Factors such as rapid population growth, urbanization and people's desire to own property have led to an increase in mortgage demand, especially in countries such as Germany, France and the UK. The European Central Bank (ECB) and national regulators have modified lending criteria to mitigate risks, affecting the accessibility and terms of mortgage loans.

In recent years, interest rates have been gradually raised by the ECB and the central banks of European countries to control galloping inflation and stabilize the economy. This fact led to higher borrowing costs, affecting the affordability of mortgages and bringing "up-downs" to the real estate market and especially to the housing market.

Existing mortgage holders with variable rate loans face higher monthly repayments, reducing disposable income and increasing the risk of loan default. Prospective homebuyers are becoming more cautious, delaying purchases or opting for smaller, more affordable properties. This shift, market players report, is causing a slowdown in real estate activities in some countries.

Northern and Western European countries, with stronger economies and higher property values, face more severe affordability challenges than some Eastern and Southern European countries. And as home ownership becomes less affordable, the demand to rent has pushed rents up making the housing industry even more difficult and unaffordable. The market, as real estate agents point out, has particularly affected young professionals, students and low-income households, while the residential project construction industry has "frozen" for quite a long time with higher borrowing costs leading to delays or cancellations of housing projects and increased costs for materials and labor.

Mortgage interest rates

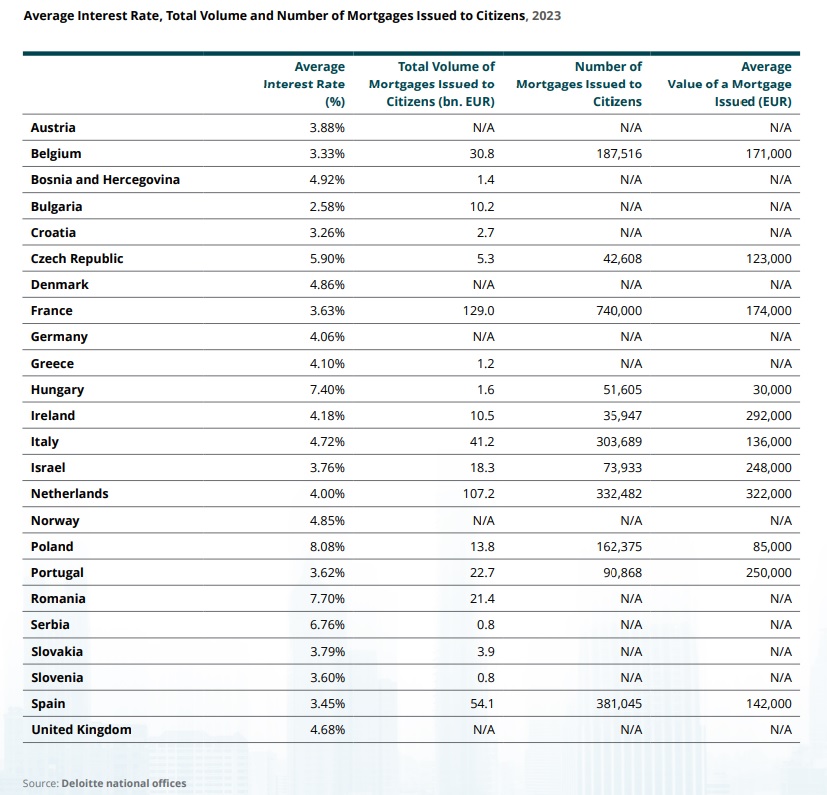

According to Deloitte in 2023, average interest rates for housing loans differed significantly amongst EU countries. More specifically, last year Poland registered the highest percentage with 8.08%, followed by Romania with 7.70% and Hungary with 7.40%.

However, Serbia also had a high rate of 6.76%, with the Czech Republic not far behind at 5.90%.

By contrast, Bulgaria offered the lowest interest rate at 2.58%. Other countries with lower rates were Belgium (3.33%), Croatia (3.26%) and Spain (3.45%).

Large economies such as Germany and France had rates of 4.06% and 3.63% respectively. The UK rate was 4.68%, while the Netherlands and Denmark had rates of 4.00% and 4.86%, respectively, as well as Greece 4.10%.

Πόσα δάνεια έδωσαν οι χώρες της Ε.Ε

According to the data collected by Deloitte's regional offices, in 2023 countries such as France (€129.0 billion), the Netherlands (€107.2 billion), Spain (€54.1 billion ) and Italy (41.2 billion euros) approved the most housing loans in the EU.

According to the available information collected by Deloitte's local offices, in 2023 countries such as France (€129.0 billion), the Netherlands (€107.2 billion), Spain (€54.1 billion ) and Italy (41.2 billion euros) approved the most housing loans in the EU.

These figures suggest very active markets, likely driven by a large number of deals or favorable lending terms. Countries such as Belgium (30.8 billion euros), Portugal (22.7 billion euros), Romania (21.4 billion euros), Israel (18.3 billion euros), Poland (13 .8 billion euros), Ireland (10.5 billion euros) and Bulgaria (10.2 billion euros) show significant volumes of housing loans in the same period.

These areas have healthy mortgage markets with significant lending activity, indicating strong demand for housing and well-established mortgage delivery systems.

Finally, countries such as the Czech Republic (€5.3 billion), Slovakia (€3.9 billion), Croatia (€2.7 billion), Hungary (€1.6 billion), Bosnia -Herzegovina (€1.4 billion), Greece (€1.2 billion), Serbia and Slovenia (€0.8 billion) recorded lower total mortgage loan volumes last year.

These figures reflect smaller market sizes due to lower property prices as well.