Although property prices gradually increased from 2013 onwards, their surge accelerated during the COVID-19 pandemic, leading to a significant decline in housing affordability. Specifically, GDP in Europe grew by 19.2% from 2013 to 2024, while property prices rose by 60% during the same period.

The pandemic further amplified this trend, driven by low interest rates and increased demand for housing. However, since 2022, stricter credit policies from banks and rising interest rates have temporarily slowed the price increase. Despite this, there has been no significant improvement in housing affordability.

Source: Eurostat/Oxford Economics

The Least Affordable Cities in Europe

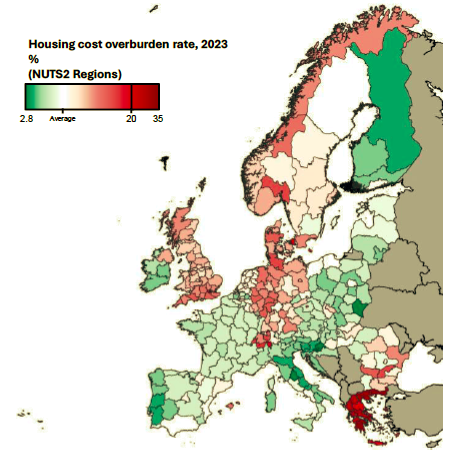

Housing affordability varies significantly across European countries, with Athens, Copenhagen, and major German cities being among the least affordable.

Athens stands out as the city with the worst housing affordability conditions in Europe. A staggering 27.9% of residents spend over 40% of their disposable income on housing. Despite housing prices in Athens being lower than in other European cities, the combination of low wages, high unemployment, and Greece's broader economic difficulties has created extremely challenging conditions for both purchasing and renting homes.

Next in line is Copenhagen (Denmark), which ranks as the second least affordable city in Europe. The housing crisis is particularly evident in the city's large urban areas, where high demand is driving up prices.

Germany also faces significant housing affordability challenges, with ten urban areas—including Berlin and Hamburg—recording lower affordability levels than traditionally expensive regions like the Netherlands. Cities such as Amsterdam and The Hague are typically known for their high housing costs, yet in some German cities, affordability is now even more constrained.

Divergence Among Cities and Countries

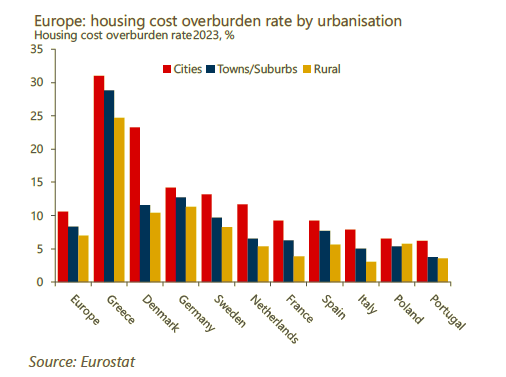

While economic conditions are generally similar across many countries, housing affordability varies considerably due to the unique characteristics of each real estate market. For example, housing affordability in Germany is about half that of France, despite both nations having comparable economic performance. Similarly, although Spain and Portugal share some economic similarities, housing affordability differs between them, highlighting that factors such as homeownership rates, tax policies, and the availability of new housing play a significant role beyond just income.

Within individual countries, substantial disparities exist as well. Large cities are much less affordable compared to suburbs, smaller towns, and rural areas. This is particularly true in Scandinavian countries and Denmark, where urban areas are facing significant challenges with housing affordability.

Future Outlook

The report forecasts that housing prices will remain under significant pressure over the medium term (2025-2029). Several key factors are expected to keep housing costs elevated:

Urban Population Growth: Cities like Prague, Amsterdam, and Berlin have seen substantial population growth, increasing demand for housing and contributing to rising prices.

Limited Housing Supply: The construction of new homes is not keeping up with demand, due to stringent zoning regulations, high construction costs, and a shortage of available land.

High Interest Rates and Borrowing Costs: Increased interest rates have raised the cost of mortgage loans, placing additional financial strain on homebuyers.

Rising Rents and Operating Costs: Renters in many cities are experiencing higher rental prices, while energy costs and property taxes remain high.

Despite varying real estate conditions across Europe, analysts agree that the overarching trend points toward worsening housing affordability, particularly in major cities. The housing crisis is most acute in areas with high demand and limited property supply. As a result, this issue is expected to persist in the coming years, affecting residents' quality of life and potentially undermining the broader economic stability of these countries.