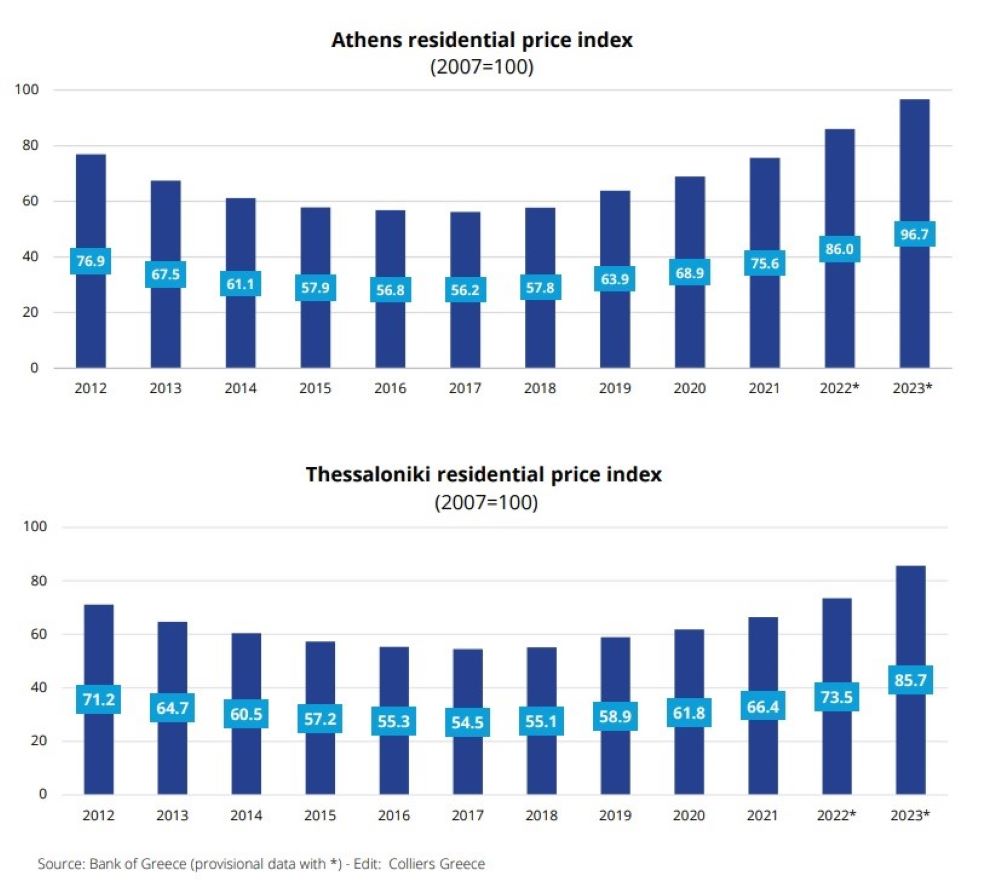

According to Colliers Greece latest report “Greek Real Estate Market. Sectorial Market Trends”, the Greek residential market during the last 5 years witnesses a progressive recovery in prices throughout the country and particularly in urban centers and metropolitan areas.

High quality residences have strong commercial potential due to the lack of sufficient relevant stock. Spacious residential properties with highstandard construction and design features are expected to be more resilient in terms of pricing. Low quality of existing building stock and lack of energy efficiency will continue to present opportunities for the development of high-quality buildings and for the renovation and upgrade of existing residences. New urban infrastructure and development projects will rise interest for areas such as the Hellinikon region and the Athenian Riviera, as well as the zones served by the upcoming new metro stations.

Greece is still expected to remain a relatively inexpensive and attractive place for foreigner buyers to buy a residential property. It remains to be seen how the inflationary pressures and supply chain disruptions, triggered by the geopolitical events will continue to influence the economy and therefore the local transactional and development activity.

Nevertheless, Colliers expects any potential correction in pricing due to the higher interest rates and cost of living to be milder in the short term.

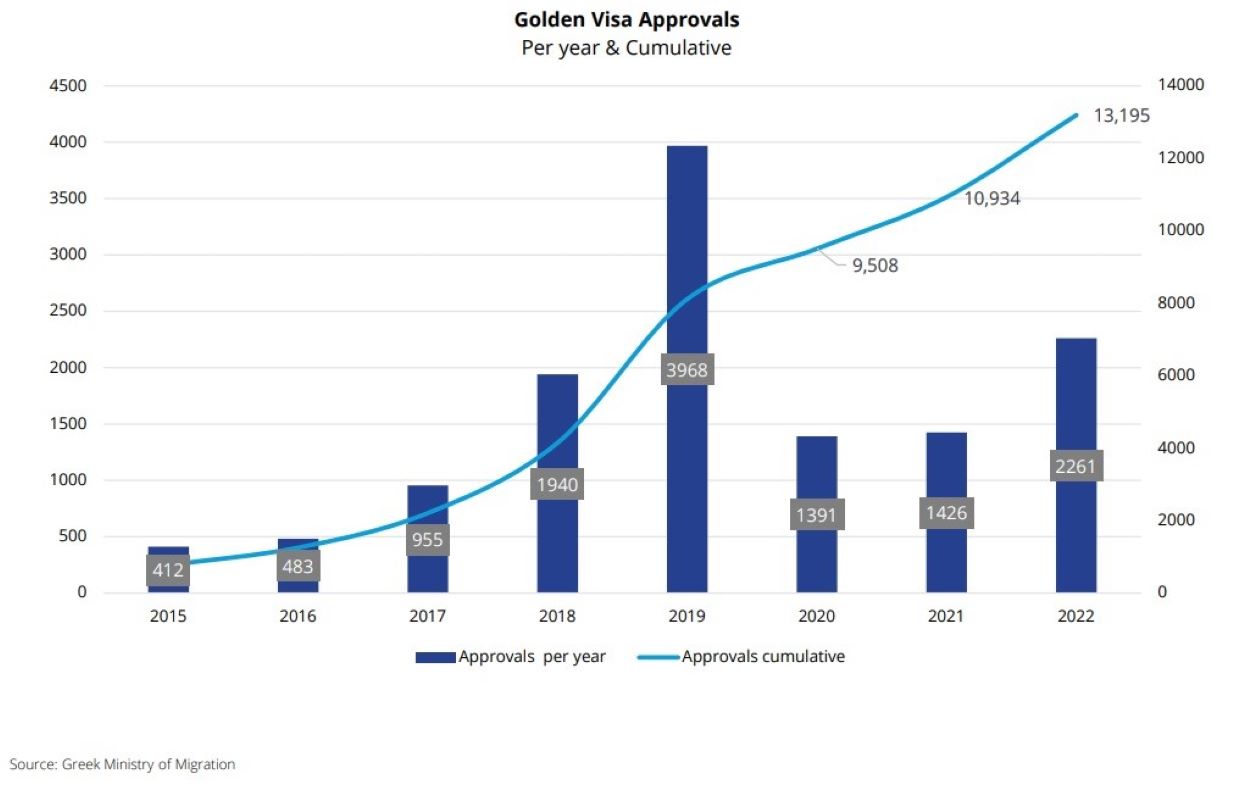

Golden Visa program regaines momentum

Since the launch of the program in 2013, transactions have grown exponentially.

The Greece Golden Visa program, is expected to favor mainly transactions of more opulent residential properties, both for personal use and for commercial exploitation, in certain attractive regions of Athens and also within major tourism destinations and hotspots.

According to published data, the Greek state has approved approximately more than 13.000 Golden Visas to property investors. By counting the investor’s family members, about 28,700 residence permit have been granted in total through the Golden Visa program.

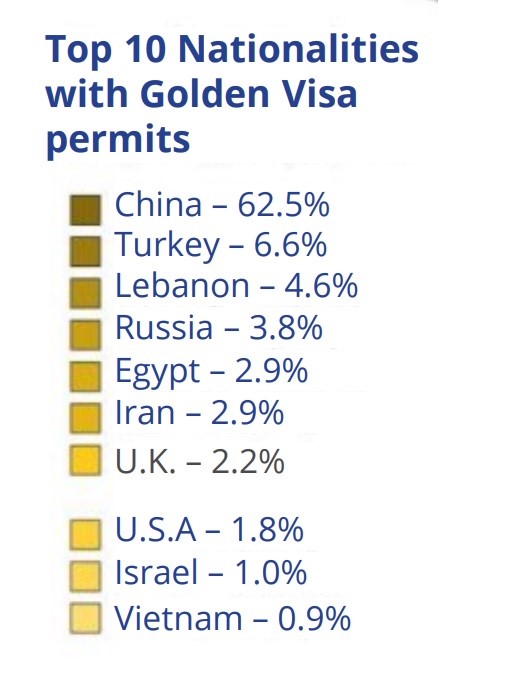

The buyers mainly come from China, Turkey, Russia, and the Middle East. Investors from China have made the vast majority of purchases (around 6,400 properties). However, recent data shows a, slow but steady, rise in transactions made by investors from other countries. It is worth noting that, until recently, golden visa transactions usually related to old and scattered properties, while now, the market was witnessed the introduction of properties specifically designed to meet golden visa standards and specifications to attract investors of all type of nationalities.

Initial data from the first 3 months of 2023, a total of 2,015 foreign property investors have applied for a residence permit (Golden Visa) and more than 5,800 during the last 12 months (April 2022 - March 2023). This is a clear sign of the momentum that the Golden Visa program has regained, after a couple of years of "low flights" due to the pandemic.

It is characteristic that in the last 12 months 1,902 new Golden Visa permits were issued and c. 3,900 are still pending. As an example, in the first two months of 2023 alone, 1,446 new Golden Visa requests were submitted, an increase of 252% compared to the same period a year ago, when requests had not exceeded 411. At the same time, 574 new permits were issued, a 101% increase from the 286 permits issued in the first two months of the year last year.