However, research by The Insights Partners forecast that the market for IOS is to grow by 4.5% annually to $2.25bn in 2028 from $1.66bn in 2021.

Savills Research, therefore, dove into this emerging subsector to analyse what it is all about. IOS provides storage space and facilities for businesses that require outdoor storage of goods, equipment, and/or vehicles. IOS facilities cater to a wide range of industries, including manufacturing, logistics, construction, transportation and agriculture. The IOS sector is, therefore, closely related to the industrial & logistics sector and provides a supportive function to the overall industrial & logistics sector and its tenants.

IOS offers flexible storage solutions to accommodate different needs. It can include open storage areas for bulk materials or larger equipment, as well as secured and enclosed spaces for sensitive and valuable goods. Some IOS facilities can offer additional services like inventory management, maintenance, or 24/7 security.

The IOS sector in Europe is new and emerging compared to a more mature market in the US. There are, therefore, limited transactional data and lease deals available. In the US, leases are typically triple net with a five- to seven-year lease term, which is often shorter than traditional warehouse leases. However, expectations are that lease lengths will increase in the coming few years due to the scarcity of sites.

First of all, the sector is uplifted by the e-commerce boom in Europe, directly impacting the IOS sector. Secondly, businesses often require additional space due to seasonal fluctuations, inventory overflow, or the need for temporary storage during relocations or expansions.

Thirdly, industries using and relying on large equipment, vehicles, or materials, such as construction or transportation, often require outdoor storage solutions. Fourthly, securing supply chains is another driver for the sector, as more space is required to store equipment, goods and vehicles. Especially after multiple lockdowns in Chinese harbours caused shortages in shipping containers with surging container shipping prices as a result.

Finally, increased demand for same/next day delivery of products causes businesses to have and invest in a fleet of vehicles to deliver their products. These vehicles (and goods) need to be stored when not being used. In most cases, the buildings and sites that businesses occupy do not provide sufficient space to store their vehicle fleet, therefore, requiring additional storage space.

The decline in consumer spending on retail could indicate a surplus of inventory levels that need to be stored. This surplus can, for instance, be stored in containers on IOS sites rather than warehousing, subject to the type of product.

The market for IOS varies per location and is affected by different factors such as local regulations, connectivity, existing IOS facilities, and economic conditions. Areas with high industrial activity or proximity to major transportation routes tend to have higher demand and, therefore, have the potential for strong rental growth. There is potential for unknown or overlooked locations that previously were not considered as IOS. However, local zoning and land use regulations can impact the availability and development of IOS facilities.

Savills Research used UK land registry data to analyse the potential IOS stock available in the UK. By overlaying the building footprint data on top of the parcel data and applying different site coverage ratios (i.e. the proportion of land in a plot that has a building on it) of 20, 30 and 40% shows that in the UK, there is a potential IOS stock ranging from 323m sq m to 510m sq m.

IOS can be an attractive investment opportunity, having the potential for healthy ROIs. Demand for storage space is expected to increase whilst the lack of supply will persist, especially due to a limited pipeline driven by zoning regulation limitations, nimbyism, and other higher and more profitable asset types being preferred over IOS developments. Investors can, therefore, benefit from rental growth combined with increasing asset and portfolio valuations.

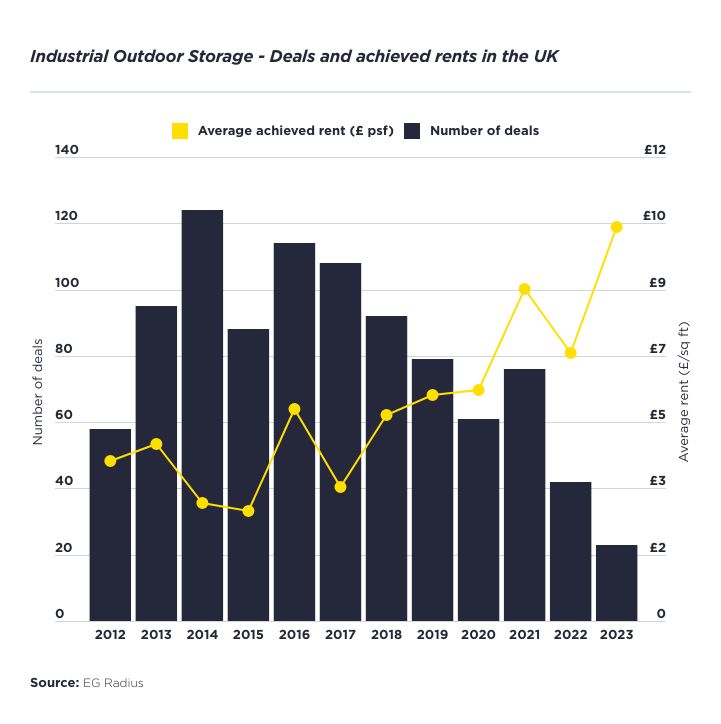

That rental growth can be achieved is shown by EG Radius leasing data related to site and storage area deals in the UK. The data presents a strong rental growth of 47% in 2023 compared to 2022. Emphasis must be made that this is based on a limited number of recorded deals (23 deals with rental data available closed in 2023 YTD vs. 42 deals in 2022). Nevertheless, it shows the potential for rental growth, especially with a limited pipeline and increasing demand. With more investors entering the market, the data quality and availability will improve and will most likely further highlight the strong rental growth in the IOS sector.

In the US, some major institutional players have already entered the market. According to Commercial Property Executive, some of these big names in the space include J.P. Morgan Global Alternatives and Zenith IOS, which formed a $700m joint venture last February; Alterra Property Group, which closed its Alterra IOS Venture II LP with $524m in investments; and Criterion Group and Columbia Pacific Advisors, whose joint venture plans to deploy $2bn by the end of the year.

In Europe, Realterm announced in May this year the continued growth of its transportation logistics real estate platform in Europe, with the acquisition of four IOS facilities. The fully leased portfolio, which boasts eight to 15 drive-through maintenance bays at each property, is located across four cities throughout the Netherlands and has a total land area of 74,352 square metres.

Furthermore, NW1 Partners recently announced its plan to allocate £1.5bn focused on the industrial outdoor storage sector across the US and Europe, starting with the UK and the Netherlands.

(source:Savills)