In the latest "EMEA Hotels Monitor" by Whitebridge Hospitality, RLB and HOTSTATS, it is stated that despite ongoing challenges such as political instability, unexpected early elections, etc. the EMEA hotel sector has shown resilience, with some areas even approaching stabilization after the disruptions caused by the pandemic.

The figures show that Dubai is the top performer with occupancy rates of 80.3% until June 2024, while Milan achieved the highest GOPPAR (Gross Operating Profit per Available Room) at €157.28.

Doha has seen remarkable growth with a 50.1% increase in GOPPAR, following the World Cup period, while in contrast, Amsterdam has seen the biggest drop of 13.3% in GOPPAR.

The Middle East continues to show revenue and profit growth of more than 8% compared to the previous year, especially the UAE and Saudi Arabia, where the profit margin has increased by more than 8 percentage points since 2019 and almost flat from year to year.

Despite the Olympic Games it hosted a few days ago, Paris records decreases in occupancy by 3.4%, Revenue per Available Room (RevPAR) by 2.0% and GOPPAR by 9.6%.

Recent trends in Europe show that demand exceeds that of the US and continues to be relatively strong. Profitability in Europe is supported by lower energy costs and slowing inflation on a year-on-year basis. However, according to the research, those who seem to be "galloping" are the mid-range hotels that show the biggest increase in their profitability.

New units construction modestly resuming

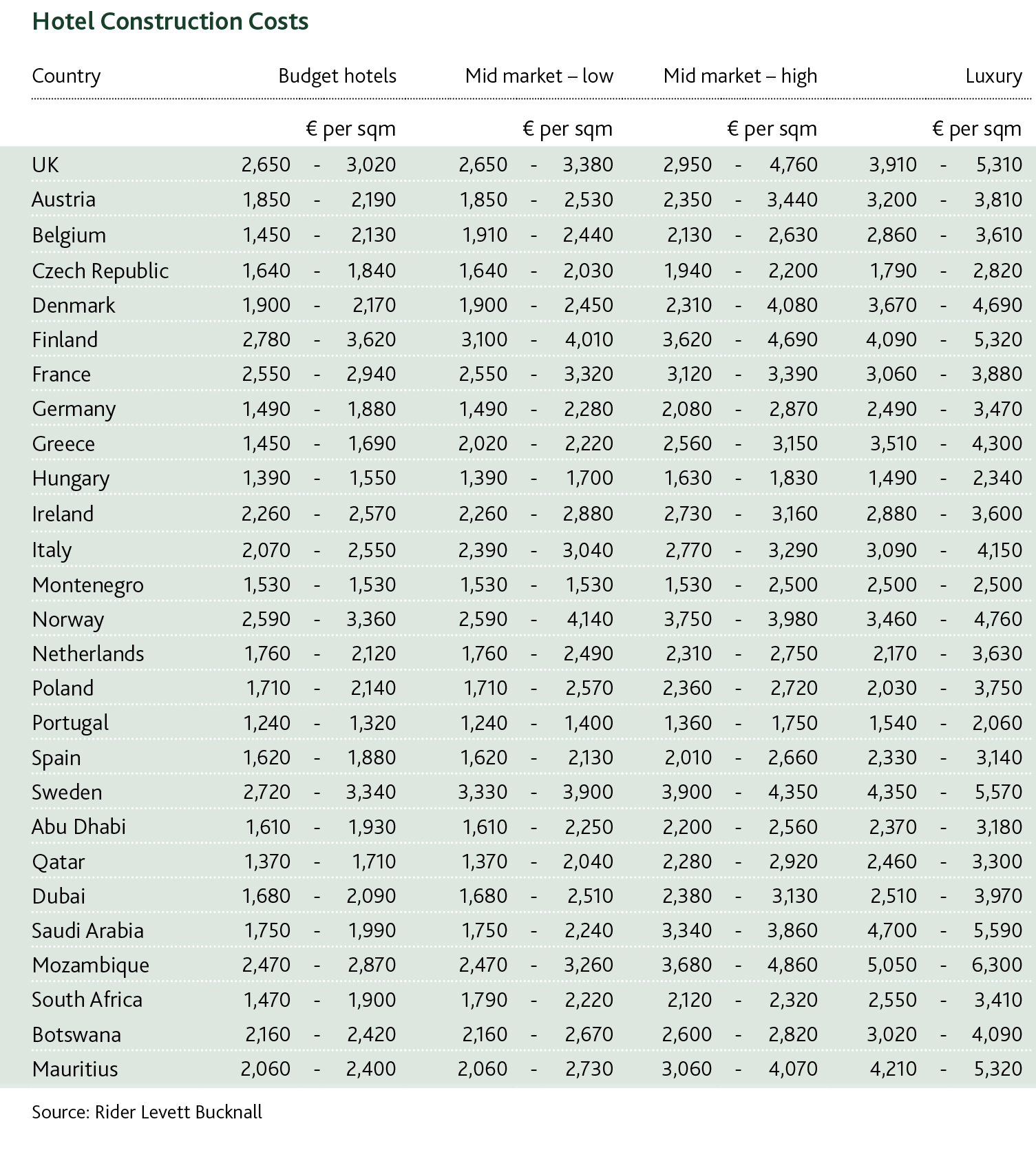

With interest rates peaking and falling in many countries, new hotel construction activity is beginning to re-emerge and will intensify in the last half of the year.

A thorn is that much of the world is in the run-up to elections in 2024, with several countries facing political instability.