The uncertainties during the last two years from the intensifying geopolitical instability and the effects of high inflation have not interrupted the upward trend in prices and do not seem to be affecting construction and investment activity significantly at the moment.

The residential real estate sector, and especially the residential properties as investment assets, have attraced the interest, with the corresponding rates of price growth recording particularly high percentages.

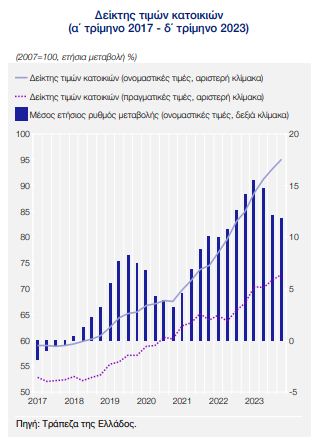

According to the apartment price indices published by the Bank of Greece, the housing market in the country as a whole continues to record strong annual rates of price growth, which, however, show a slowdown in the last quarters of 2023.

In more detail, according to the assessment data collected by the country's credit institutions, in 2023 there is an increase in prices in the housing market at national level, with apartment prices (in nominal terms) increasing significantly by 13.4% in annual base, versus an increase of 11.9% in 2022 and 7.6% in 2021

The prices of old apartments (over 5 years old) in 2023 increased at an average annual rate of 14.2%, slightly higher than that of new apartments (12.4%). Disaggregated by geographic region, strong annual growth rates in apartment prices were recorded in the country's major urban centers. More specifically, the highest annual rates of increase in prices, higher than the average annual rate for the whole country, were recorded in Thessaloniki (16.2%), in the other major cities (14.5%) and in Athens (13, 7%), while in the other regions of the country the growth rate was milder (10.8%).

The high investment interest, mainly from abroad, the low supply of especially high-end homes, the positive course of tourism and short-term leasing, as well as the high demand for the subsidized housing program, contributed significantly to the further strengthening of the residential real estate market in 2023. ("My house") to new people for the purchase of a first home. The maintenance of market dynamics is also confirmed by residential investments (non-seasonally adjusted ELSTAT data at constant prices) which increased by 20.7% in 2023 against 33.7% in 2022, although they remain at a low level as a percentage of GDP (1.9%).

Also, in the first eleven months of 2023 the construction activity for residences throughout the country (ELSTAT data) recorded a significant increase both in terms of the number and the buildable volume of new building permits, by 23.6% and 16.0% respectively. At the same time, positive business expectations for housing construction (IOBE data) strengthened further in 2023 on an annual basis (18.1%), against a moderate increase of 4.0% in 2022.

However, the total cost of construction of new residential buildings (ELSTAT data) continued to increase by 6.2% for the year as a whole, but decelerating to 8.8% in 2022, while the annual growth rates of construction materials costs were higher ( 7.6% in 2023, versus 11.0% in 2022). It is worth noting that, despite the significant growth of the Greek residential real estate market, the total amount of new mortgage loans after six years of continuous increases continues to remain at low levels, while it fell in 2023 by 1.9%, compared to an increase of 20.7 % in 2022. Also, according to the data of the Bank Loans Survey (Q4 2023), there has been a continuous decrease in the demand for housing loans for almost two years (with the exception of the second quarter of 2023) due to the increase in mortgage interest rates loans.

In the commercial real estate sector, based on data collected by the Bank of Greece, in the first half of 2023 high-end office prices rose by 6.6% year-on-year and high-end shop prices by 6.9%. In Athens the corresponding rate of increase in office prices was higher (7.2%), while a large increase was also noted in the rest of Greece (7.3%), after a long period of relative stagnation in prices.

In Thessaloniki, on the contrary, after two consecutive six months of high growth rates, a slight price correction was recorded compared to the previous year (-0.5%). With reference to high-end stores, in the first half of 2023 significant positive annual rates of change were recorded in the price indices of Athens (8.4%) and Thessaloniki (9.8%), while in the rest of Greece the corresponding rate amounted to 3, 7%.

Finally, during the same period for the entire country, rents for both offices and shops recorded an annual increase of 5.6%. In the eleventh month of 2023, the construction activity for commercial properties (ELSTAT data) was positive as a whole, while the individual categories presented a mixed picture.

More specifically, the number of new licenses for offices increased (44.8%), while the corresponding total volume (in cubic meters) was reduced by 10.1% compared to the eleventh month of 2022.

New hotel permits fell by 31.1%, while the corresponding buildable volume fell by 4.0%. Finally, the construction activity for shops was recorded particularly increased in terms of volume (280.5%), but more modestly positive in terms of the number of new permits (13.9%). The positive rates in the licenses of new offices and shops confirm the continued investment interest, but also the mobility of users towards properties of modern specifications.

The variation in rates of change recorded in the hotel sector follows consecutive years of strong growth rates in the corresponding construction activity, even during periods when construction for other professional (as well as residential) uses was in recession.

Based on the data gathered by the Bank of Greece, during 2023 the funds of Real Estate Investment Companies (REIC) and other investment portfolios and real estate development companiesor they were directed in the majority to the purchase and/or development of high-standard office spaces, mainly with modern bioclimatic characteristics. Hotels, professional warehouses and special-use investment housing also attracted significant capital.

Based on the results of the Commercial Real Estate Market Survey of the Bank of Greece, during the first half of 2023 the minimum yields of high-end offices in the most commercial parts of the center of the capital ranged between 5.5% and 6.6%, at approximately the same levels like the previous half-year, while the minimum yields of high-end shops in the most commercial locations of the center of Athens ranged between 5.3% and 6.0%.

Expectations for the Greek real estate market for the next period remain moderately positive, as uncertainties related to geopolitical instability at the global level are still significant.

The conditions of increased inflation and construction costs, as well as higher interest rates, affect the investment profit margin and increase the requested yields from real estate, which may gradually affect the prices of the domestic market, which in recent years has been significantly fueled by foreign investments.

source:BoG