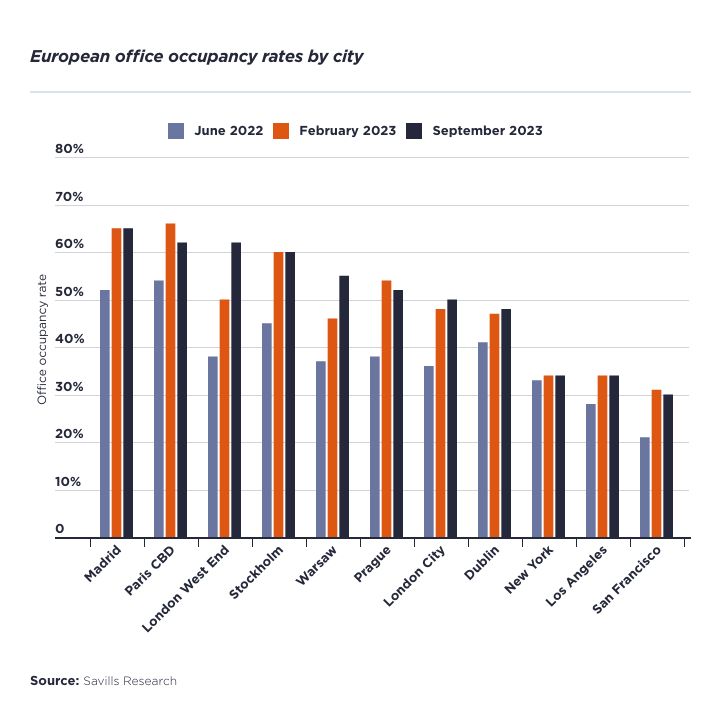

Among the largest increases were London West End, rising from 50% to 62%, supported by the Finance sector (see feature), along with increased tenant demand for office space in mixed-use locations. Warsaw also marked an increase from 46% to 55%, reflecting more demand for CBD locations, although some Tech companies continue to offer space for sublease.

Madrid (65%) overtook Paris CBD (62%) as the market with the highest European office occupancy level, with both cities supported by a high proportion of city centre living, good transport infrastructure and lower public transport costs. Stockholm remained at 60% occupancy, whilst Prague (52%), London City (50%) and Dublin (48%) recorded little change.

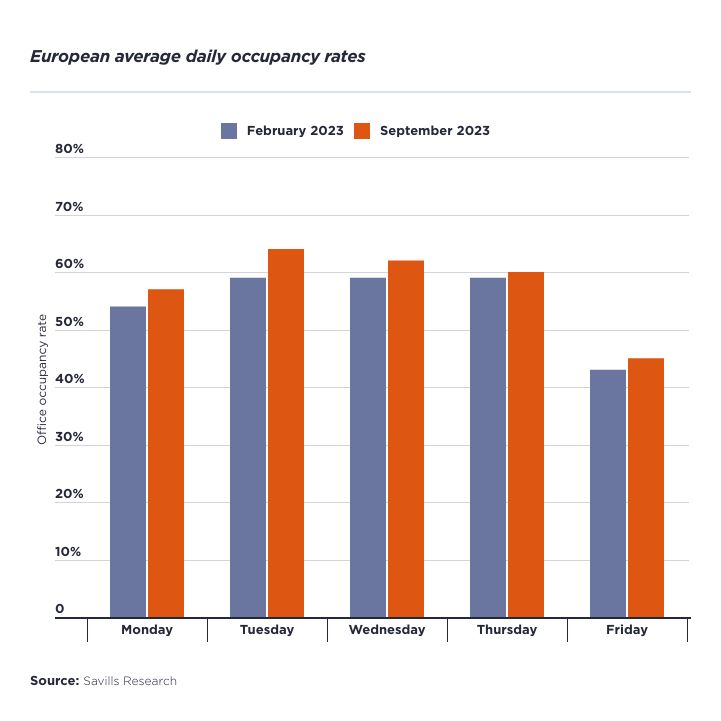

The data indicates that average European occupancy rates have increased across all days, with Tuesday the most popular day to work in the office, at 64% occupancy. This is important, as occupiers will have to manage the peak to trough occupancy throughout the course of the week. Given the preference for remote working on Fridays, Savills do not expect headline occupancy rates to rise to the levels recorded pre-pandemic and so, how the level of peak occupancy changes could be a more reliable indicator for the impact on office demand.

Looking forward, we expect average European office occupancy rates will begin to stabilise around the 60% mark as companies and employees find an equilibrium that works for them. Many US-headquartered businesses have increased pressure on employees to increase office attendance during Q3 2023, although any evidence of a significant increase remains limited. This reflects a tight employment market as employers are still seeking to offer flexible terms to attract and retain staff.

At the same time, occupier demand continues to intensify for well-connected, good-quality office space in mixed-use locations, in order to attract and retain employees. Amid construction delays and a shortage of prime building stock, occupiers end up competing for the best space, thus supporting prime rental growth.

* Savills Research has analysed office occupancy rates, based on the average number of workers as a percentage of the office’s maximum capacity, over the course of a working week for a sample of fully let, multi-let office buildings located in the central business district (CBD) of selected European cities. The data is based on Building Management Systems from Savills European Property Management network taken during September 2023, and attendance is based on one user’s access card per day.

(Source: Spotlight: European Office Occupancy Rates, Savills)