In the second quarter of 2022, house prices rose by 9.2% and 9.8% in the euro area and EU respectively. According to figures come from Eurostat, the statistical office of the European Union.

Compared with the second quarter of 2022, house prices rose by 1.0% in the euro area and by 0.9% in the EU in

the third quarter of 2022.

Among the Member States for which data are available, fifteen showed an annual increase in house prices in the third quarter of 2022 of more than 10%.

The highest increases were recorded in Estonia (+24.2%), Hungary (+21.0%) and Lithuania (+19.3%), while prices fell only in Denmark (-2.4%).

Compared with the previous quarter, prices increased in twenty Member States. The highest increases were recorded in Cyprus (+5.8%), Bulgaria (+4.1%) and Austria (+4.0%), while decreases were observed in Denmark (-3.8%), Sweden (-3.1%), Finland (-1.3%), Romania (-1.2%), Italy (-1.0%) and Germany (-0.4%).

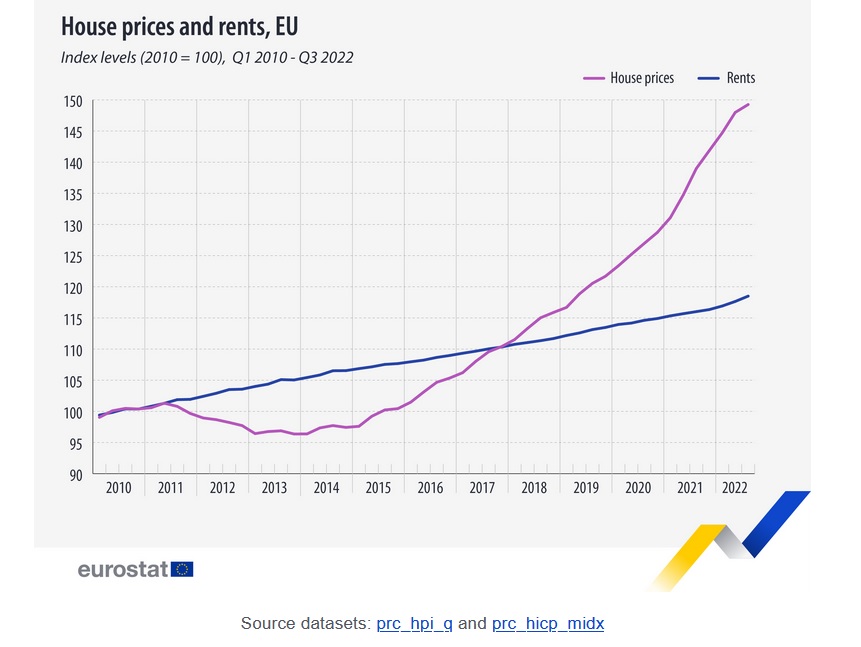

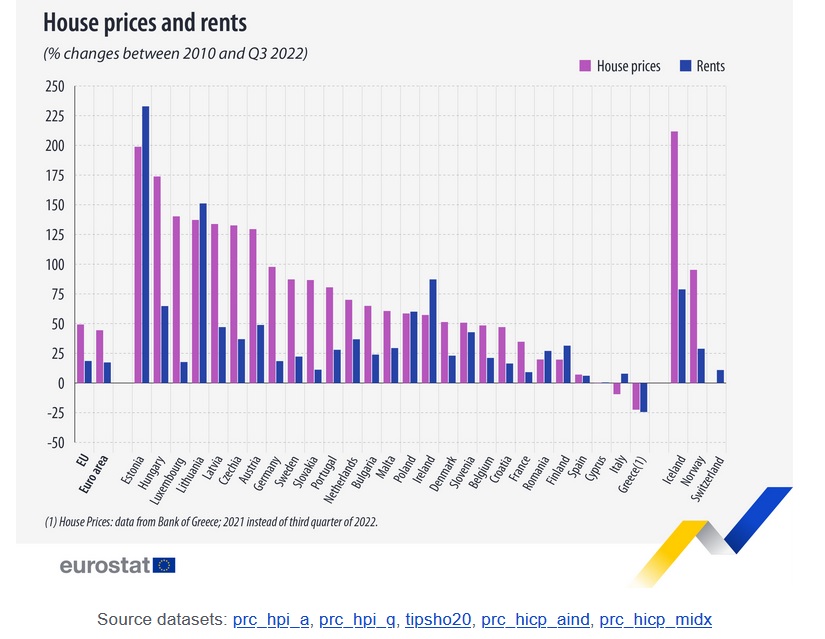

Comparing the third quarter of 2022 with 2010, house prices rose more than rents in 19 EU Member States.

During this period, house prices rose in 24 EU Member States and fell in three. They more than doubled in Estonia (+199%), Hungary (+174%), Luxembourg (+140%), Lithuania (+137%), Latvia (+134%), the Czech Republic (+133%) and Austria (+130%). Reductions were observed in Greece, Italy and Cyprus.

Comparing the third quarter of 2022 with 2010 for rents, prices rose in 26 EU member states and fell in one, with the highest increases in Estonia (+233%) and Lithuania (+151%). A decrease was recorded in Greece (-24%).

According to the latest data published by the Bank of Greece (BoG) for the third quarter of 2022, sales prices nationwide recorded an annual increase of 11.2%, with newly built properties recording an increase of 12.2% , and the older properties by 10.5%.

In first place is of course the region of Attica with an annual increase of 13%, followed by Thessaloniki with 11.1%, the other major cities of the country with 9.4% and the other regions with 8.9%.

This is a clear acceleration of the rate of price increase, as based on the revised figures of the Central Bank, during the first and second quarters, the increase in Attica was 11.3% and 11.8%, while in Thessaloniki it was 9, 6% and 10.8%. For the whole of 2021, the increase in Attica was 9.7% and in Thessaloniki 7.4%.

Αβεβαιότητα στον ελληνικό κλάδο ακινήτων

The uncertainty about the future of the Greek real estate sector is expressed by the Bank of Greece in its interim report on monetary policy. As he typically says in the eleventh month of 2022, the Greek real estate market attracted intense investment interest and high demand for residential and high-end professional uses, but despite the dynamics, the market is again faced with significant uncertainties related mainly to the ongoing war in Ukraine.

At the same time, the effects of the gradual increase in the cost of materials and energy, the rise of interest rates and inflationary pressures are already being reflected in the reduction of construction activity and the decline in expectations for the course of the real estate market and the economy in the country, but also internationally.

The fact that the increase recorded in prices and demand for high-end real estate is linked to the direct or indirect – through tourism – influx of foreign capital into the market makes the maintenance of high growth rates vulnerable to the international situation and especially to issues of adequacy and energy costs, the Bank of Greece points out.

As reported by the Bank of Greece on an annual basis, negative rates are recorded in the number of new permits for the construction of offices (-8.0%) and shops (-31.5%), while the rates of reduction in terms of volume are also high (-18, 8% and -26.6% respectively). The building activity in the hotel sector remains at positive levels in terms of the number of new permits (32.0%), although in terms of volume it is down by 8.3%.

Also, during the first half of 2022, the funds of REIC and other investment portfolios and real estate development companies, which were directed to new commercial real estate markets, were mostly invested in hotels, high-end offices and professional warehouses, while land of considerable value was also acquired for investment residential development. A trend which, according to many players in the real estate market, will continue in 2023, although they themselves speak of a "waiting attitude" in view of the upcoming elections.