But in Athens, conditions are manageable, as there is still strong demand for Class A office space. In addition, there is a backlog of new projects for certified offices, which will partially satisfy the ongoing demand. Still, the sector has optimistic plans for the next five years because the national economy is growing and attracting new players operating according to ESG criteria.

Due to a prolonged economic crisis (2008-2017), there was no significant development of new office buildings in the Greek real estate market for almost a decade. The health crisis of 2020 has found the market with excess demand that still needs to be met due to a reduced stock of modern and energy-efficient office space, while at the same time, the demand for older office space varies significantly depending on the location.

Athens remains one of the most affordable capitals at a pan-European level for renting modern offices, a fact that, combined with the significant investments in the development of new modern and mainly green office buildings, as well as the upgrading of a part of the existing building stock, generates substantial expectations for the future attraction of foreign groups, to establish their headquarters in Athens, against other cities in Europe, with all that this implies, not only for the office market but also overall for the economy and the added value that will be generated. However, some difficulties still need to be solved that prevent further improvement of the appeal of the Greek market to foreign groups, such as bureaucratic obstacles, higher taxes, and higher employment costs, especially compared to other competitive Balkan countries.

The demand for sustainable offices is high internationally, driving up their prices. Today, there is a gap of up to 26% in sale prices between London buildings with sustainability ratings from organizations such as BREEAM and LEED and those without. This is known as the 'green premium.' On the other hand, the less environmentally friendly, usually older buildings have the so-called "brown discount." This gives company managers and investors a choice between lower overhead costs, lower emissions, and increased initial costs. But even with the increased costs, most companies are willing to invest in a green workplace, according to the global JLL Future of Work Survey 2022. The survey found that 74% of companies surveyed, by representatives of 1,095 real estate companies and developers in 13 countries, "are likely to pay a premium for green criteria," with 56% saying it is in their immediate plans by 2025.

The same is observed in the Greek office market, where more and more office users, regardless of whether they rent or own their properties, are willing to pay higher rent or invest funds to align with the EU's green requirements for sustainability. Also, companies wish to be more attractive to employees in terms of the working environment through their office buildings at a time when finding and retaining staff in most business sectors is a severe problem.

Increased demand from the technology and education sectors is offset by a partial contraction in corresponding demand from other business sectors, which have adopted flexible working methods and have less need for physical office space.

Over the last year, we have seen a surge in office buildings with bioclimatic features, almost doubling them. Specifically, this year, the number of green buildings has increased to over 200, with a total surface area approaching 3 million square meters. In contrast, 12 months ago, they numbered 112 and had a surface area of 1.5 million square meters. These figures concern the entire stock, i.e., the buildings already in operation and those under construction or planning. This development is due to several reasons. First, these buildings are sought after by users, and they immediately secure tenants at higher prices than a conventional building. At the same time, their construction can be co-financed by funds from the Recovery Fund, which has very favorable loan terms. In this context, real estate investment companies and groups are trying to meet this demand, intensifying their investment program. In the broader area of Marousi alone, investments exceeding 200 million € are underway and concern new office development projects, reconstructions, and upgrades of existing buildings.

According to office market executives, 80% of rental agreements concern high-end buildings that usually offer quality facilities and high energy efficiency. By the end of 2024, it is estimated that an additional 124,000 sq.m. will be added to the existing green stock, and by the end of 2026, it is predicted that a further 211,000 sq.m. will have been developed in total.

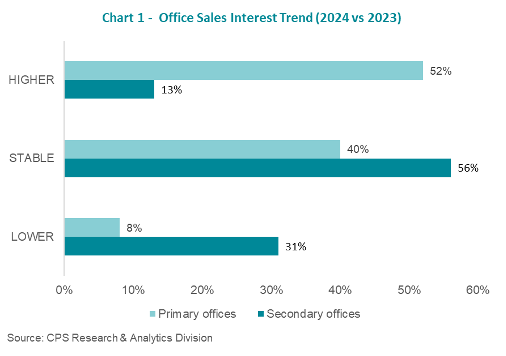

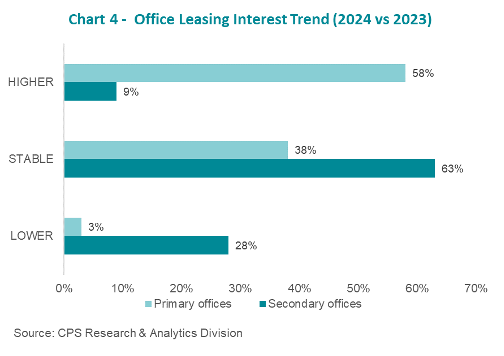

The volume of new investments for developing new office buildings is now significant, pushing sales interest upwards in primary markets and narrowing lower interest in secondary markets, as depicted in CPS’s survey data on the following chart.

Based on the data processed by CPS, the monthly cost of renting a modern office building in Athens is 25 €/sq.m., and the trends for such offices remain upward. But there are also cases of new, bioclimatic offices in areas of high demand, such as Marousi, where leases can be finalized at 30 €/sq.m. having recorded an increase of 10% year-on-year. According to the analysis, the few newly built energy-certified buildings in central locations with parking spaces register double and triple the rents of the older ones, without including communal expenses in this figure.

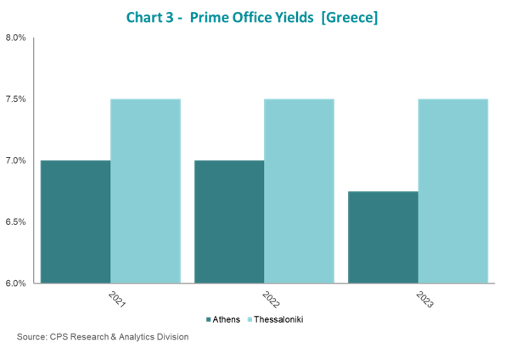

This particular category on which investment interest is concentrated appears to be unaffected by the changes in the work model. The yields of these offices are around 6 - 6.5%. On the other hand, old offices without modern specifications make up more than 90% of the existing stock of office space. These offices, in prominent locations and on central road axes, show remarkable strength, with their monthly rents hovering around 15 - 20 €/sq.m. with a yield of approximately 7 - 7.5%.

It is noted that office rental prices in Athens are comparatively affordable as lower rental prices than in Athens are only found in a few regional markets in the rest of Europe, such as Bucharest, Bratislava, and Antwerp. On the other hand, in London, which remains the most expensive market, renting offices amounts to 140 €/ sq.m. per month, while in Paris and Geneva, it amounts to 80 and 78 €/ sq.m. respectively.

Based on the CPS survey data, primary office markets will continue to benefit as demand is strong, keeping rent and sale prices at an elevated level if not pushing them upwards. Nevertheless, most potential tenants of B and C-class office space were wary of making decisions due to the unfavorable international economic climate and the consolidation of telework and its implications for companies' future housing needs.

Source: Cerved Property Services