investment is reguired to meet current levels of unmet student demand across 16 key European countries, which represents a significant opportunity for listed property companies to expand across different geographies aiming to receive private investments.

Second, there is substantial evidence of undersupply of student accommodation in most of the main cities in Europe. According to JLL , the number of students in Europe is expected to grow by 10% between 2021/22 and 2030/31, reaching 23.5 million students, while the PBSA pipeline will fulfil only 11% of current unmet demand in European cities once completed. Therefore, the total unmet demand across Europe will reach 3.2m beds, up 8% compared to 2022/23, as the PBSA pipeline fails to offset growing demand, suggesting a further need for new PBSA stock. In total, circa €450 billion of investment is reguired to meet current levels of unmet student demand across 16 key European countries, which represents a significant opportunity for listed property companies to expand across different geographies aiming to receive private investments.