Investment turnover in the UK is expected to reach c.€52billion in 2024, up 20% on 2023 levels, before reaching around €92.7billion in 2027 – the same level as that recorded in 2021 and 2022.

According to the international real estate consultancy by 2027 global investment turnover will be on track to reach €1.275 billion, making it one of the best performing years of the last decade.

According to the head of international capital markets at Savills World Research, property markets have bottomed out. Sentiment has improved from last year's lows and prices are stabilizing.

Greece: €215 million have been transacted on the capital’s retail market

According to Savills Hellas, over the last 12 months a significant number of transactions in the Attica region, mainly for income producing big box units, retail parks and well positioned highstreet stores.

The majority of domestic market participants purchasing this kind of assets are institutional investors, private equity funds as well as family offices of both foreign and domestic capital.

It is noted that during 2023 an approximate of €215 million have been transacted on the capital’s retail market, with the sale of “Smart Park” in the East submarket (a total size of 52,000 sqm with well-established anchor tenants of the global market) for a total amount of €110 million, giving a great boost to the domestic retail investment volume.

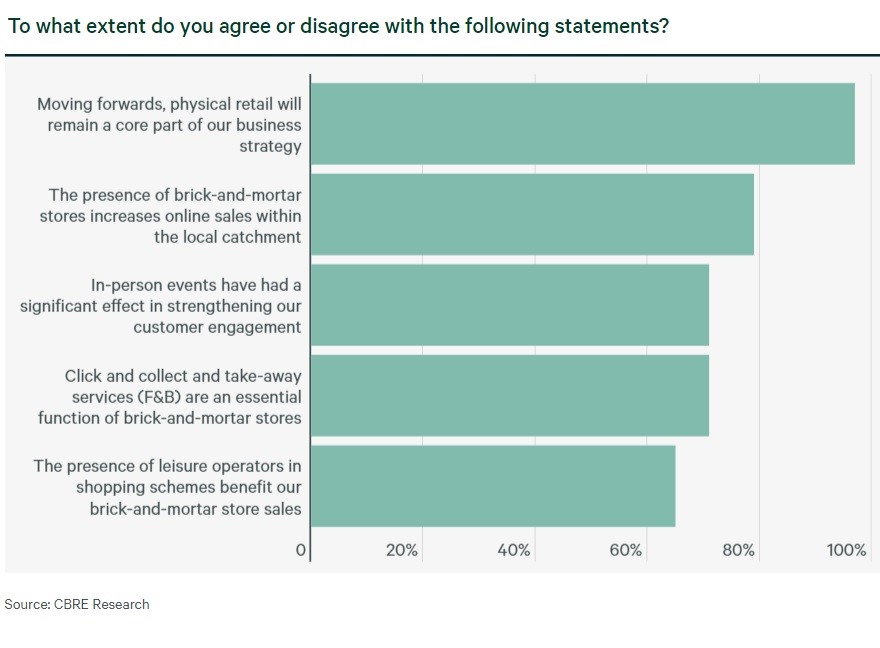

97% of retailers either agree or strongly agree that physical retail will remain a key part of their strategy

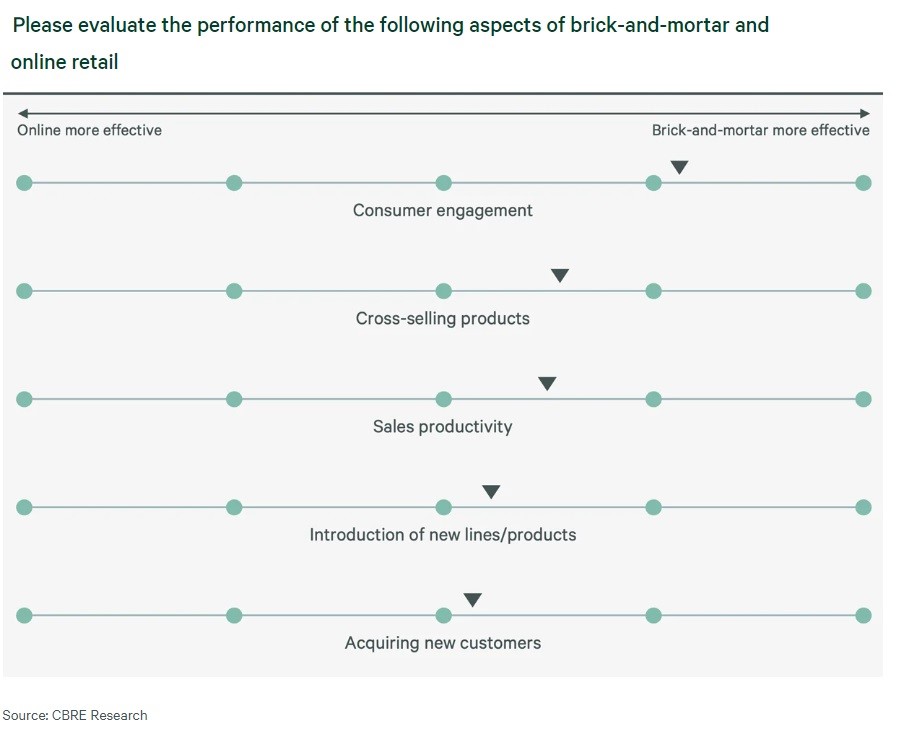

Europe’s largest retailers, with a combined worldwide store portfolio of over 130,000 stores, rated brick-and-mortar retail as more effective than online. According to CBRE’s recently unveiled report, brick-and-mortar’s strengths were most apparent in consumer engagement and cross-selling products.

The majority of them is expected to expand their store portfolio while they put high on the agenda the ESG considerations since their majority believe that green leases will be included in lease negotiations within the next three years.

Brick-and-mortar as more effective

The CBRE’s “European Retail Occupier Survey 2024” unveiled that retailers in Europe rated brick-and-mortar as more effective than online retail overall, and particularly for consumer engagement.

97% of retailers either agree or strongly agree that physical retail will remain a key part of their strategy. Meanwhile 79% of those believe that brick-and-mortar stores increase online sales within the local catchment.