This year’s study was conducted in a landscape marked by the gradual stabilization of interest rates, alongside the emergence of new challenges that are redefining strategic priorities across the sector.

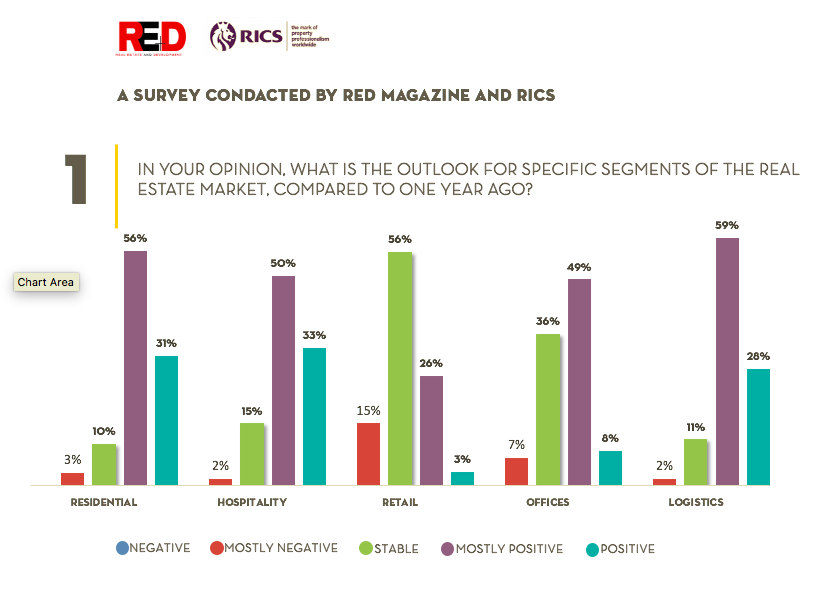

The performance assessment of key real estate asset classes reveals a generally stable to positive outlook. The strongest prospects are observed in logistics and residential real estate, with 87% of respondents expressing a positive or somewhat positive view. The hospitality sector is also showing strong signs of recovery, with 81% reporting improved expectations. In contrast, office spaces and retail properties exhibit more limited momentum, with muted expectations and clear indications of stagnation.

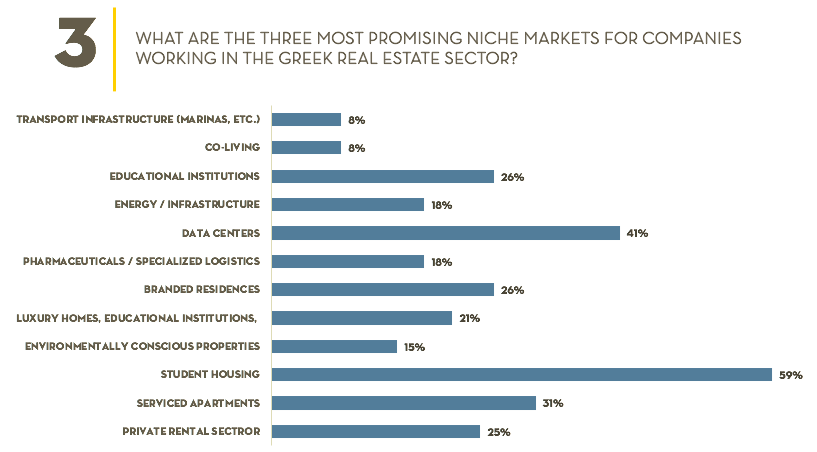

The Greek real estate market remains highly sensitive to external economic influences. Investor sentiment, fluctuations in financial markets, interest rate trends, inflation, and restricted access to financing are all considered critical factors shaping market dynamics.

Significant disruption was triggered by a recent Council of State ruling on the New Building Regulation. The ruling has introduced widespread legal uncertainty (66%), led to a reduction in buildable surface area (57%), and caused a noticeable slowdown in investment activity (44%). Industry stakeholders also report rising costs resulting from the need for project redesigns and delays in the permitting process.

The need to adapt to a shifting regulatory and legislative landscape stands out as the most pressing challenge for companies in the sector, cited by 80% of respondents. This is followed by the shortage of specialized personnel and the imbalance between supply and demand.

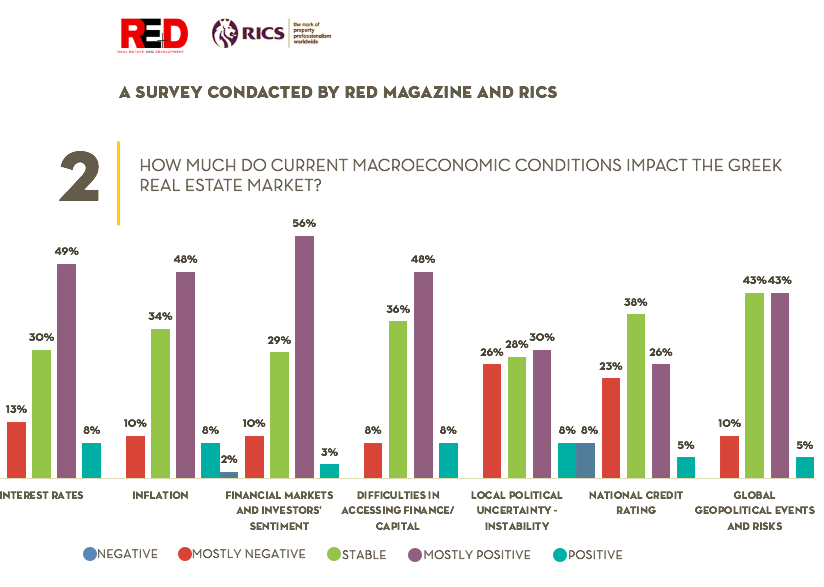

In terms of investment interest, student housing leads as the most promising asset class (59%), followed by data centers (41%) and serviced apartments (31%).

ESG Standards Remain High on the Strategic Agenda

Compliance with ESG standards, better utilization of existing building stock, and attracting institutional investors have emerged as key pillars in corporate strategic planning. At the same time, the adoption of Artificial Intelligence is gaining traction: 49% of respondents report already integrating AI solutions—primarily for property valuation, market analysis, and trend forecasting.

The importance of sustainability is reaffirmed: 74% of professionals observe a tangible demand for energy-efficient buildings, highlighting a market-driven need that goes beyond mere regulatory compliance. Nevertheless, location remains the dominant factor for commercial success, with 72% of participants identifying it as the most critical element.

Regarding the repurposing of older buildings, the main incentives cited are cost savings (33%) and carbon emission reductions (31%), followed by the preservation of architectural heritage and time efficiency. Structural integrity (46%) is considered the most important technical factor for the success of such projects, with energy efficiency, layout flexibility, and accessibility also viewed as crucial.

When it comes to potential government incentives to encourage redevelopment investments, tax relief ranks first (43%), followed by financial support through grants or guaranteed loans.

The full survey results will be available in the next issue of RED Magazine.