According to Deloitte's latest report, "2023 Global Powers of Construction," the long-term outlook for the construction industry remains positive, with global construction output expected to rise from $10.4 trillion in 2023 to $16.1 trillion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 5.9%.

In Europe, analysts forecast moderate growth, largely dependent on easing inflation, robust labor markets, and supportive investment policies. However, the region faces challenges from geopolitical tensions and the lingering impacts of previous monetary policy tightening.

In 2023, global real GDP grew by 5.0%, with projections of 4.5% and 4.3% growth in the following years. India and China are expected to lead global economic growth, while Japan's economy is predicted to grow at a slower pace of around 1%. Despite difficulties in the real estate sector, China's construction market remains strong. Valued at approximately $4.80 trillion in 2023, it is projected to grow at a CAGR of 6.0% from 2024 to 2032, reaching an estimated $8.11 trillion by 2032.

China's emphasis on infrastructure development, particularly in transportation networks (roads, railways, ports), energy projects, and urban development, is a key driver of this growth. Initiatives such as the Belt and Road Initiative (BRI) have spurred demand for construction services and fostered significant investments in infrastructure.

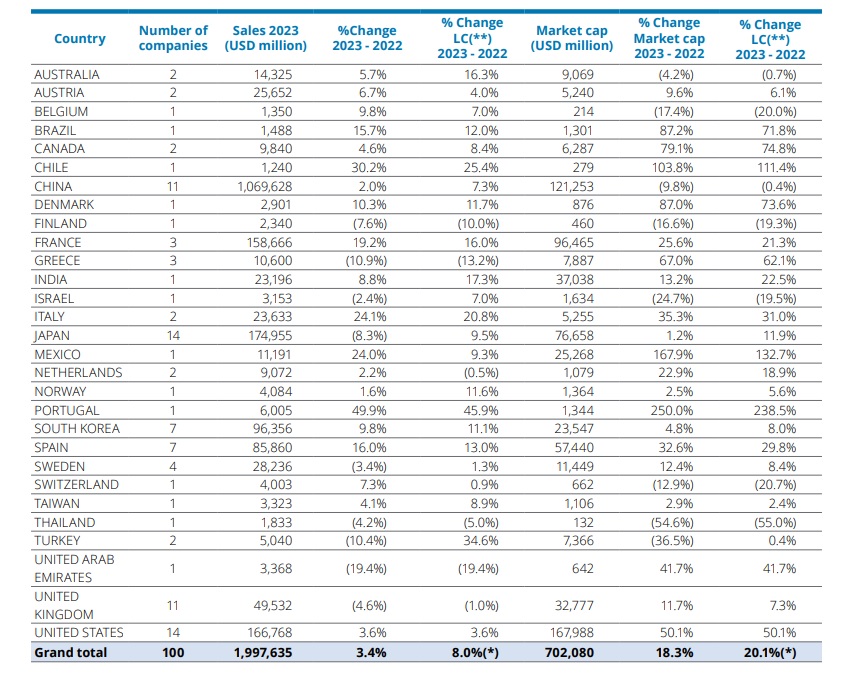

Top construction groups

According to Deloitte's report, the top five construction companies globally, based on sales, are all headquartered in China. Leading the ranking are China State Construction Engineering Corp. Ltd. (CSCEC) with $320 billion in sales, China Railway Group Ltd. (CREC) with $178 billion, and China Railway Construction Corp. Ltd. with $160 billion in sales.

In Europe, the foremost companies include Vinci, Bouygues, and Strabag, which occupy prominent positions in the rankings. Greece also holds a significant presence among the leading construction firms, with Mytilineos Holdings reporting sales of $5.94 billion, followed by GEK TERNA at $3.78 billion, and Ellaktor at $875 million. Industry experts note that the outlook for Greece’s construction sector is notably positive, driven by a sustained increase in the project backlog for the major players within the market.

Climate change transition challenges for the sector

In order to align with the mandates of the Paris Climate Agreement, the United Nations has emphasized that the construction sector must reduce its emissions by 50% by 2030 and achieve net zero across all new developments and existing assets by 2050. The current decade is therefore pivotal in meeting the necessary milestones to transform the industry and reach net zero targets by 2050. Cement production, in particular, is responsible for approximately 8% of global CO2 emissions, making it one of the largest contributors to global warming.