Total European hotel investment volume for the year finished 19% below 2022 and 60% below 2019, with average deal sizes in Europe further declining, extending a trend that began mid-pandemic in 2021, driven mainly by a large drop in portfolio deals.

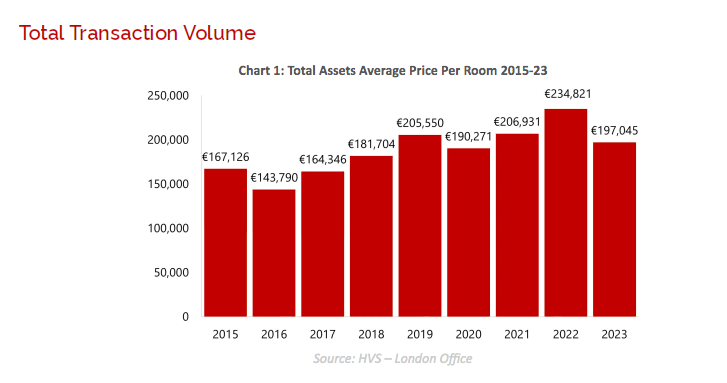

The average price per room was €197,000 in 2023, a decrease of 16% over 2022 and around 5% lower than in 2021 and 2019. Hotels in 2023 transacted for an average price per hotel of €27,500,000 (a 9% decrease over 2022) and had an average of 140 rooms (a 9% increase over 2022).

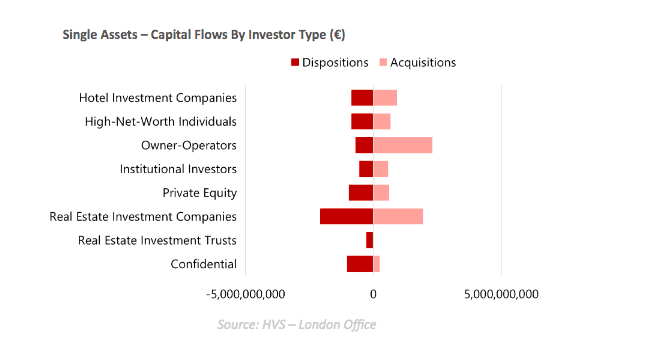

Owner-Operators were 2023’s largest net buyers of single assets at €1.6 billion (an 84% increase over 2022). Private Equity companies were the largest net sellers of single assets in 2023 at €348 million. Real Estate Investment Trusts followed, with total net sales reaching €267 million;

Institutional Investors were largely neutral in 2023 with a net acquisition volume of €37 million, after being responsible for single asset net purchases of €1.4 billion in 2022, demonstrating the significant effect on this segment in the current environment.

Owner-operators were the second most active, transacting €4.1bn of property, up 45% on 2022 levels, while investment from private equity firms fell significantly as most found themselves on the side of sellers, creating a net negative balance of €628 million.

Most of the transactions took place in Spain and France, representing 44% of the total investment volume and taking advantage of the resurgence of tourist flows to Southern European destinations. The decline in core asset trading activity was notable as investor interest shifted more towards a focus on value-added assets promising higher returns.

Single asset transaction volume in 2023 totalled €7.3 billion, which was 17% less than 2022 volumes and 39% below 2019, and was again the second lowest level since 2013. Majority of the activity took place in H1 2023

France was Europe’s most liquid single asset market in 2023, with 37% more activity than in 2022, moving up two places and dethroning the United Kingdom, which accounted for only 18% of all single asset transactions in 2023 compared to 22% in 2022. Spain remained in second place for the fourth consecutive year, with Germany and Italy remaining in fourth and fifth positions respectively

Other markets besides France and Spain that saw increased single asset activity in 2023 were Portugal (+43% and up to sixth), Denmark (+167% and up to seventh) and Switzerland (+45% and up to tenth).

At the portfolio level, transactions as a whole decreased by 24% in 2023 with a total volume of €3.4 billion.

The report concludes that the worst of this current cycle seems to be behind us, with inflation having fallen dramatically during the past 12 months and expected to be <3% in both the EU and the UK in 2024. Recessions in major economies have not been the trend but rather a rare exception, and interest rates seem to have peaked towards the end of 2023.