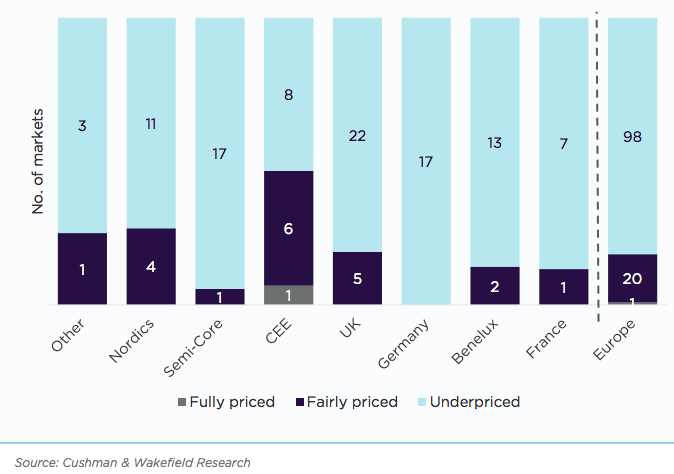

The company’s Fair Value Index (FVI) remains elevated—at 91 out of 100—indicating strong return potential across the 119 prime markets it monitors.

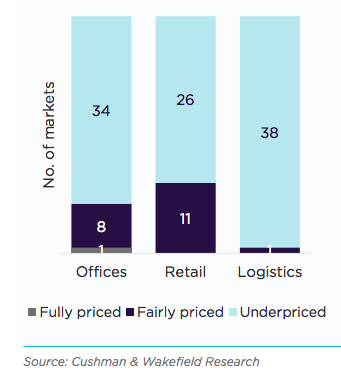

The German market appears the most undervalued across all sectors, following a significant market correction. Logistics properties throughout Europe are also considered undervalued and are being acquired at a rapid pace, driven by demand consistently outstripping supply—particularly in major urban centers and last-mile delivery hubs.

“The stabilization of key market fundamentals, combined with increased liquidity, is fostering favorable conditions for investment across the European real estate sector,” notes the Head of Forecasting at Cushman & Wakefield. As interest rates decline and inflation moderates, the environment becomes increasingly conducive to stable capital flows, particularly toward sectors that are currently performing well and exhibit strong recovery potential.

Financing conditions remain robust, with lenders engaging in heightened competition—an encouraging sign for market recovery. Lenders are demonstrating increased flexibility in deal structuring, offering higher loan-to-value (LTV) ratios, which reflects a growing confidence in both asset performance and borrowers’ repayment capacity. In addition, more adaptable financing arrangements are being made available, including covenant-light loans and payment-in-kind (PIK) mechanisms, thereby supporting the execution of investment strategies.

The improvement in interest rate swap benchmarks has further enhanced financing accessibility and strengthened investor confidence. These favorable borrowing conditions are facilitating greater capital deployment into the market.

Among the various real estate segments, the hospitality sector—encompassing hotels and tourism-related properties—has shown the most pronounced growth. This momentum is attributed to the rebound in travel activity and evolving consumer preferences. Investors are increasingly targeting underutilized assets in central urban locations, which present opportunities for redevelopment or conversion into tourism-focused or mixed-use properties. This trend is particularly evident in secondary cities demonstrating strong tourism-driven growth.