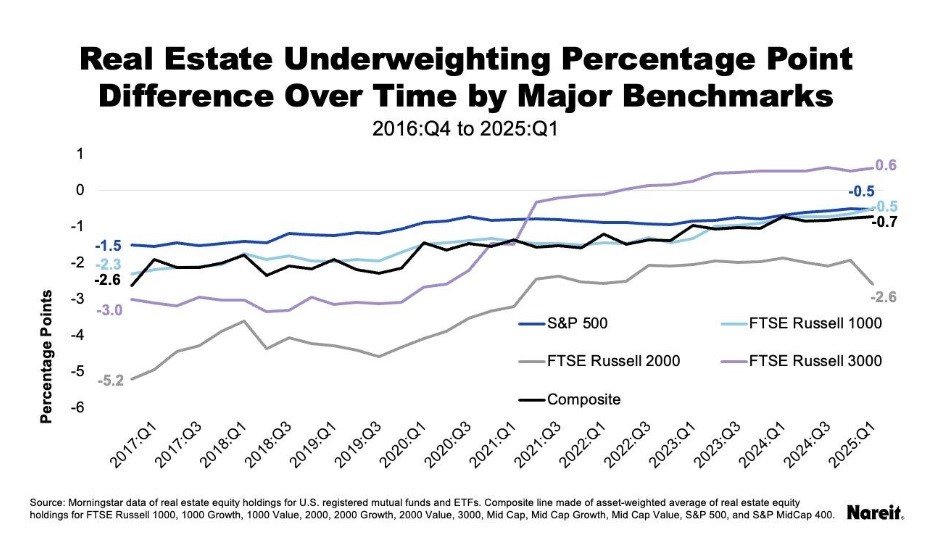

A NAREIT analysis of U.S.-registered mutual funds and ETFs, based on

Morningstar Direct data, shows that actively managed funds benchmarked to broad

stock indexes consistently allocate less to real estate equities—primarily

REITs—than the benchmarks themselves. However, since 2016, the extent of this

underweighting has decreased significantly.

For example, in the fourth quarter of 2016, generalist funds

benchmarked to the S&P 500 were underweight real estate by 1.5 percentage

points. By the first quarter of 2025, this underweight shrank to just 0.5

percentage points. Similarly, a composite of funds benchmarked across 12 major

indexes—including growth and value style funds and encompassing nearly 1,400

funds with over $9 trillion in assets—showed the REIT underweight narrowing

from 2.6 percentage points at the end of 2016 to 0.7 percentage points in early

2025.

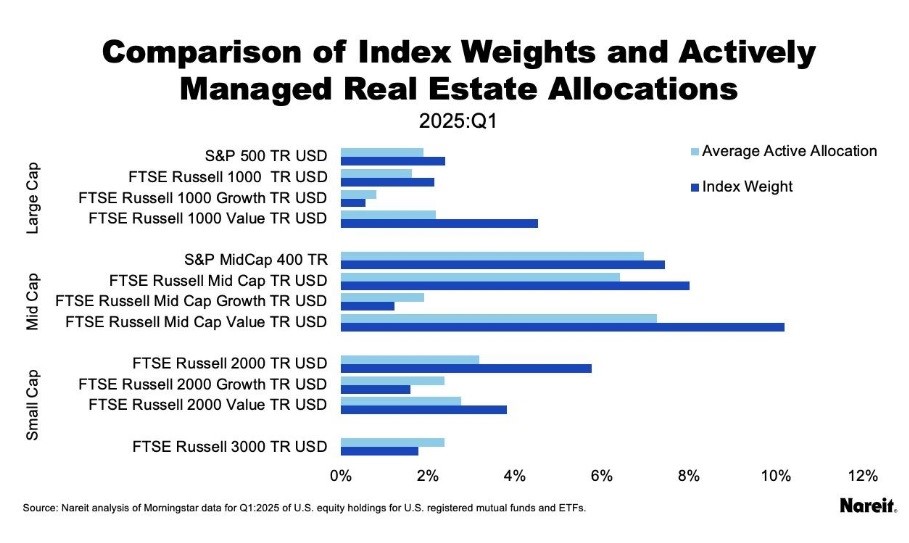

Examining individual benchmarks:

- The S&P 500 in 2025 included 380 actively managed funds with $4.7 trillion AUM. This index historically showed the highest active allocation to real estate but was overtaken by Russell 3000 funds in 2021. By 2025, S&P 500 funds were underweight in real estate by 0.5 percentage points.

- The Russell 1000, with 96 funds managing $416 billion, began 2016 with a heavier underweight of 2.3 percentage points but improved to a 0.5 percentage point underweight by 2025.

- The Russell 2000, comprising 46 funds and $59 billion AUM, exhibited the greatest variation in real estate allocations and the most substantial improvement—gaining 2.6 percentage points in allocation from 2016 to 2025.

- The Russell 3000, with 384 funds and $1 trillion AUM, had the largest underweight in 2016 at 3 percentage points—double that of the S&P 500. However, it steadily increased its real estate exposure and flipped to an overweight position of 0.6 percentage points by early 2025.

The data also reveal differences between growth and value indexes. Actively managed funds tend to overweight real estate in growth indexes—where the benchmark weight is relatively small—and underweight it in value indexes, where real estate constitutes a larger portion of the benchmark.

In summary, while active managers have traditionally allocated less to real estate than benchmarks suggest, they have steadily increased their exposure over the past decade. This trend reflects a growing recognition of real estate’s role in diversified portfolios, with some indexes and fund categories showing a notable shift toward parity or even overweight positions relative to their benchmarks by 2025.