The survey indicates that approximately 60% of respondents have allocated at least 20% of their portfolios to the Living Sector. Moreover, nearly 80% anticipate that their investment in this sector will increase over the next five years.

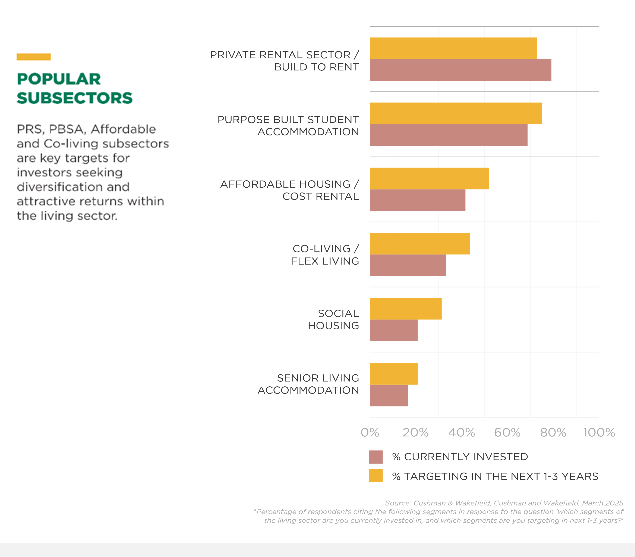

According to Cushman & Wakefield, the Private Rental Sector (PRS) and Purpose-Built Student Accommodation (PBSA) are currently the most prominent segments. Notably, student housing is expected to remain one of the most attractive investment opportunities over the next three years.

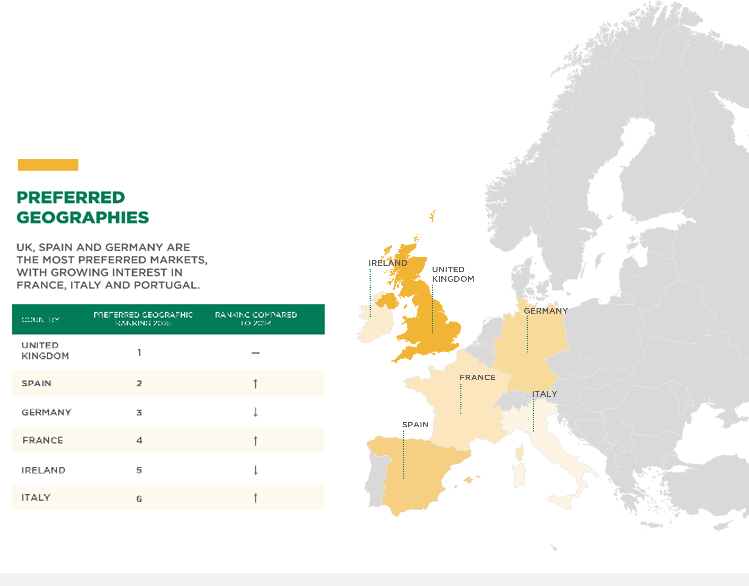

Among European regions, the United Kingdom, Spain, and Germany continue to stand out as the top three geographic markets of interest for 2025. Meanwhile, investor sentiment toward France, Italy, and Portugal has seen a modest uptick.

Student housing is projected to be the strongest-performing sector this year. However, the most commonly cited challenge remains the pricing mismatch between buyers and sellers — a persistent obstacle to market activity.

Sustainability has emerged as a core investment priority for 73% of respondents, with 52% indicating a willingness to pay a premium for assets that support sustainable living. At the same time, 52% anticipate a decline in returns across the broader Living Sector.

It is also worth noting that the survey was conducted between November 2024 and January 2025, gathering insights from leading institutional investors, private equity firms, and funds across Europe.