According to HVS' recently unveiled report "H1 2025 European Hotel Transactions" in 2024, Europe confirmed its dominance in global tourism, recording approximately 750 million tourist arrivals — a 1% increase over pre-pandemic 2019 levels and a 5% gain over 2023, per UN Tourism.

Europe accounted for 58% of global arrivals, with all subregions exceeding pre-pandemic benchmarks except Central and Eastern Europe, where ongoing geopolitical instability stemming from the Russo-Ukrainian conflict continues to suppress demand. Initial uncertainty in early 2024, driven by the imposition of broad tariffs by former U.S. President Donald Trump (“Liberation Day”, 2 April), posed concerns regarding outbound U.S. travel. However, relative political stability since then has helped restore investor confidence in the sector.

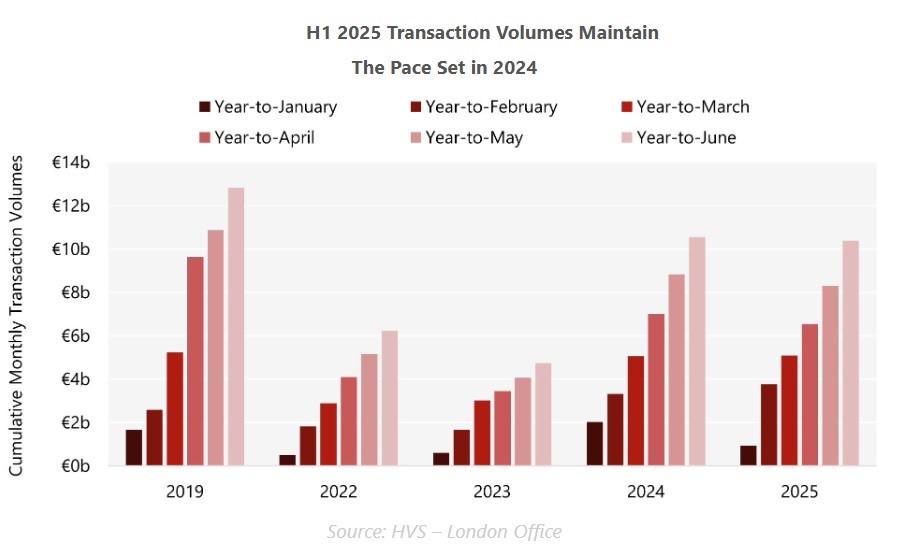

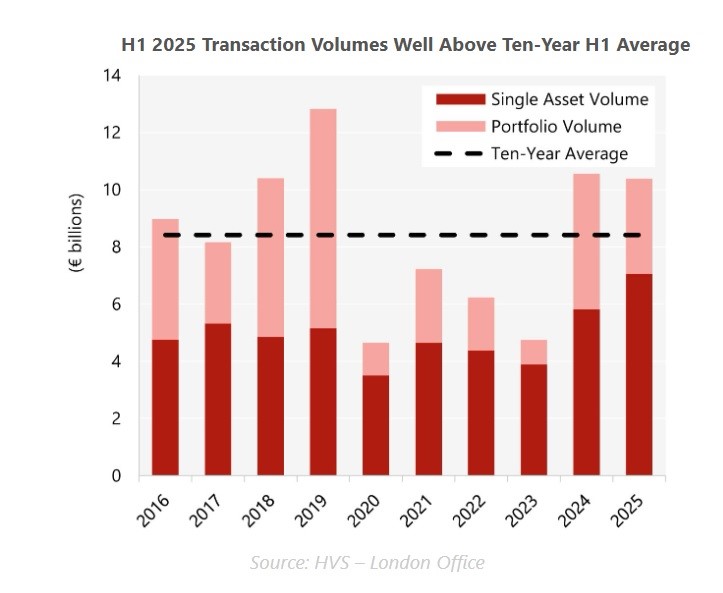

Transaction volumes were seasonally concentrated in February and June, with January remaining subdued. Overall, H1 2025 saw a significant bifurcation between single-asset and portfolio transactions. Single-asset deals dominated, returning to a 70% share (compared to 55% in H1 2024), driven by a slowdown in portfolio-level activity. Single-asset volume surged by 22% year-on-year, reaching €7.1 billion — a record high, 12% above 2019 levels in real terms. Key transactions included Spring Hotel Group’s €430 million acquisition of the 1,037-room Mare Nostrum Resort in Tenerife and George Procopiou’s full buyout of the Four Seasons Astir Palace Hotel Athens.

In contrast, portfolio transactions declined 30% year-on-year to €3.3 billion in H1 2025. Although the number of portfolio deals remained stable at 24, the average size contracted both in hotel count (6.1 per portfolio vs 7.8 in 2024) and room count (807 vs 973). Notable deals included CapMan Real Estate’s acquisition of 28 Nordic hotels from Midstar Fastigheter AB and Brookfield AM’s €776 million purchase of Generator Hostels from Queensgate.

HNWIs emerged as the dominant net buyers in H1 2025, deploying €967 million, followed by real estate investment companies (€298 million). On the sell side, institutional investors (€424 million) and REITs (€242 million) reduced exposure.

Four countries accounted for more than half of all transaction volume: Spain (17%), the UK (16%), France (12%), and Germany (11%). London led as the most active city (€827 million), ahead of Paris and Berlin.

Despite lingering macroeconomic uncertainty and policy unpredictability from the U.S., the resilience of the hotel sector — particularly in single-asset deals — highlights growing investor conviction. Hotels continue to attract capital as a real asset class capable of delivering yield, inflation protection, and capital growth, especially when underpinned by strong fundamentals and professional management.