Deals that were completed worldwide in the first half reached $78bn, down 16% from 1H2023 but up more than 9% from the 2015-19 average.

According to Savills, the average deal increased in size by around 11% compared to the first quarter, which is interpreted as investors of scale returning as activity from cross-border "players" picks up.

Cross-border investors have already backed some of the biggest deals this year, including Brookfield's agreed purchase of a US logistics portfolio (1.36m sq m) from DRA Advisors for $1.3bn that was also third US deal to break the $1 billion mark so far this year, across all sectors.

€34 million investments in Greece in 2024

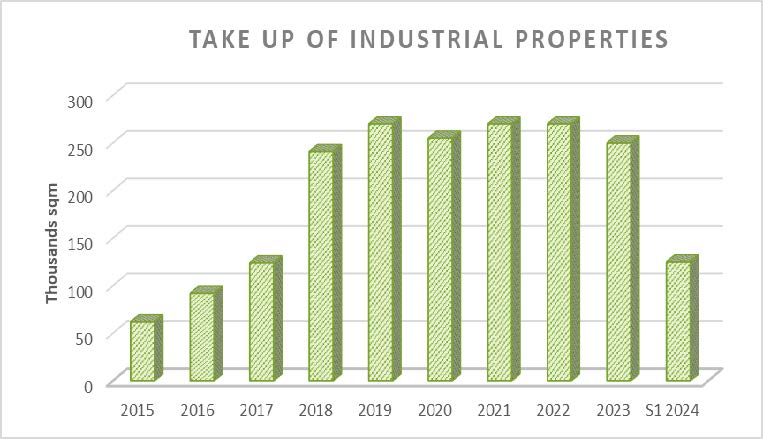

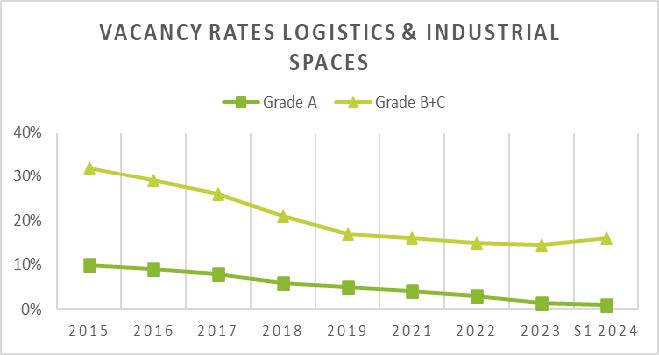

In Greece, investments of €34 million were recorded in the first half of 2024 with the demand for logistics properties still very high according to a report by DANOS - an alliance member of BNP PARIBAS REAL ESTATE. Base rents for large, modern and sustainable assets are rising, while yields are consolidating. More than 250,000 square meters of new logistics buildings are estimated to be delivered by 2024.

The biggest investors in the area are still the Greek REICas that are mainly interested in prime logistics, in locations such as Aspropyrgos and Magoula, the prices of which are increasing due to the high demand with the interest now being transferred to secondary locations such as Oinophyta and Markopoulos.

The port of Piraeus has surpassed other ports in the Mediterranean, as Piraeus gradually develops into a key hub for the Balkans, while interest also begins to be noted for ports in Northern Greece such as Thessaloniki, Volos and Alexandroupoli. .

For the rest of the year, we expect further compression of yields due to demand from investment funds, focused on the logistics industry.