At a global level, the headline Commercial Property Sentiment Index (CPSI) was slightly improved from Q4 2022, edging up from -15 to –11. This improvement was mostly due to the significant pick-up in the aggregated results for the Asia Pacific region, with China's CPSI climbing from -44 to -7.

Credit conditions remain challenging, reflecting a tighter lending environment, with around 50% of respondents indicating the picture worsened over the period. The report notes that the sector trends reflect structural changes (i.e. the increased prevalence of working from home and increased online shopping), with the office and retail sectors struggling while the appetite for industrial/logistics space remains robust.

The Global Commercial Property Monitor (GCPM) Q1 2023 report reveals a mixed picture of the real estate environment worldwide. Interest rate increases in many countries were balanced by a resilient macro environment due to stable labour markets. At a global level, the headline Commercial Property Sentiment Index (CPSI) was slightly improved from Q4 2022, edging up from -15 to –11.

Credit conditions remain challenging, reflecting a tighter lending environment, with around 50% of respondents indicating the picture worsened over the period. The report notes that the sector trends reflect structural changes (i.e. the increased prevalence of working from home and increased online shopping), with the office and retail sectors struggling while the appetite for industrial/logistics space remains robust.

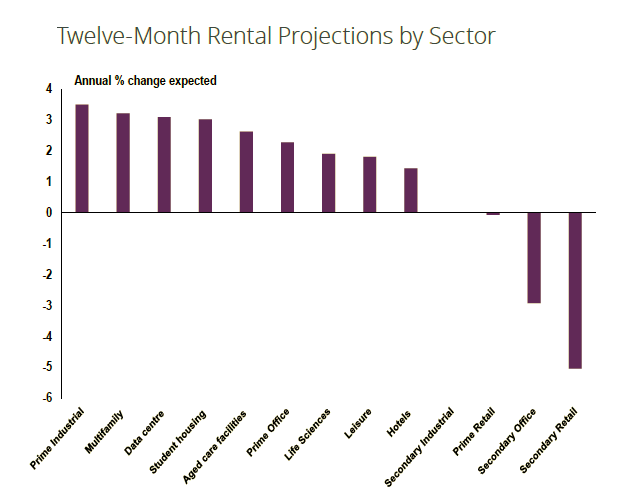

Rental outlook remains positive

Rental growth projections across some of the more alternative asset classes are also comfortably positive.

Indeed, multifamily units, data centres, student housing, aged care facilities, life sciences, leisure and hotels are all anticipated to see an uplift in rental prices (to a greater or lesser degree) over the year to come. Conversely, secondary retail and office rents appear significantly challenged, with respondents foreseeing further declines during the year ahead.

Likewise, at the country level, secondary office and retail remain the poorest performing areas of the rental market across virtually all nations covered. The only countries in which rents for such properties are not expected to fall over the next twelve months are Romania and Portugal. In keeping with the broader results for the continent, alternative asset classes are generally considered to have a solid rental growth outlook in most national markets, with aged care facilities increasingly coming through as an area expected to deliver a strong pick-up in rents of late.

Weakening is less pronounced than that cited on the investment side of the market, The case of Greece and Cyprus

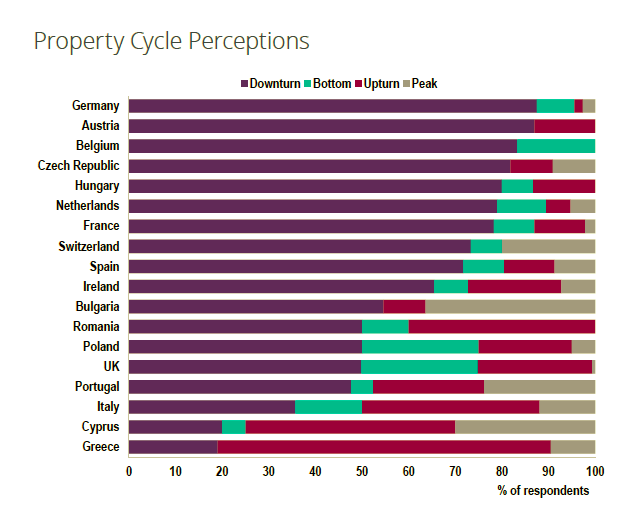

Across Europe in aggregate, the Occupier Sentiment Index (OSI) posted a figure of -12, barely changed compared to the reading of -14 last time. Although still consistent with a softening in overall occupier market dynamics, the degree to which conditions are weakening is less pronounced than that cited on the investment side of the market.

What’s more, positive OSI readings were in fact posted within a number of European markets.

Portugal, Greece, Cyprus and Bulgaria in particular stand out as demonstrating reasonably solid overall occupier trends. Nevertheless, the occupier backdrop in Q1 appears to have been altogether weaker in some markets such as France and Belgium, as both saw a deterioration in the OSI reading in the latest results.

The Greek real estate market was on an upturn. The new bank crisis, with rising credit rates, continuing energy problems and the world’s political scene does not leave room for great optimism for capital gains in all sectors, despite the low prices in Greek real estate stock in comparison to other european countries. Some sectors of real estate are nonetheless expected to boom.

Market is exhibiting signs of recovery particularly for premium office space and high quality private residences. However, financial institution uncertainty and market volatility (long term Covid effects, Ukraine war, shortages etc.) are still a risk to growth rates.

The market is driven by foreign investment and foreign buyers / tenants and the relocation of various companies from Ukraine and Russia due to the war. The market over the past year increased by 30000 to 40000 professional people that they moved to Cyprus after the war.