First new data show that household net wealth in euro area increased by 29% over last five years, with homeowners’ net wealth increasing more than that of non-homeowners

The DWA link household-level information from the Household Finance and Consumption Survey (HFCS) to macroeconomic information available in the sector accounts and therefore complement existing household survey data. The data will be compiled every quarter and published five months after the end of each period.

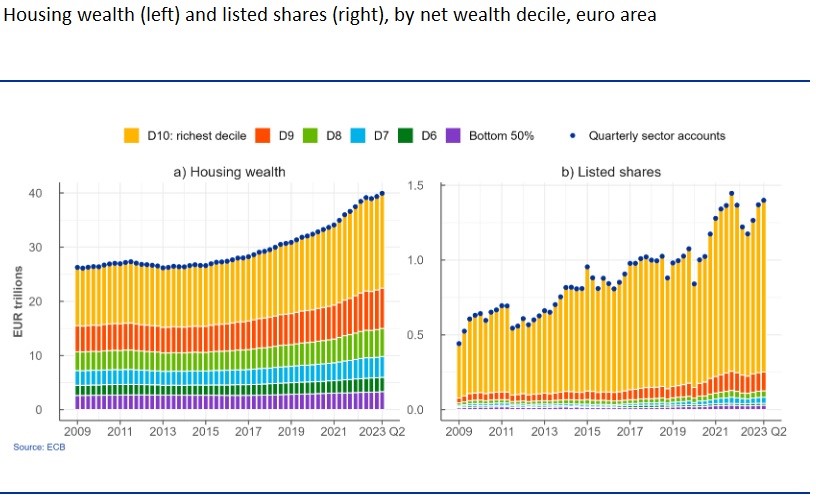

The DWA provide data on net wealth, total assets and liabilities and their components. Households are broken down into the top five deciles of net wealth and the bottom 50% as well as by employment and housing status. Through these data, it is possible to analyse the effects of, for example, growing housing wealth and the rising value of listed shares on the distribution of household wealth.

Slight decrease in inequality, partly because homeowners benefited from increased housing prices

The DWA results show that the increase in housing wealth in recent years has been more equally distributed than the increase in the value of listed shares.

The significant rise in euro area household net wealth observed in national accounts over the past five years (29% or about €13.7 trillion) was accompanied by a slight decrease in inequality, partly because homeowners, who account for more than 60% of the population, benefited from increased housing prices.

Their net wealth (per household) increased by 27% over this period. In parallel, the net wealth of non-homeowners, making up 40% of the population, grew by 17%, mainly owing to the rise in deposits observed over this period.

The median net wealth increased by approximately 40%

The DWA dataset also includes the Gini coefficient (The Gini coefficient, is a measure of statistical dispersion intended to represent the income inequality, the wealth inequality, or the consumption inequality).

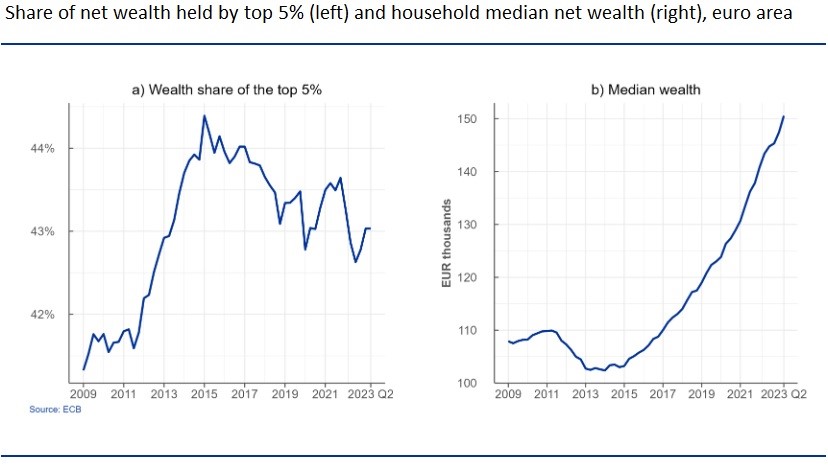

The DWA results show that, in the euro area, the share of net wealth held by the top 5% of households of the net wealth distribution dropped slightly between 2016 and the second quarter of 2023, while still exceeding 43%.

At the same time, the median net wealth increased by approximately 40%.