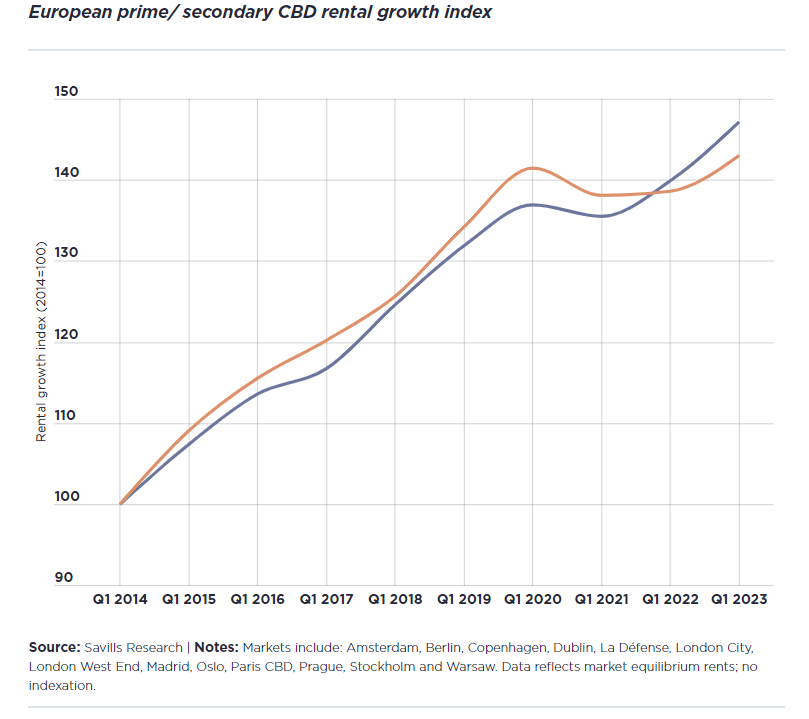

According to a recent Savills report, between 2014 and 2020, rents for Class A and Class B office in central business districts followed a similar path. Average office vacancy rates fell in the wake of the eurozone crisis to just 5.5% by Q1 2020, in an environment that strongly favored office owners. Many tenants seeking office space in central locations were forced to make do with older and B-grade space, increasing the annual rate of demand for the CBD, which was outstripping demand for high-end properties.

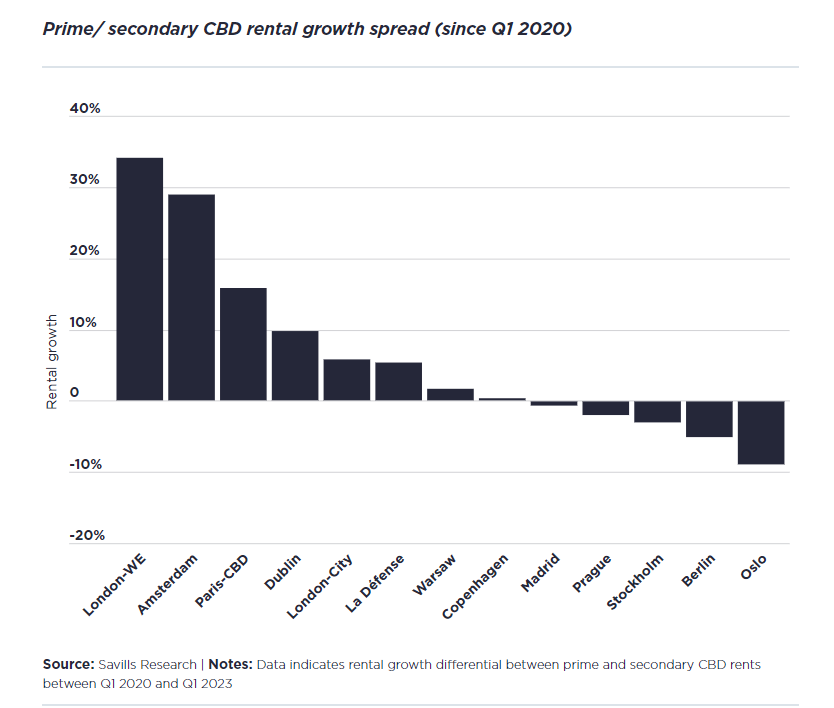

This regime has been reversed since the pandemic, with average vacancy rates rising to 7.6%. However, average rents for tier one properties in central areas rose by 7.4% from Q1 2020, compared to just 1.1% for tier two offices over the same period.

There are important factors influencing the shift to greener office spaces. On the one hand, tenants are opting for greener office space, both to attract and retain talent over industry rivals amid record low unemployment rates. In addition, over the last three years, there has been a significant increase in demand for space in central business districts that are also close to transport hubs.

For example, the company's recent analysis of central London shows that companies are signing leases for properties located an average of three minutes' walk from tube stations.

Analysts at Savills expect continental European markets to see a similar divergence in rents once new and inevitably tougher EPC regulations are implemented, and if further regulations are introduced, landlords are expected to reconsider their options and move to other premises. alternative uses. For example in Madrid, developers have already converted 130,000 sq.m. of second-rate office stock over the past five years (66% of which became residential).

In this environment, Savills estimates that landlords who take the risk of managing older office building assets in central business districts, in cities with low vacancy rates, are expected to be rewarded with higher rental yields in the future.

Source: Savills