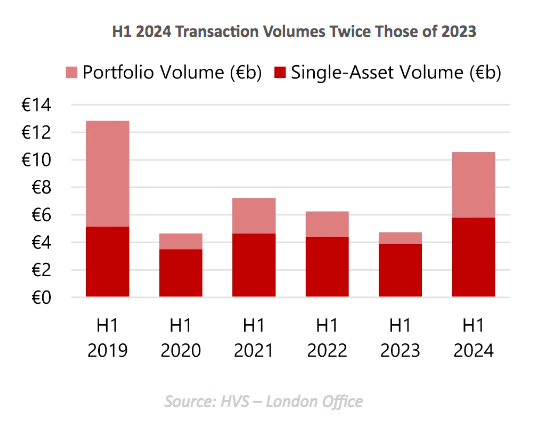

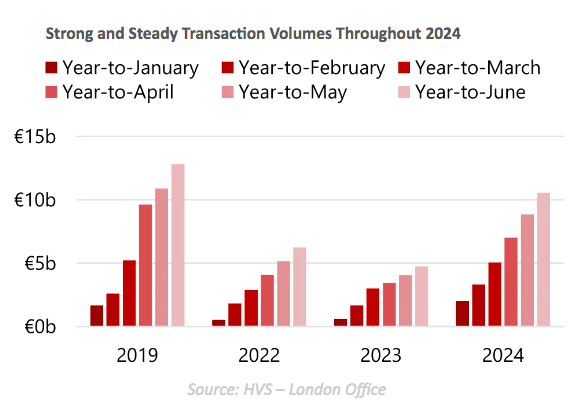

Reaching €10.6 billion, the total volume transacted increased by 123% year-on-year, already reaching the total volume for the whole of 2023. There were 20% more transactions this semester, with a decrease of 11% in the number of rooms per hotel, translating into a 30% increase in price per room over H1 2023.

Single-asset transaction volumes increased 50% year-on-year last semester, totalling €5.8 billion, surpassing H1 2019 totals for the first time since the start of the pandemic.

Portfolio transaction activity doubled year-on-year, despite eight fewer transactions compared to H1 2019. While the volume reached €4.7 billion, the highest since 2019, it remains nearly 40% behind pre-pandemic levels.

Private and hotel investment companies were buyers, and hotel unit owner-managers were sellers.

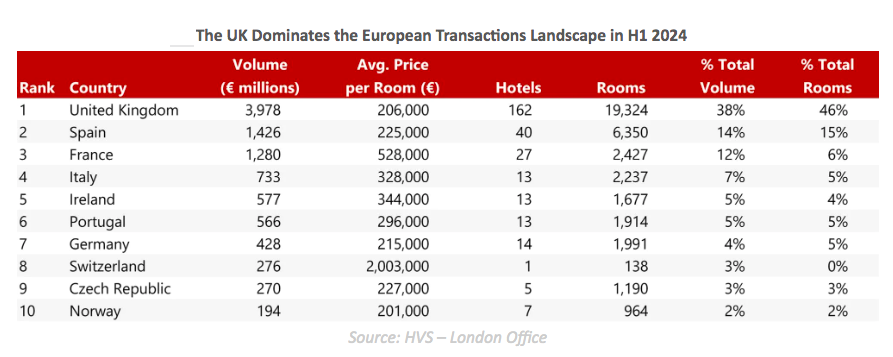

With the pick-up in transaction activity last semester, the price per room increased by 30% year-on-year, 9% ahead of 2019 levels in nominal terms. Transactions where the price per room was above €1 million accounted for 12.2%, a volume which increased nearly two-fold, signalling a growing proportion of luxury assets transacted.

Whilst average rate growth was a global phenomenon post-pandemic, luxury hotels have disproportionately benefitted from it, as ‘revenge leisure’ travellers splurged. High suite ratios and an array of bespoke ancillary services allowed luxury hotels to increase average rates by two-thirds in urban properties, and by even more in resorts.Slightly sluggish volumes haven’t prevented very healthy top lines, which have driven profitability across most hotels, despite payroll and cost of goods increases (and often decreased profitability of F&B). RevPAR levels increased by 50% for urban properties, and by around 70% for resorts.

Europe captured around 55% of the total share of visitors worldwide in 2023, according to the World Trade Organization. Its strong fundamentals, strategic location, ease of access and sophisticated infrastructure will allow the continent to maintain this level of interest in the future.

Source: HVS