The main driver behind the expected increase in real estate prices is the inability of supply to keep up with rising demand. Demand is being strengthened by factors such as low unemployment, rising real wages, and low inflation, which allow buyers to allocate more disposable income towards home purchases.

The strongest increase in housing prices in 2025 is expected to occur in the Netherlands, Canada, Brazil, and Mexico. In the Netherlands and Canada, government support programs for first-time homebuyers, as well as wage growth, will help stimulate demand. In Brazil and Mexico, the rising cost of construction is expected to contribute to higher property prices, alongside other factors such as wage increases.

In real estate finance terms, this suggests that markets with strong demand drivers, like increased household income and government-backed mortgage initiatives, will experience more significant price appreciation. The Netherlands and Canada, with their focus on affordability programs and rising wages, are likely to see a healthier demand-supply balance, further bolstering property values. Meanwhile, in emerging markets such as Brazil and Mexico, increased construction costs will likely push home prices higher, making real estate investments in these countries potentially more expensive but also offering opportunities for capital appreciation, driven by both economic growth and supply-side inflation in construction.

China and France are exceptions to this trend.

While construction cannot keep up with growing demand in most countries, pushing prices up nearly everywhere, China and France are expected to experience a slowdown in price increases or even declines, due to differing economic conditions, including challenges related to affordability and political factors. In China, the economic slowdown is expected to drag down property prices.

From a real estate finance perspective, this suggests that, unlike most markets where supply-demand imbalances are driving price hikes, China and France will likely face downward pressure on property values. In China, the ongoing economic deceleration, combined with challenges in the property sector—such as a potential housing market correction and reduced consumer confidence—will likely result in weaker demand and price declines. Similarly, in France, factors such as high home prices, affordability issues, and possibly more stringent regulatory or fiscal policies may contribute to a cooling housing market. Investors and lenders in these markets will likely see less favorable conditions for capital appreciation and might need to adjust their expectations regarding returns, especially if a price correction occurs.

What’s Happening in the Eurozone

Household real income continues to improve in the Eurozone, driving demand and boosting prices in almost all member states. The only exception is France, where prices are expected to decline due to affordability pressures and political uncertainty, which cannot be offset by the rise in prices driven by limited supply and lower interest rates in the country. However, the rate of decline is expected to slow compared to last year, and prices may start to rise again in 2026, according to Fitch’s report.

In other European countries, price increases are expected to accelerate in Germany and Spain, while remaining stable in Denmark.

In Spain, housing prices are projected to increase by between 4% and 6% in 2025 compared to 2024, with further increases expected in 2026 of between 5% and 7%. Meanwhile, there is still a shortage of new homes being built, with new housing only covering half of the new household formations, according to Fitch’s report.

From a real estate finance perspective, this suggests a continuing imbalance between supply and demand in Spain, which will drive up property prices further. The gap between the demand for homes and the pace of new construction supports sustained price growth, particularly given that new housing is not being delivered quickly enough to meet the needs of new households.

In Germany, housing prices are expected to rise by between 2% and 4% in both 2025 and 2026, an increase from the previous forecast of 1.5% for 2024. On one hand, moderate wage growth is expected to limit affordability, while on the other hand, continued rent increases are making home purchases more attractive, which is supporting demand, according to Fitch.

For real estate investors and lenders, this suggests that although the market remains relatively stable, the ongoing rise in rents could drive more people toward homeownership, helping to push up property prices despite the limitations on affordability. The relatively modest price growth reflects a balancing act between wage growth and rising housing costs. In Italy, housing prices are expected to increase by between 0.5% and 2.5% in 2025 and 2026 due to cooling demand, primarily driven by high mortgage interest rates.

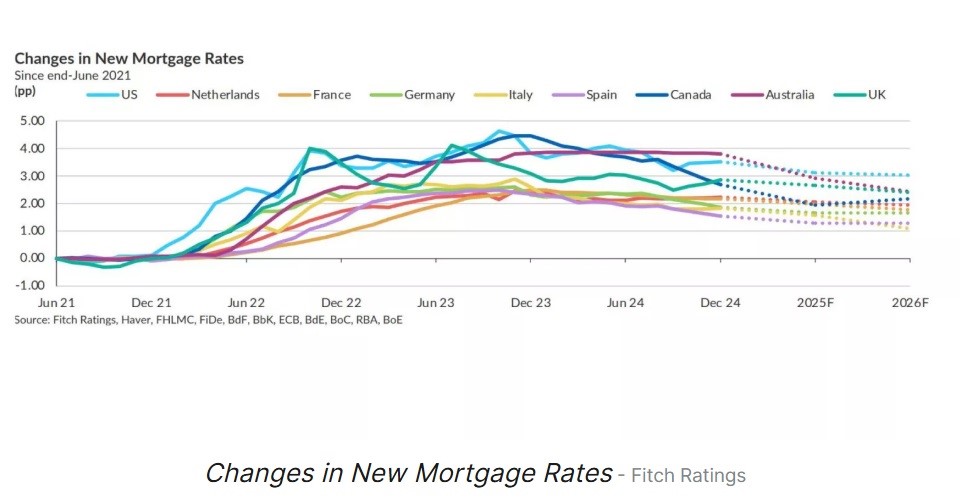

"We expect mortgage rates to decrease to 2.5% over the next two years, but remain significantly higher than pre-2022 levels," Fitch report states. Meanwhile, supply is being constrained by a decrease in building permits, so most transactions involve older properties, leading to slower growth compared to new homes.

In Italy, the high mortgage rates continue to be a key factor suppressing demand. As a result, price growth is expected to be slower compared to other European markets, but still positive, supported by limited new construction and rising demand for existing properties. However, the expected reduction in interest rates may help alleviate some affordability challenges over time, which could spur more activity in the housing market.

Outlook

Supply is expected to remain low relative to demand in the countries mentioned in the report, due to high land, labor, and material costs, combined with elevated borrowing rates for smaller homebuilders and regulatory constraints. On the other hand, demand is further supported by falling interest rates, low and stable unemployment, increased household disposable income, and the formation of new households.

Fitch anticipates that mortgage rates will remain similar to or even lower than the levels seen at the end of 2024 in most countries over the next two years, which will help improve housing affordability.