2023 was characterized by high uncertainty and unfavorable international geopolitical tensions in the global environment. However, the Greek economy demonstrated particular resilience, recording, in the first nine months of 2023, one of the higher rates of economic growth (2,4%) among the member states of the European Union.

The most important development in the first nine months of 2023, which has a positive effect on the prospects of the Greek banking system, is the upgrade of Greece's government credit rating in the investment scale, contributing to the containment of the increase of borrowing costs from the international bond markets, due to the global tightening of monetary and financial terms.

According to the "Danos Group Property Market Overviews for the 2nd Semester of 2023", in this favorable economic context the Greek market appears to be on the rise in performance metrics.

Οffice

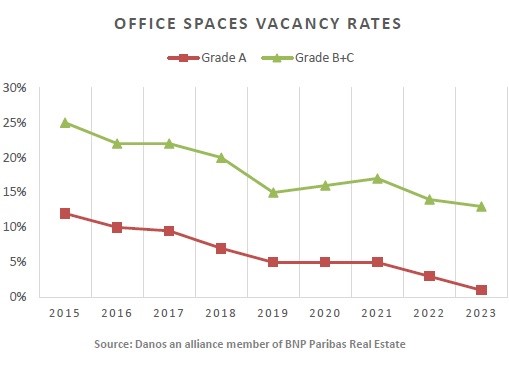

The office market seems to be maintaining positive performance metrics. During 2023 investors continued to be interested in new-built office spaces, and new projects were fueling the pipeline for future growth. Demand has been primarily driven by location and amenities and significant projects, which will fundamentally alter the office market, have been revealed. Businesses in the post-pandemic era will ultimately adopt new tactics, and while offices will continue to be crucial for businesses and employees, tenants will also demand higher standards.

Successful developers followed by REICs and private equity funds continue their investment activity in the main sub-markets such as Kifissias Av., Syggrou Av., Piraeus and Athens South, while deploying new development strategies in upcoming areas close to CBD such as Votanikos. Increasing activity is observed between developers in prime CBD locations and CBD Periphery (e.g., Vas. Sofias Ave., Alexandras Ave., T. Vassou str. etc.). In the south sub-market new developments are expected along Vouliagmeni Ave., in and around the Hellinikon Project.

There is still a high demand for Grade A office spaces, and many prospective investors are paying attention to this particular asset class, especially REICs, which have accumulated large amounts of capital. There is a backlog of new projects for Grade A certified office spaces, that will partially satisfy the ongoing demand, but there are optimistic plans for the sector's next five years, because the economy is growing overall and luring new players.

In accordance with ESG criteria, prime rents and the desire for high-quality spaces with strict sustainability standards are expected to keep increasing also throughout 2024, but in a lower pace. In the previous six months, REICs and foreign investors engaged in a race to participate in the construction and renovation of commercial projects.

Retail

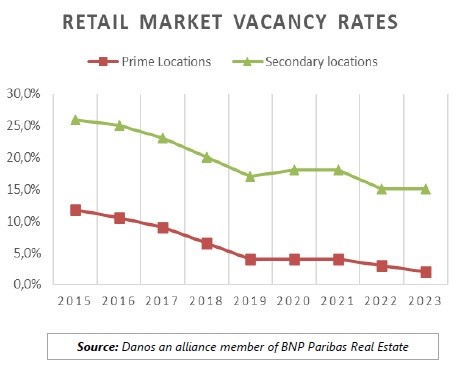

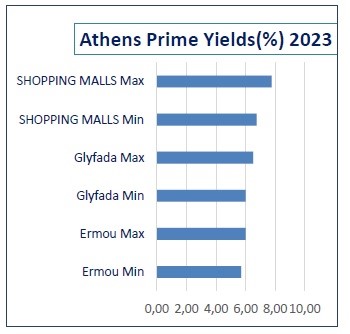

The yields in the high streets remained stable for 2023, with the higher rates in the shopping malls 6,75%- 7,75% and the lower rates in Ermou street 5,75%-6%. Prime locations so far seem to be resilient and show stability in the short term.

Logistics

According to "Danos Group Property Market Overviews for the 2nd Semester of 2023", Greece has made significant progress in the performance of the logistic sector during last years and as depicted in World B nk’s Logistics performance Index (LPI), moving from the 54th position in 2010 to the 42nd in 2018 and 19th in 2023, on a Global level.

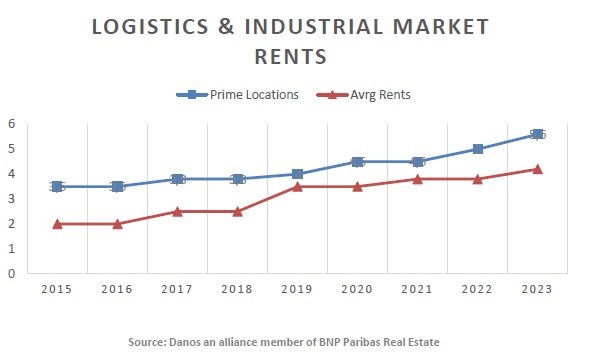

The Greek logistics market remains resilient and continues to perform well through 2023, offering to investors, competitive returns and sustainable rental levels. The Greek logistic market offer higher returns relative to other strong European markets, but still lower the Balkan area.

Rents are expecting to continue move upwards in 2024, as the result of the increasing demand and the lack of new and sustainability logistics units. Currently, prime rents are showing a 10 % increase from 1st semester of 2023. The monthly rents for prime logistics are close to 5,7 € sq m in the west areas of Athens (Aspropyrgos, Mandra, Magoula and Elefsina.

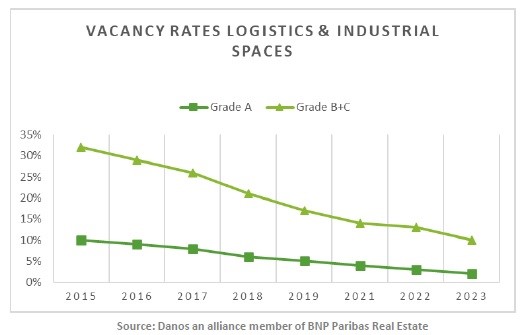

Prime logistics vacancy rates will remain extremely low in 2024 as result of continued demand from occupiers for modern and “green” product.

Aspropyrgos is getting set to accommodate tens of thousands of square meters of new storage space, and Elefsina and Thriassio are still the upcoming hotspots of logistics industry investments. Investor interest in prime logistics locations like Aspropyrgos and Magoula has been growing, and the demand there is anticipated to grow even more in the upcoming quarters. Secondary locations like Oinofuta and Markopoulo are currently also demanded due to the lack of prime assets in Aspropyrgos. The harbor of Piraeus has supplanted other Mediterranean ports, particularly those in Northern Greece, and is gradually evolving into a hub for the Balkans.