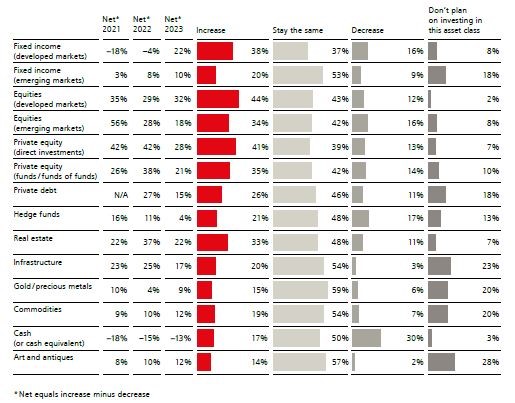

According to UBS «Global Family Office 2023» the biggest turnaround family offices are planning to make is in developed market fixed income, where after three years of cutting back on bonds, almost four in ten (38%) are planning an increase over the next five years.

Fixed income is now the most popular source of diversification, as more than a third (37%) of family offices move to high-quality, short-duration bonds for potential wealth protection, yield, and capital appreciation. At this time, increased fixed income exposure reflects general reallocation from a broad mix of asset classes. Over the next five years, those surveyed still foresee greater allocation to risk assets, with 34% planning increases in emerging market equities following a peak in the US dollar and the reopening of the Chinese economy.

As shown in last year’s report, there continues to be a strong trend among family offices for including alternatives to help diversify a portfolio, but they are refocusing their allocations. Hedge fund allocations have risen to 7% from 4% and in contrast, direct private equity allocations decreased to 9% from 13%. Family offices also plan to reduce real estate allocations in the coming year. Collectively, this is due to an increased allocation to private equity funds, private debt, and infrastructure.

Active management is back in favor with 35% of family offices relying more on investment manager selection and active management to enhance diversification. Family offices have confidence in hedge funds’ ability to generate investment returns, as monetary policy reduces excess financial liquidity and macroeconomic uncertainty persists. Almost three quarters (73%) believe that hedge funds will meet or exceed their performance targets over the next 12 months.

Overall, 41% plan to raise private equity direct investments over the next five years. While these will be reduced in 2023, this is partially offset by increased allocation to private equity funds, as well as planned increases in private debt and infrastructure. Family offices with private equity investments prefer to invest using funds (56%) as typically, they deliver diversification and can allow family offices to enter markets where they do not have in-house expertise.

Looking to the next 12 months, they appear to be hoping for value opportunities, with 45% of family offices with private equity investments planning to over-allocate their portfolios towards the secondary private equity market, anticipating that some institutional investors will be forced to rebalance portfolios following declines in public markets, and as exits remain difficult to achieve through IPOs.

Family offices are cautiously planning to cut real estate allocations in 2023, but over five years, a third (33%) of them foresee moving to higher allocations. This fits a picture of interest rates remaining high in 2023, with some softness in real estate prices, before easier money and lower valuations start to support the asset class once again.

Regional findings

US

According to the report, the main purpose of family offices created in the US is to support the generational wealth transfer (76%). Sixty-three percent have a wealth succession plan in place for family members, but only 38% have created a succession plan for the overall family office. Investment allocation to real estate (21%) and hedge funds (10%) was the highest among global peers. In contrast to other regions, a recession is the greatest concern for US family offices and their cash allocations were the least conservative (7%).

Latin America

Compared to global peers, family offices in Latin America had the highest allocation to fixed income (30%). Their allocation to real estate was the lowest (5%) and only a fifth (20%) use hedge funds as a portfolio diversifier. Sixty percent of family offices in Latin America do not invest in decentralized payments or technologies.

Asia-Pacific

Compared to global peers, family offices in Asia-Pacific had the highest allocation to equities (37%), and almost half (46%) use hedge funds as a portfolio diversifier. Of those with private equity investments, they also make direct investments more than other regions (31%) and 77% of their private equity investments are invested in technology. From an investment theme perspective, medical devices and health-technology resonates best (76%). Family offices in Asia-Pacific have a home bias, with 51% of assets invested in the region, including Greater China.

Europe ex. Switzerland

Family offices in Europe allocated 11% of investments to real estate, with 30% planning to increase allocations in the next five years. Ninety-four percent manage strategic asset allocation in-house and 75% agree that illiquidity increases returns. Following digital transformation (79%), automation and robotics is the second most preferred investment theme (75%).

Switzerland

According to the report, the main purpose of family offices created in Switzerland is to support the generational wealth transfer (73%). Forty-three percent have a wealth succession plan in place for family members, but only 35% have created a succession plan for the overall family office. Compared to global peers, they have the highest allocation to real estate (18%), cash (13%) and art & antiques (4%), with the lowest allocation to hedge funds (4%).