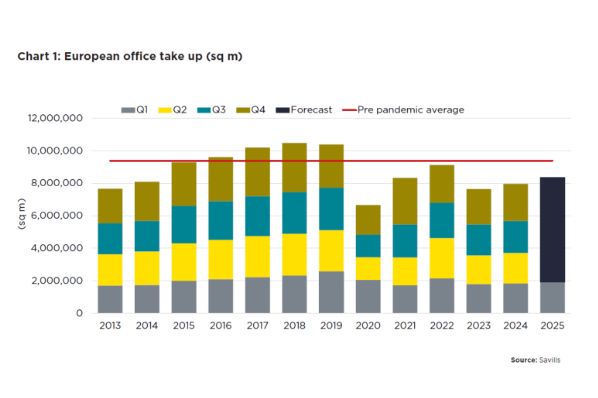

According to the company, despite renewed demand in core markets, the office sector is grappling with a significant shortage of new developments. The number of completed projects has dropped to its lowest level since 2017.

Returns have been particularly strong in Prague (+41%), Dublin (+29%), and London (+26%) compared to their five-year averages. These markets are becoming increasingly competitive, especially for energy-efficient, high-specification office assets, according to Savills.

“Average office vacancy rates in Europe rose by 10 basis points in the first quarter of 2025, reaching 8.4%,” said Mike Barnes, Director of European Commercial Research at Savills. “However, this appears to be stabilizing after several years of gradual increases. Vacancy growth is primarily concentrated in peripheral areas, while central business districts continue to demonstrate much greater resilience.”

Increase in Rents in Prime Areas

Both tenants and investors are particularly concerned about the dramatic decline in the construction of new office spaces. This is because, according to recent data, new office space is expected to rise to 4.3 million square meters in 2025, only to sharply fall to just 3.1 million square meters in 2026. This shortage of quality office stock is already pushing prime rents to higher levels. Over the past year, London’s West End, Cologne, and Paris’s central business district have seen rent increases of 21%, 21%, and 18% respectively.

The big winners from the lack of supply in core markets are property owners in secondary markets, who are carrying out extensive renovations to meet stricter ESG standards and attract tenants who will ensure the long-term viability of their investment.

Central and Eastern Europe remains a hotspot, with Bucharest (39%), Warsaw (37%), Budapest (32%), and Prague (27%) leading in new office stock developed over the past decade.