According to a recent Savills Investor Sentiment survey, 72% of investors are willing to shift into "manage to ESG" type investment strategies, since with the current regulatory framework without "green" certification, there will be a decline in the assets' value in a greater degree than in case of green properties that comply with the standards.

Generally corporate ESG strategies limit investment options, with "green" capital focused on buildings with the highest credentials.

What's the burden for the investor?

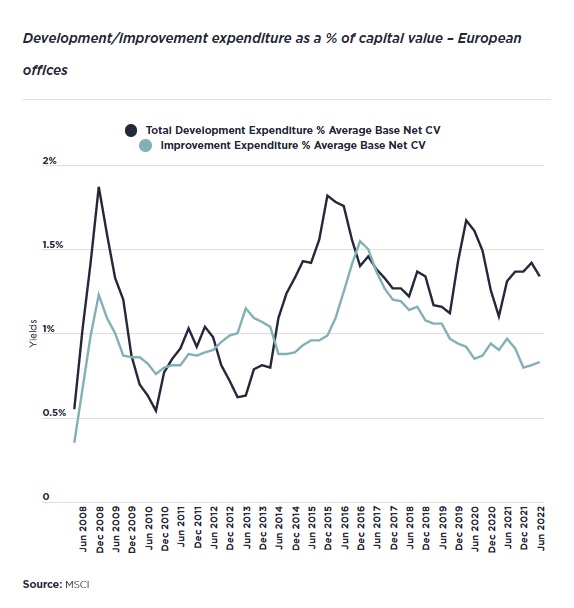

According to MSCI data the European spending on office upgrades has dropped to just 0.8% of total building value. This budget usually covers costs for replacement lighting and air flow systems, but renovations that can increase the energy rating. Savills estimates that the average cost to upgrade an office's energy class from D to B is around €500/sqm, although this varies considerably from case to case. But with the visible risk that the building will fall into disrepair in the short term, increasing improvement costs are the only way for investors to future-proof their building. Planning the interventions, before it becomes imperative, even now allows for negotiation between landlords and tenants about how to share the costs.

Any delay and as we approach 2030, it means that tenants will be more cautious about signing new leases for less energy efficient buildings, .

In this climate, "green finance" is taking on an increasingly important role for lenders and borrowers. Financial strategies and the reduced risk associated with investments that take ESG strategies into account offer more favorable financing conditions, such as increased access to green and sustainability-related loans. Lenders are increasingly aware of the risk to their loan if borrowers use funds to invest in non-performing assets, due to the risk of default.

What's next ahead

Improving the energy efficiency of an office building can bring multiple benefits to investors. In terms of demand, higher occupancy rates can be achieved as tenants seek more sustainable, greener buildings in an effort to adhere to corporate ESG strategies, attract talent and maintain their corporate reputation.

At a time of macroeconomic instability across Europe, limited financial resources to upgrade buildings to comply with EU EPC regulations are creating problems for builders as construction costs and inflation are high. Where these properties are located in less desirable locations, they are expected to generate lower rental income, further complicating the path to compliance with European energy performance certificates.