According to Savills' Global Real Estate Capital Markets Annual Review 2025 - EMEA, real estate capital markets in Europe have experienced a significant correction, not unlike that experienced through the global financial crisis. But the market stabilised in mid-2024 and a good second half means that total investment for the year represented a near 11% increase on 2023.

This recovery is broad-based, albeit with France and Germany as very notable exceptions. The strongest recovery is evident in the UK, where investment rose by 21% in 2024. Many investors have also been attracted to Southern Europe, with a tourism-led recovery in growth supporting unexpected strength in leasing activity across the region. Central and Eastern European markets are also in recovery, albeit from a low base.

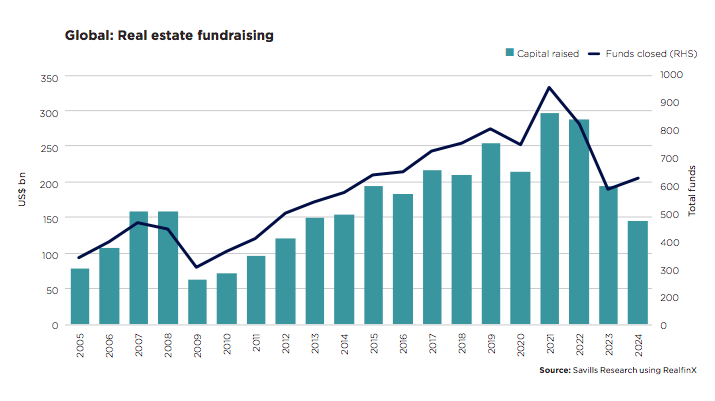

Overall liquidity remains well down on past levels, but turnover in the final quarter rose by more than 25%, providing good momentum entering the new year. As a result, total global investment of US$828bn represented a near 8% increase in comparison with 2023.

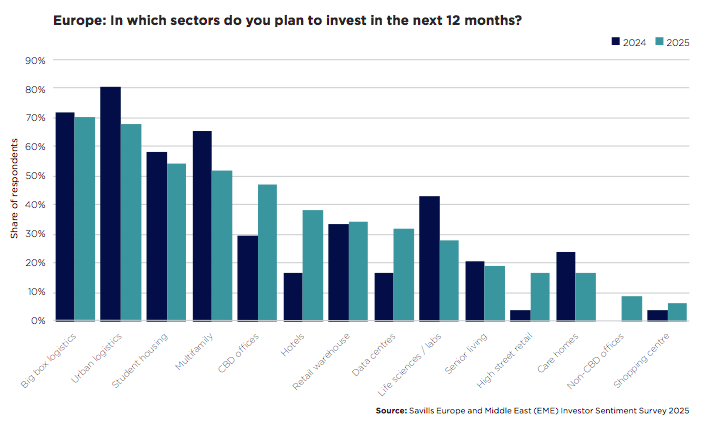

The residential, industrial & logistics, and hotel sectors are leading the recovery from a sectoral perspective, with double-digit growth in transaction volumes. However, the stabilization of the office sector was perhaps the most significant development of 2024, with investments increasing by 7%.

The consulting firm predicts that global real estate investment will experience a 7% increase in 2024, reaching $747 billion, with further growth to $952 billion in 2025. By 2026, global activity is expected to surpass the $1 trillion mark for the first time since 2022.

Particular Interest in the Greek Market

The Greek market is of particular interest, as it continues to attract significant capital despite being smaller compared to the larger European markets. Foreign investors remain keen on the tourism and residential sectors, while the development of logistics and commercial properties is beginning to gain momentum.

At the same time, the "Golden Visa" program remains a strong factor driving demand. The recovery of the European real estate market can be attributed to various factors. Central banks in major economies have started to reduce policy interest rates, fears of a global recession have largely subsided, and commercial property markets remain resilient. The fundamental aspects of real estate continue to attract institutional investors.

With Europe playing a pivotal role in the recovery, major markets such as London, Paris, and Madrid continue to capture investor attention. However, the quicker price adjustments and emerging opportunities in smaller markets, such as Greece, make Southern Europe particularly attractive for new capital placements.

The year 2025 is shaping up to be a year of recovery for the European real estate market, with positive prospects bolstered by interest rate reductions and the gradual return of investors. Industry professionals will need to closely monitor developments, as the market continues to adjust and present new opportunities.