The results were supported by the continued increase in foot traffic, reaching 25.6 million, as well as the achievement of a new record in store sales, amounting to €865 million (a 5% increase compared to 2023).

Regarding commercial leases at the two retail and entertainment destinations under development at The Ellinikon, Heads of Terms (HoT) agreements have been signed with tenants for 63% of the Total Gross Leasable Area (GLA) at The Ellinikon Mall and 76% of the GLA at the Riviera Galleria, at higher rates compared to the operating shopping centers. This reflects both the strong fundamentals of a market with limited supply and the strong interest of retailers in these new developments.

In February 2025, a bank loan of €185 million (including €39 million for VAT financing) was signed to finance the construction and operation of the Riviera Galleria. The consortium of banks participating in the syndicated loan includes: Piraeus Bank, Eurobank, Alpha Bank, and Attica Bank.

At the same time, construction work continues. Concrete pouring works are in full progress for all buildings in the Riviera Galleria complex, while excavation works at The Ellinikon Mall have been completed, with the remaining contract under tender. The total Group Asset Value (GAV) of LAMDA MALLS as of December 31, 2024, exceeded €1.5 billion, with the value of the 4 operating shopping centers reaching a new historic record of €1.2 billion.

The Marinas

The Marinas confirmed once again their steadily increasing performance, achieving a new historic record in 2024 both in total revenues, which amounted to €32.7 million (a 12% increase compared to 2023), and in EBITDA, which grew by 8% compared to 2023, reaching €19.5 million. This significant performance is mainly attributed to the consistent preference of customers for the two mega yacht Marinas (which record 100% occupancy in permanent docking spaces) and the annual contractual increases in docking fees. The higher revenues from passing recreational vessels, due to the increase in tourist arrivals in Athens, also contributed to the improved performance of the Marinas.

Additionally, in October 2024, a 40-year sub-concession agreement was signed for the right to construct, operate, manage, maintain, and exploit the Mega Yacht Marina in Corfu. LAMDA MARINAS INVESTMENTS will invest over €50 million in the construction and development of the marina, while the total value of the payment to be made to the Hellenic Republic Asset Development Fund (TAIPED) over 40 years exceeds €89 million. With the investment in the Corfu Marina, LAMDA strengthens its leadership role in the maritime tourism sector.

The Ellinikon

Regarding The Ellinikon project, EBITDA before valuations increased by 50% compared to 2023, reaching €97.4 million.

Total cash receipts from property sales since the start of the project until February 28, 2025, have exceeded €1.1 billion, with receipts in 2024 amounting to €589 million, of which approximately €312 million came from residential developments. In 2024, transactions involving the sale of land to third parties for the development of residential, office, and educational spaces, as well as a retail park, were completed, with the total transaction value amounting to €258 million, of which approximately €194 million was collected within 2024. From these transactions, the estimated total accounting profit before taxes for the LAMDA Development Group amounts to €173 million, the majority of which was recognized in the 2024 financial results, while an amount of approximately €30 million is expected to be recognized in the first half of 2025. It is noted that deferred revenues from property sales/leases, which will be recognized gradually in the financial results, amounted to €286 million as of December 31, 2024.

The apartments at Little Athens are selling like hotcakes, as by February 28, 2025, out of the 559 apartments available for sale, sales and reservations from interested buyers have already reached 453 apartments, or 81%.

The cash reserves allocated to The Ellinikon project increased by €161 million in 2024, reaching €292 million by December 31, 2024. For yet another year, no bank loans were disbursed for The Ellinikon project, despite the existence of an approved credit line from the lending banks amounting to €232 million.

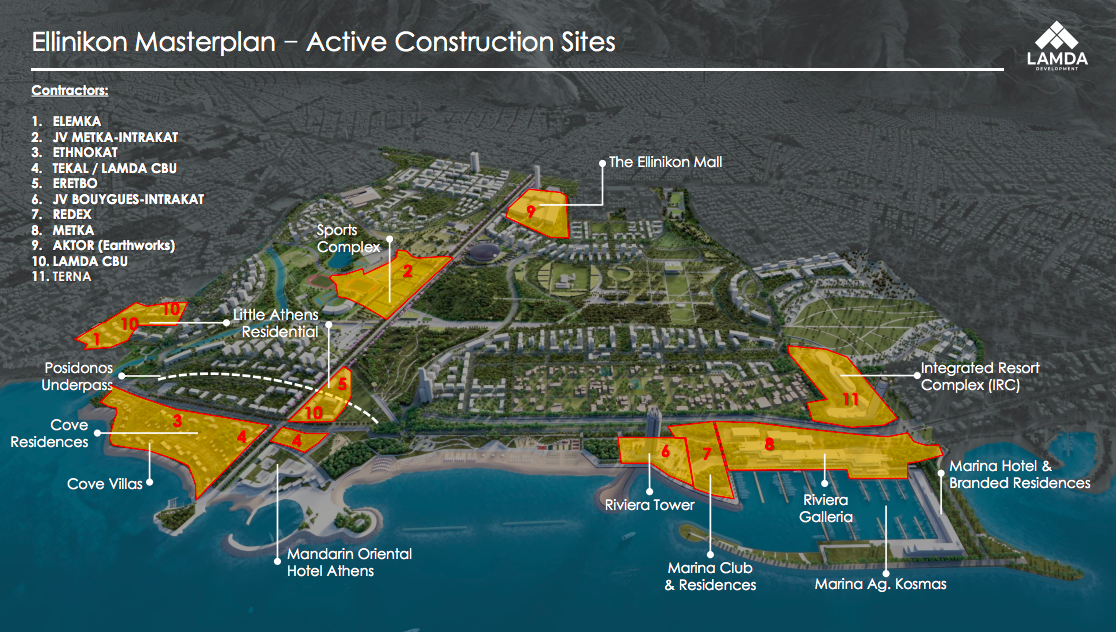

Progress continues both in infrastructure projects and in building constructions

Specifically, work is already underway on 14 different developments in collaboration with 12 different manufacturers, while work has now started on all the residential developments that have been made available for sale. During the year 2024, capital expenditures (CAPEX) for buildings and infrastructure projects amounted to €248 million, with the total capital expenditures from the start of the project up to December 31, 2024, now reaching €564 million.

Finanancial results

The results reflect significant achievements across multiple sectors. A new historic record for EBITDA was set for the Marinas, reaching €19 million, an increase of 8% compared to 2023. Additionally, EBITDA before valuations for The Ellinikon project saw a remarkable 50% growth, reaching €97 million.

Total receipts from property sales for The Ellinikon project in 2024 amounted to €589 million, marking an 84% increase compared to 2023. As of February 28, 2025, the cumulative receipts from the project have surpassed €1.1 billion. Moreover, approximately €30 million in accounting profit before taxes from property sales to third parties is expected to be recognized in the financial results for the first half of 2025.

The Group also experienced a €191 million increase in cash reserves, which now total €679 million. Furthermore, consolidated sales rose by 48%, reaching €665 million.