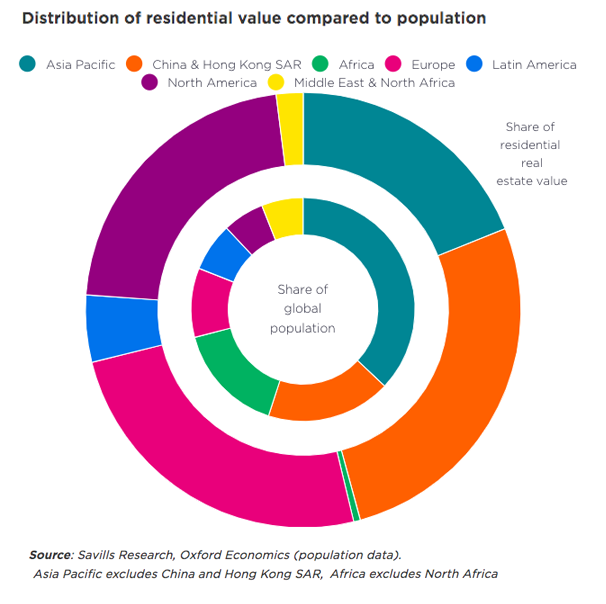

Europe, with just 10% of the world’s population, holds 25% of the total value of global residential real estate. Similarly, North America—home to only 6% of the global population—accounts for 22% of the total value.

In contrast, the highly populated regions of Asia and Africa — where the majority of the world’s population resides — hold a disproportionately small share of global residential wealth. A striking example is India, which, despite being the most populous country globally, ranks only 16th in terms of the total value of its housing stock.

The World’s Largest Residential Real Estate Markets

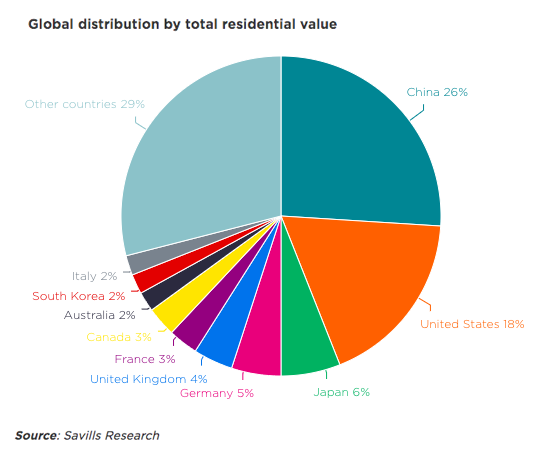

Global residential wealth is heavily concentrated in just ten countries. China, the United States, Japan, Germany, the United Kingdom, France, Canada, Australia, South Korea, and Italy collectively account for 71% of the world’s total housing value.

China retains the leading position, representing 26% of global residential value, followed by the United States with 18%. Together, these two nations make up nearly half (44%) of the global housing market. In 2024, the United States saw a 5.1% increase in residential value, driven primarily by rising home prices and continued construction of new housing.

By the end of 2024, the total value of global housing reached $286.9 trillion (approximately €264 trillion), marking an annual decline of 2.7%. Although the overall value decreased, most countries recorded increases in local currency, due to rising prices and the expansion of residential stock.

The total value of housing worldwide remains 19% higher compared to 2019, reflecting the post-pandemic boom in real estate markets.